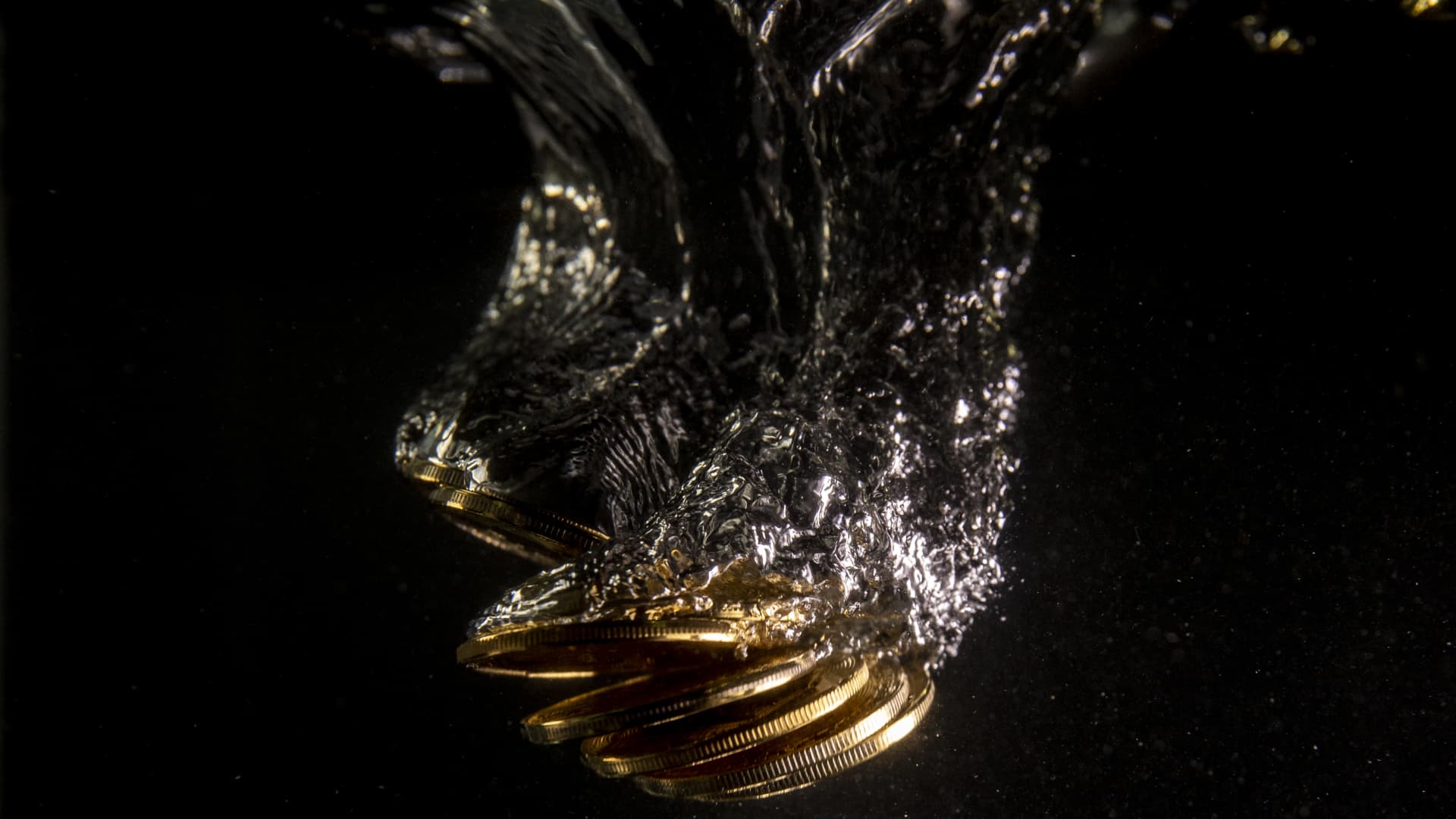

Luna, the sister cryptocurrency of controversial stablecoin TerraUSD, dropped to $0. The collapse of the algorithmic stablecoin TerraUSD has raised question about the future survival of similar crypto assets.

Dan Kitwood | Getty Images News | Getty Images

Algorithmic stablecoins like terraUSD, which collapsed and sent shockwaves through the cryptocurrency market, are unlikely to survive, the co-founder of digital currency tether told CNBC.

Stablecoins are a type of cryptocurrency that is usually pegged to a real-world asset. TerraUSD or UST, is an algorithmic stablecoin which was supposed to be pegged to the U.S. dollar.

Whereas stablecoins like tether and USD Coin are backed by real-world assets such as fiat currencies and government bonds in order to maintain their dollar peg, UST was governed by an algorithm.

UST lost its dollar peg and that also led to a sell-off for its sister token luna, which crashed to $0.

The debacle has led to warnings that algorithmic stablecoins might not have a future.

“It’s unfortunate that the money … was lost, however, it’s not a surprise. It’s an algorithmic-backed, stablecoin. So it’s just a bunch of smart people trying to figure out how to peg something to the dollar,” Reeve Collins, the co-founder of digital token company BLOCKv, told CNBC at the World Economic Forum in Davos, Switzerland, last week.

“And a lot of people pulled out their money in the last few months, because they realized that it wasn’t sustainable. So that crash kind of had a cascade effect. And it will probably be the end of most algo stablecoins.”

Collins is also the co-founder of tether, which is not an algorithmic stablecoin. But tether’s issuer claims it is backed by cash, U.S. Treasurys and corporate bonds. In the crypto market turmoil last month, tether also briefly lost its dollar peg before regaining it.

Jeremy Allaire, CEO of Circle, one of the companies behind the issuance of the USDC stablecoin, said he thinks people will continue to work on algorithmic stablecoins.

“I’ve compared algorithmic stable coins to the Fountain of Youth or the Holy Grail. Others have referred to it as financial alchemy. And so there will continue to be financial alchemists who, who work on the magic potion to to create these things, and to find … the Holy Grail of a stable value, algorithmic digital currency. So I fully expect continued pursuit of that,” Allaire told CNBC last week.

“Now, what happens with regulation around it is a different question. Are there going to be, you know, clear lines drawn about what can interact with the market. What can interact with … the financial system, given the risks that are embedded,” he added.

Regulation ahead

The crytpo industry is expecting tougher regulation on stablecoins, especially after terraUSD’s collapse. Bertrand Perez, CEO of the Web3 Foundation and a former director of the Facebook-backed Diem stablecoin project, expects regulators to demand that such cryptocurrencies are backed by real assets.

“So I expect that once we have a clear regulation of stablecoins, the basic rules of the regulation would be that you have a clear reserve with a set of assets that are strong, that you’re subject to regular audits of those reserves,” Perez told CNBC last week.

“So you can have an auditing company that comes regularly to make sure that you have the proper reserves, that you have also the proper processes and measures in order to face bank runs and other, let’s say, negative market conditions, to make sure that your reserve is really secure, not only when everything goes well.”

Follow CNBC International on Twitter and Facebook.