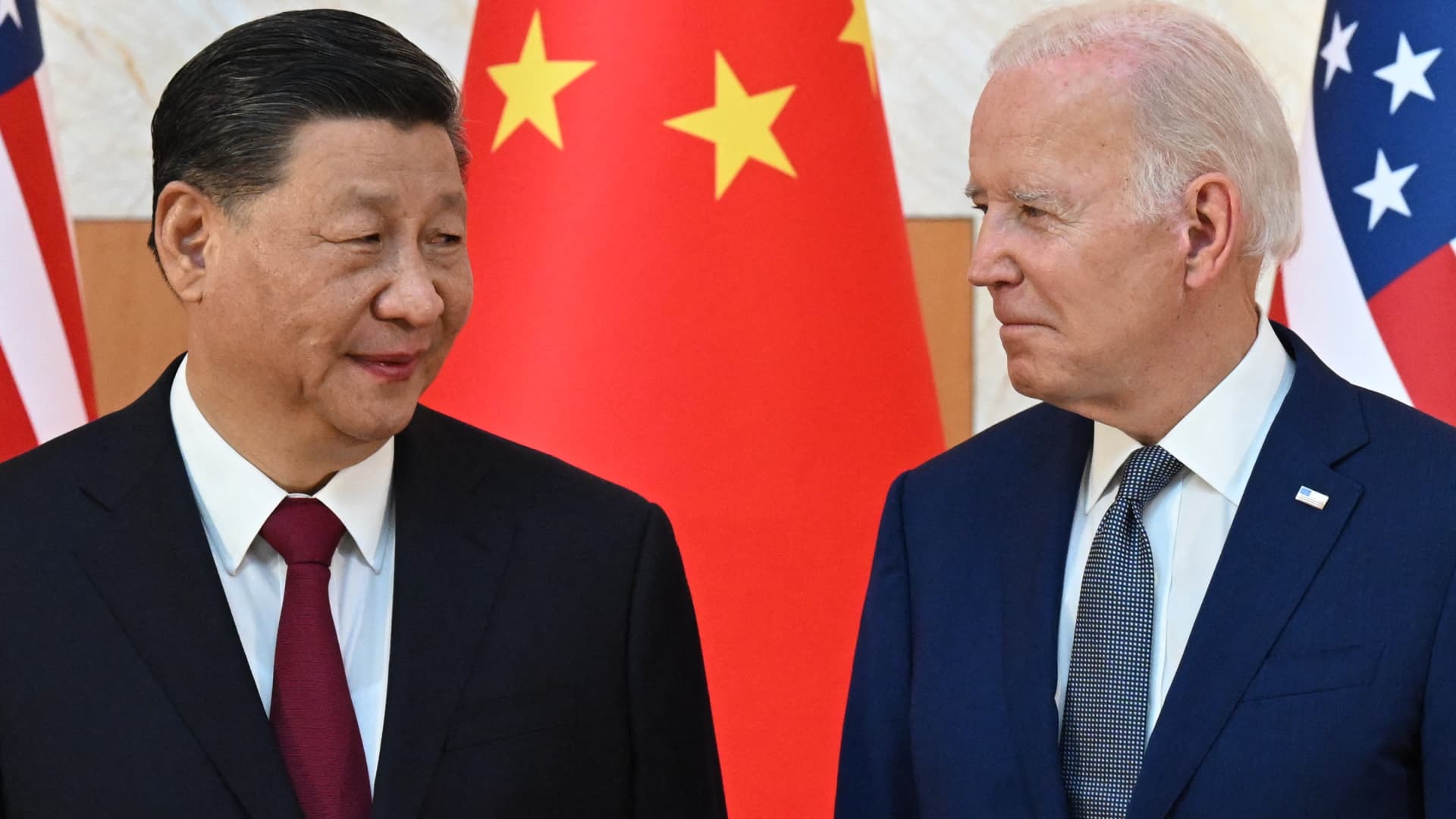

President Joe Biden and his Chinese counterpart Xi Jinping are expected to meet on the sidelines of the Asia-Pacific Economic Cooperation summit in San Francisco in November.

Saul Loeb | Afp | Getty Images

Global chip stocks fell sharply, with ASML, Nvidia and TSMC posting declines amid reports of tighter export restrictions from the U.S. and a ramp-up of geopolitical tensions fuelled by comments from former U.S. President Donald Trump.

ASML’s Netherlands-listed shares were down 6.5% in morning trade, while Tokyo Electron shares in Japan closed nearly 7.5% lower.

The moves came after Bloomberg on Wednesday reported that the Biden administration is considering a wide-sweeping crackdown to clamp down on companies exporting their critical chipmaking equipment to China.

Washington’s foreign direct product rule, or FDPR, allows the U.S. to put controls on foreign-made products even if they use the smallest amount of American technology. This can affect non-U.S. companies.

CNBC has reached out to the U.S. State Department, the Bureau of Industry and Security and the Office of the U.S. Trade Representative for comment on the report.

ASML’s stock drop came even as it reported earnings that beat market expectations in the second quarter. However, 49% of its sales over the period took place in China — highlighting how much is at risk for the firm, in the event of tighter restrictions. ASML makes the machines that are required to manufacture the most advanced chips in the world.

Comments from former president Trump added further negative sentiment to semiconductor stocks.

Trump said Taiwan should pay the U.S. for defense, in an interview with Bloomberg Businessweek published on Tuesday. The former president also claimed Taiwan took “about 100%” of America’s semiconductor business.

The remarks have thrown doubt over the U.S.’s commitment to defend Taiwan if Trump becomes president and in the event of an attack by China, which sees the democratically governed island as part of its territory.

TSMC’s Taiwan-listed shares closed down 2.4% on Wednesday.

The geopolitical tensions also weighed on chip stocks in the U.S. The VanEck Semiconductor ETF was down around 2.7% in premarket trading, while Nvidia was down about 3% before the market open. Arm and Applied Materials were among the other U.S.-listed laggards in U.S. premarket trade