Switzerland, a region seriously dependent on finance for its economic system, is on track to see its two largest and very best-regarded banks merge into just one particular economical huge.

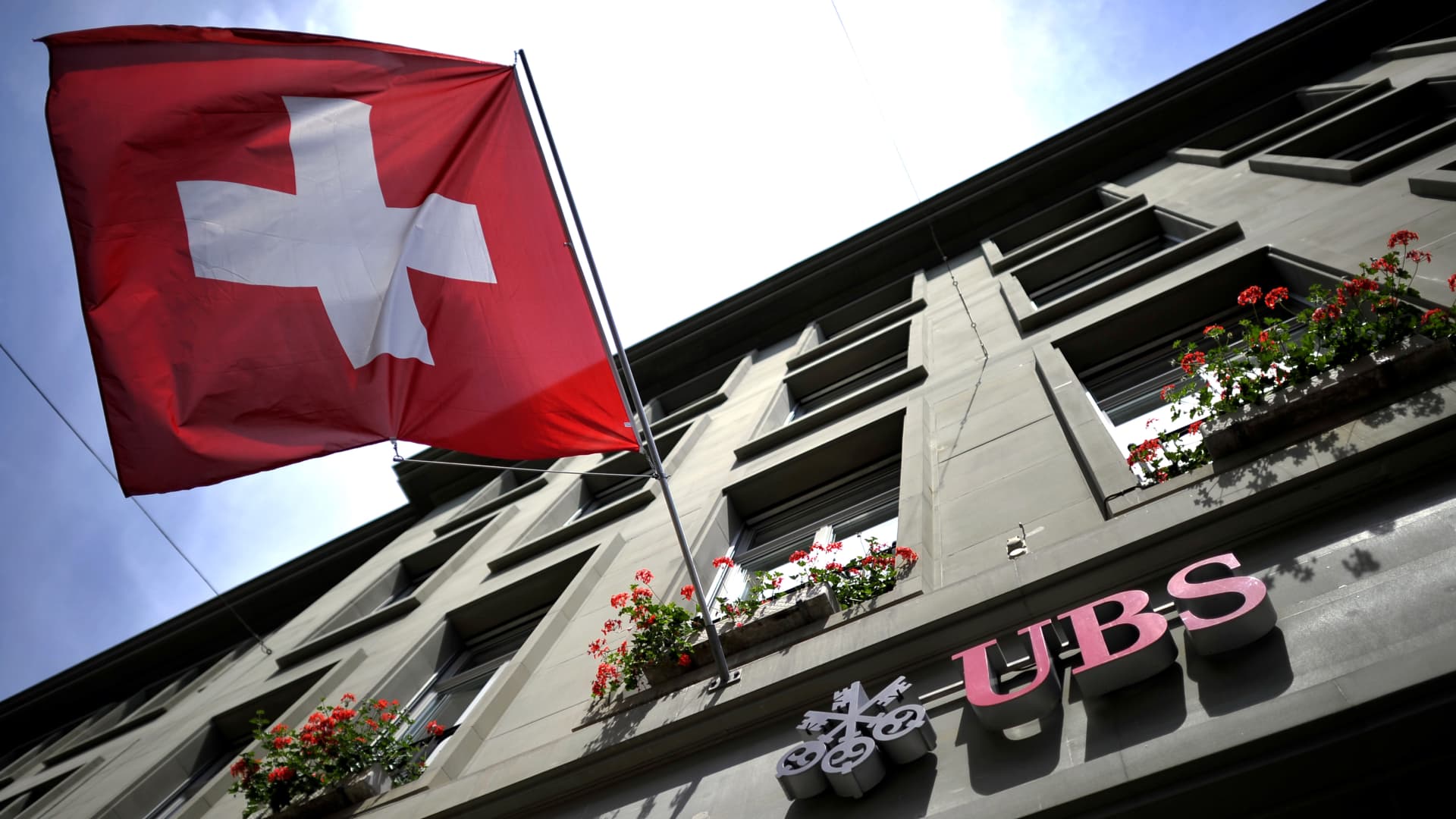

Fabrice Coffrini | Afp | Getty Photographs

The demise of banking giant Credit Suisse sent shockwaves by money marketplaces and seems to have dealt a blow to Switzerland’s track record for security, with one executive suggesting investors will now search at the mountainous central European region as “a economical banana republic.”

UBS, Switzerland’s greatest lender, agreed on Sunday to acquire its embattled domestic rival Credit history Suisse for 3 billion Swiss francs ($3.2 billion) as portion of a authorities-backed, cut-rate deal.

Swiss authorities and regulators assisted to control the arrangement, which came amid fears of contagion to the world-wide banking program right after two lesser U.S. financial institutions collapsed in latest weeks.

The rescue offer usually means Switzerland, a state heavily dependent on finance for its economy, is on observe to see its two most significant and most effective-identified financial institutions merge into just just one economic big.

“Switzerland’s standing as a economic centre is shattered,” Octavio Marenzi, CEO of Opimas, explained in a investigate notice. “The place will now be viewed as a money banana republic.”

“The Credit rating Suisse debacle will have major ramifications for other Swiss money establishments. A nation-huge track record with prudent monetary administration, seem regulatory oversight, and, frankly, for being considerably dour and dull regarding investments, has been wiped absent,” Marenzi said.

Shares of UBS on Tuesday rose practically 4% by all-around 10:15 a.m. London time (6:15 a.m. ET), extending gains right after closing better in the preceding session.

Credit rating Suisse, meanwhile, was trading .6% reduce during morning deals following ending Monday’s session down a whopping 55%.

What about the Swiss franc as a harmless haven?

“1 characteristic of this total banking stress that we have viewed more than the very last 7 days or two is that actually of course we’ve witnessed major volatility in equity markets, significant volatility in set revenue markets, and also commodity marketplaces, but extremely very little volatility in international exchange markets,” Bob Parker, senior advisor at Global Cash Marketplaces Affiliation, explained to CNBC’s “Squawk Box Europe” on Tuesday.

Questioned about how buyers could now think about Switzerland’s reputation for balance, Parker replied, “When I was in Zurich final 7 days, this subject matter really was a hot matter.”

He claimed there experienced been “some very modest” weak spot in the Swiss franc towards the euro in current times, noting that this is the currency pair the Swiss National Bank focuses on.

1 euro was seen trading at .9961 Swiss francs on Tuesday early morning, weakening from .9810 when in comparison to March 14.

“We have moved back shut to parity on Swiss franc-euro. So, I believe to respond to your dilemma, of course, to some extent the Swiss franc as a secure haven forex has dropped some of its attract. There is no doubt about that,” Parker explained.

“Will that be regained? Likely yes, I would argue this is incredibly significantly kind of a quick-expression influence,” he included.

— CNBC’s Elliot Smith contributed to this report.