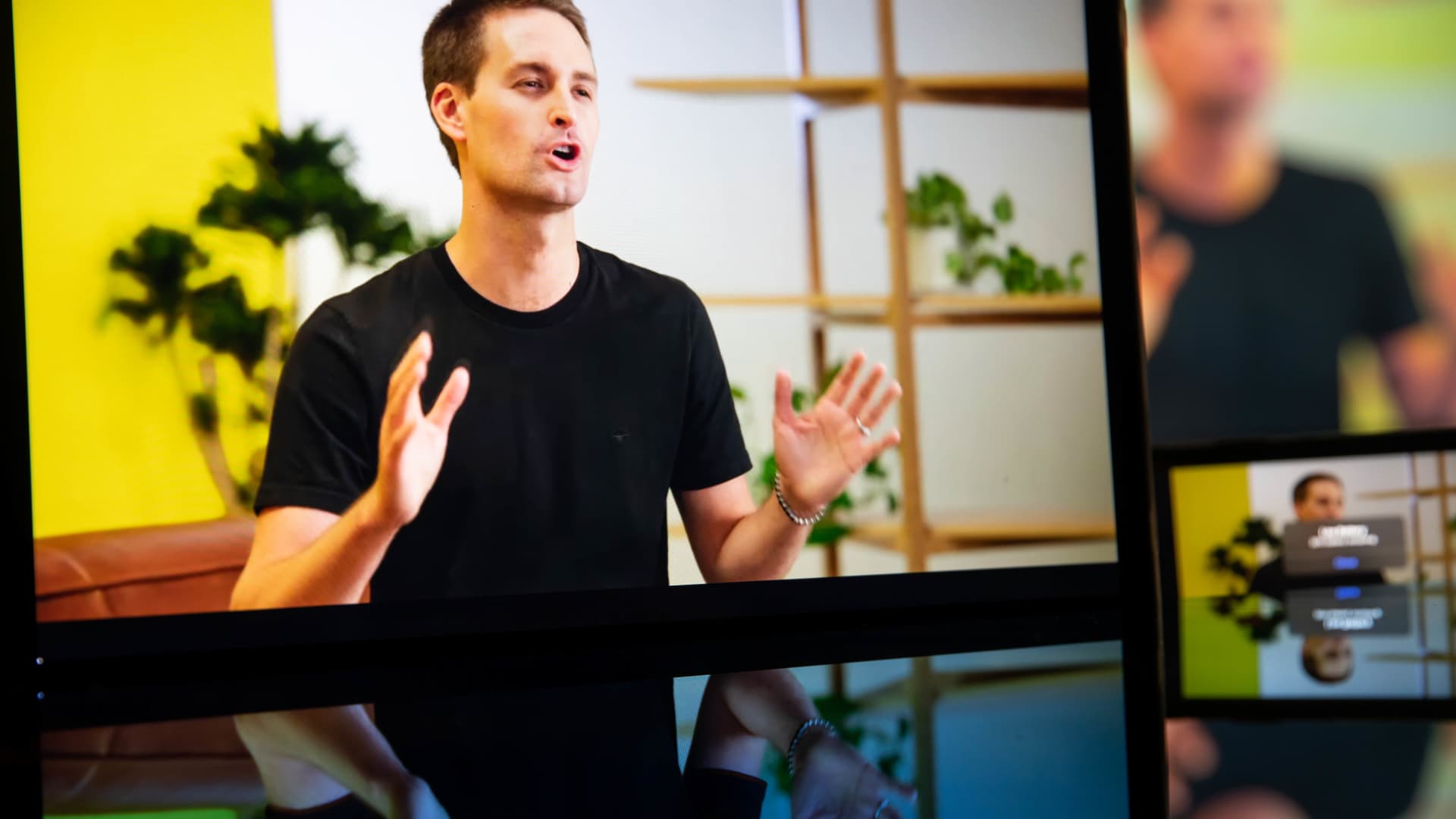

Evan Spiegel, co-founder and chief executive officer of Snap Inc., speaks during the virtual Google Pixel Fall Launch event in New York, on Tuesday, Oct. 19, 2021.

Michael Nagle | Bloomberg | Getty Images

Snap shares plunged 40% on Tuesday, putting the company on pace for its worst day ever and dragging down other social media and digital ad company stocks.

The tumble comes after Snap issued a warning on Monday to investors saying it won’t meet its own targets for revenue and adjusted earnings in the current quarter.

“Since we issued guidance on April 21, 2022, the macroeconomic environment has deteriorated further and faster than anticipated,” the company said in an SEC filing. Shares are down about 83% from a 52-week high in September 2021 and are off 70% year-to-date.

The filing also led its peers with a heavy reliance on advertising down in the morning. Shares of Meta were down more than 9%, Roku is down more than 15% and Pinterest fell more than 26%. Google and Twitter dipped 6% and 2%, respectively.

Snap’s warning is also impacting the ad tech industry. The Trade Desk fell 21%, Magnite dipped 11% and PubMatic is also down more than 11%.

“We expect all online ad platforms to feel some impact of a significant consumer pullback,” Morgan Stanley analysts said in a Tuesday note to investors. “Advertising is cyclical.”

Fears around inflation, interest rate concerns, continued supply chain issues and the war in Ukraine has forced some advertisers and brands to rethink ad spend in the current quarter. Companies, including Snap, have been pressured into slowing hiring and cutting back costs in an effort to make up for losses.

“We see no real reason to not take Snap’s negative pre-release at face value. Digital advertising is cyclical, but like all advertising, and Macro headwinds are very likely getting much harder,” Evercore ISI analysts said in a Monday note.

Subscribe to CNBC on YouTube.