Japan is not seeking a strong yen but alternatively aiming for a reasonably secure currency, in accordance to veteran trader David Roche.

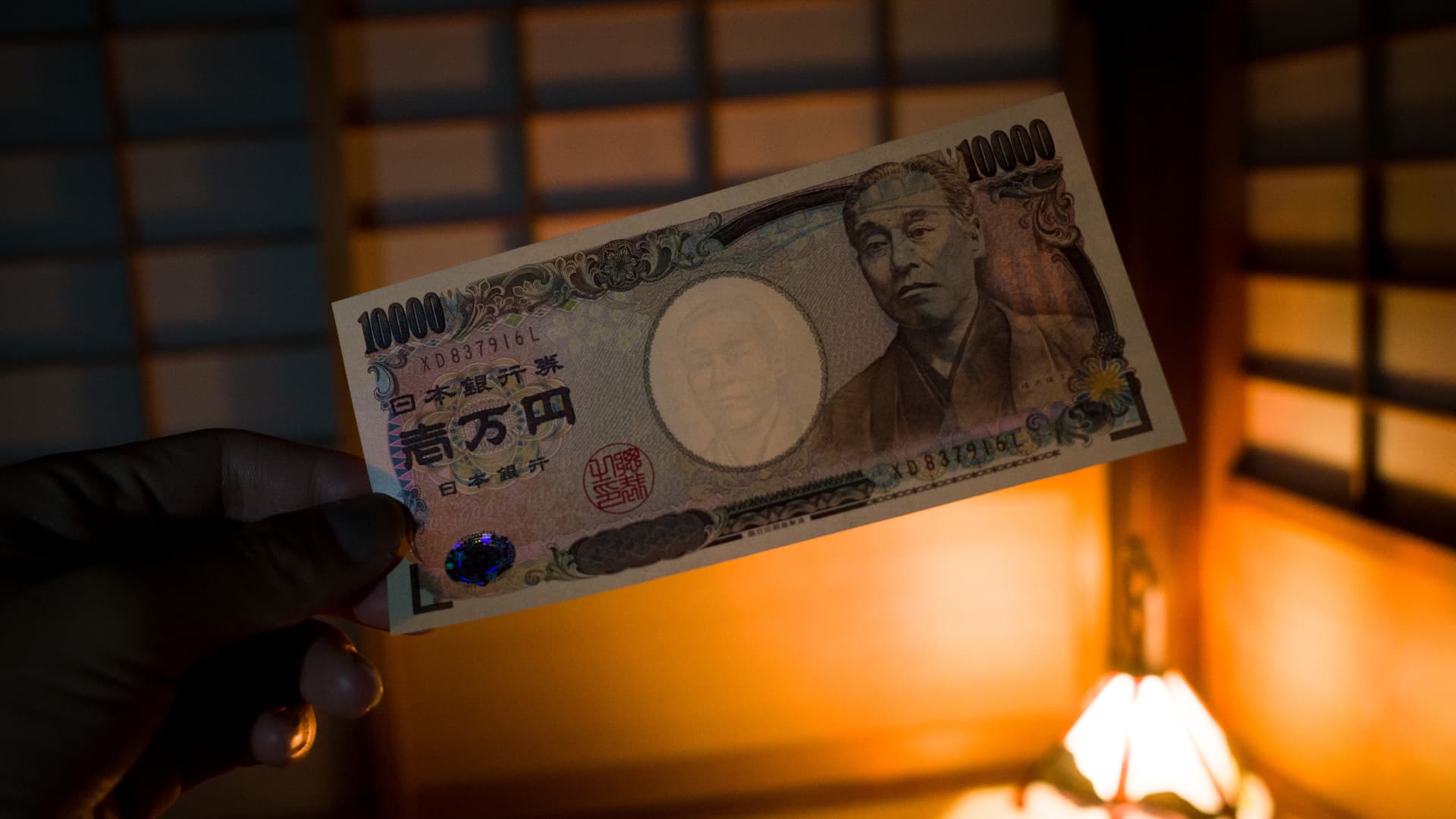

The Japanese yen has been a roller coaster experience, with the currency breaking earlier 160 from the greenback last week — steepest drop in extra than 3 many years. It has considering the fact that strengthened amid speculation about two interventions by Japanese authorities.

“The Japanese are not aiming at a notably powerful yen. I think they’re aiming at a rather steady yen — they really don’t want it to go through the flooring anymore,” Roche, president and world wide strategist at Independent Approach, advised CNBC’s “Squawk Box Asia” on Thursday.

Japan has acted in way so as “not to make inflation, which undermines the governor of Bank of Japan.”

The weakness in the yen had persisted after the BOJ’s financial coverage final decision in April and in spite of warnings from Japanese authorities.

Reportedly, Japanese authorities could have expended about $60 billion to prop up the yen following its sharp slide past 7 days. The yen was very last trading at all-around 155.61 towards the dollar.

The summary of the BOJ’s hottest coverage assembly produced Thursday unveiled that the central bank was worried that a sharply weaker yen challenges driving up import price ranges.

“The current depreciation of the yen and rises in charges, these kinds of as crude oil, have started to impact producer costs via an maximize in import charges,” the BOJ plan board users claimed at their very last assembly that concluded on April 26.

“While the yen’s depreciation is probably to press down the economic system in the shorter operate through rate rises pushed by cost-press variables, it could force up fundamental inflation in the medium to lengthy operate” the customers explained.

Japan could not “potentially discuss to have policy that really outcomes in a potent yen until they tighten monetary plan,” Roche reported, incorporating that it would contain increasing fascination fees by at minimum 50 foundation points and enabling “unsterilized intervention” of the yen.

“In other words and phrases, it shrinks the offer of domestic revenue. As considerably as I can see from the statistics, they’ve [Bank of Japan] performed almost nothing like that,” Roche mentioned.