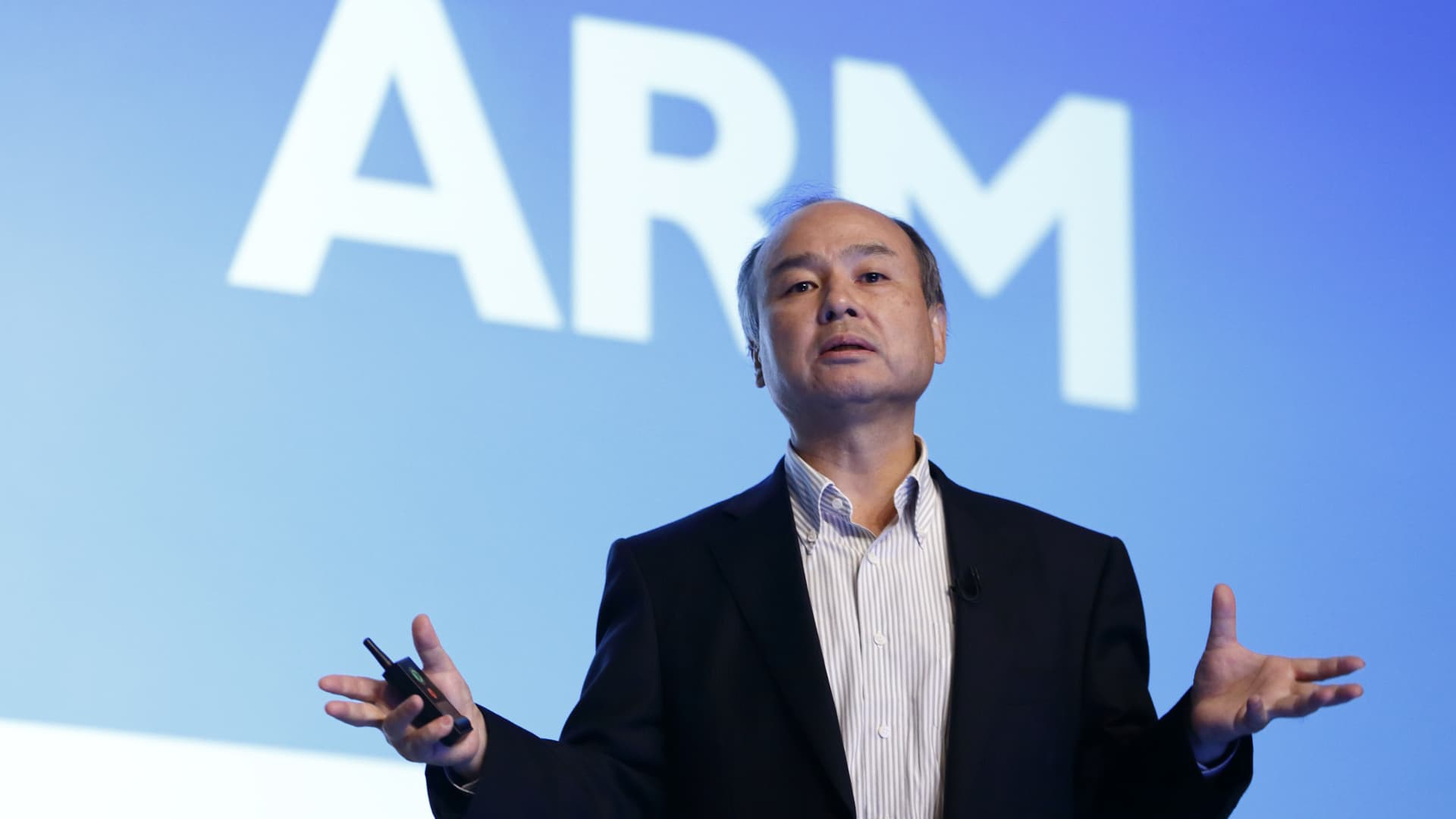

- British chip designer Arm not too long ago determined to listing in New York, main to anxieties that London will skip out on much more blockbuster tech IPOs.

- VCs have voiced frustrations with how the London market treats significant-advancement tech firms.

- They say the institutional traders that dominate the current market deficiency a good knowledge of tech, while Brexit, much too, has clouded the outlook for tech listings.