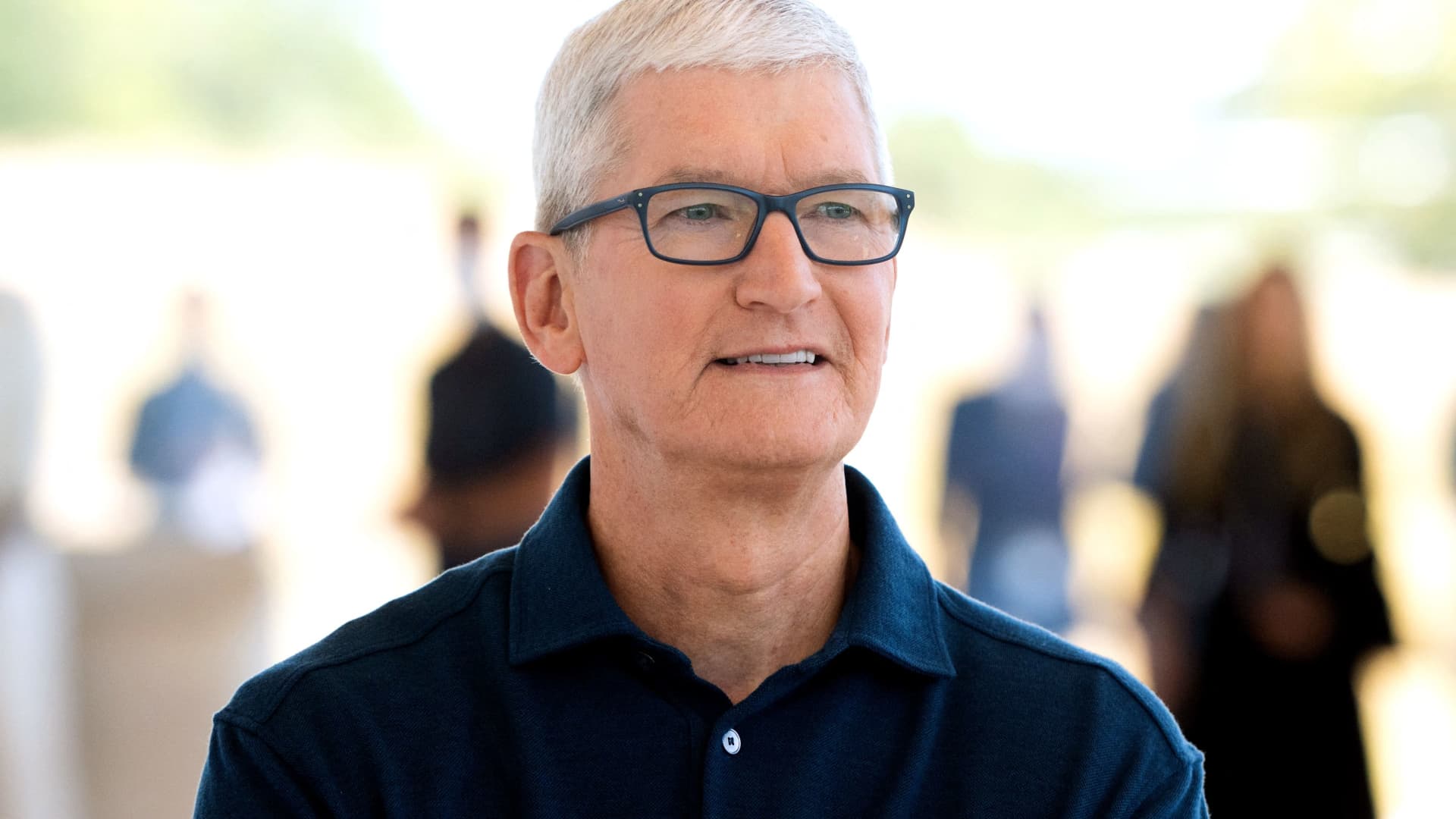

Apple CEO Tim Cook poses for a portrait next to a line of new MacBook Airs as he enters the Steve Jobs Theater during the Apple Worldwide Developers Conference (WWDC) at the Apple Park campus in Cupertino, California on June 6, 2022.

Chris Tuite | AFP | Getty Images

A wholly owned subsidiary of Apple will check user credit and extend short-term loans to users for the company’s forthcoming short-term loan service, Apple Pay Later, the tech giant said.

The new service, which will compete against similar offerings from Affirm and PayPal, was announced during Apple’s developer conference on Monday. Later this year, when the company’s new iOS 16 iPhone software is released, users will be able to buy products with Apple Pay and pay the balance off in four equal payments over six weeks as a buy now, pay later (BNPL) service.

Apple has partnered with Mastercard, which interacts with the vendors and offers a white label BNPL product called Installments, which Apple is using. Goldman Sachs, which issues the Apple Card, also is involved as the technical issuer of the loans and is the official BIN sponsor, the company said. But Apple is not using Goldman’s credit decisions or its balance sheet for issuing the loans.

The behind-the-scene structure of Apple’s new loan product, and the fact that it is handling loan decisions, credit checks and lending showcases the iPhone giant’s strategy to bring the framework and infrastructure for its financial services in-house as much as possible.

Apple has increasingly broken into the fintech industry, through its Wallet app and financial services that’s centered on making its iPhone more valuable and useful to users, who will be inclined to continue to buy buy Apple hardware, which remains the company’s main source of sales.

The loans from the Apple Pay Later product are unlikely to be material to Apple in the short term, while suggesting the company could use its prodigious balance sheet to offer more financial services in the future. Apple reported $378.55 billion in revenue in 2021.

Apple Pay Later

Courtesy: Apple Inc.

Apple will run a soft credit check to ensure that borrowers are capable of paying back the loans, which will likely be capped at around $1,000, the company said. If Apple Pay Later loans aren’t repaid, then Apple will no longer extend those users credit. But the company said it won’t report the missed payments to credit bureaus.

The company will initially launch the Pay Later product the United States. Apple Card, the company’s other credit product, is currently only available in the U.S.