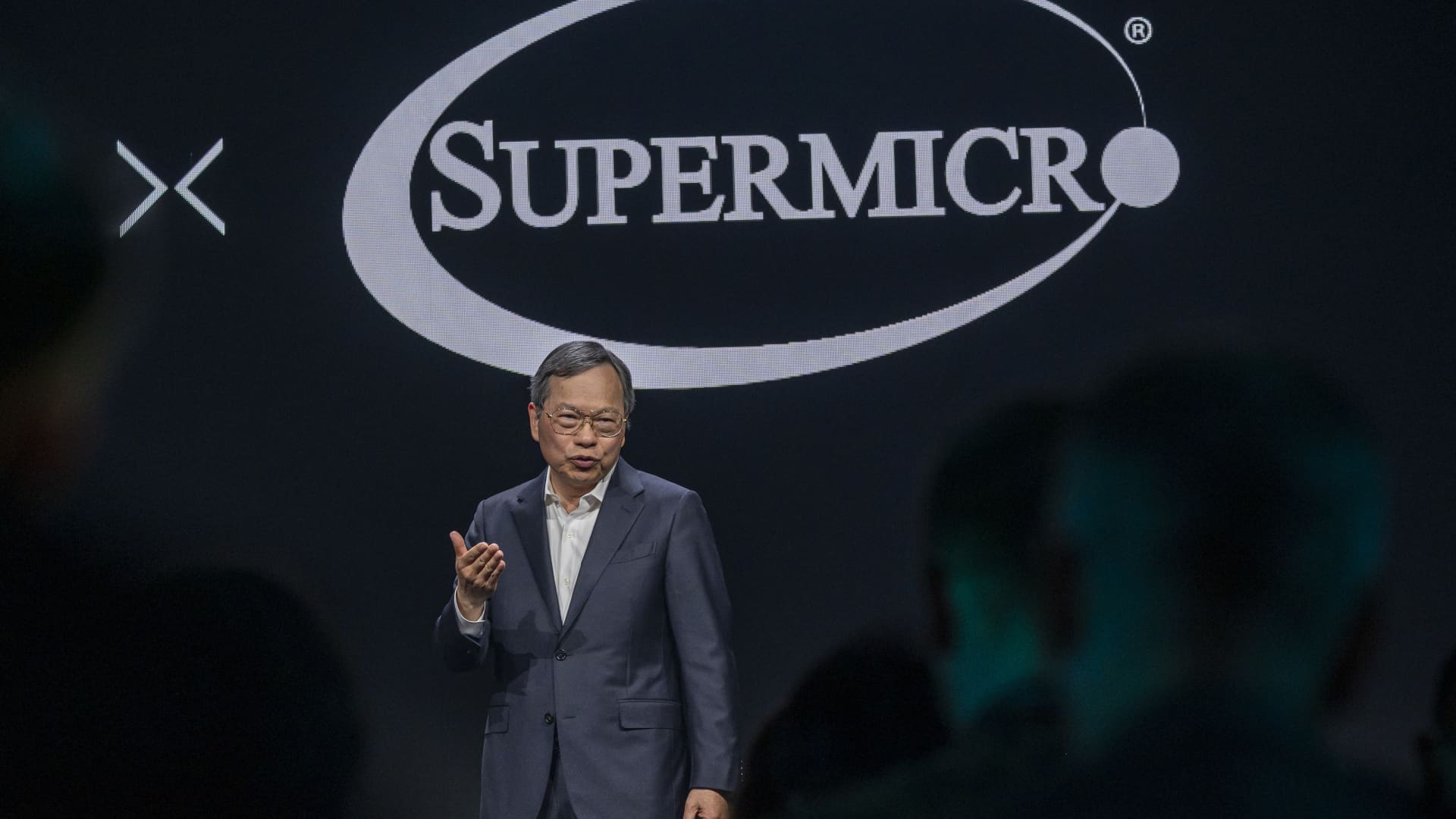

The Super Micro Personal computer brand is viewed on a smartphone display screen.

Pavlo Gonchar | SOPA Visuals | Lightrocket | Getty Images

Tremendous Micro Laptop shares plunged 18% on Wednesday morning after the server business upped its top rated-line assistance but noted 3rd-quarter income that a little bit missed estimates.

The enterprise on Tuesday posted revenue of $3.85 billion, down below the $3.95 billion anticipated by analysts surveyed by LSEG. Altered earnings of $6.65 for each share surpassed the $5.78 in earnings for each share analysts predicted.

Super Micro hiked its fiscal 2024 profits forecast to in between $14.7 billion and $15.1 billion, exceeding the $14.6 billion anticipated, for each LSEG.

In 2023, the inventory surged 246% on trader hopes that Super Micro, which competes with businesses such as Dell and Hewlett Packard Company, could be an important seller of servers for Nvidia, whose graphics processing models operate powerful synthetic intelligence models.

Tremendous Micro joined the S&P 500 in March. Its shares are however up about 150% this year.

Bank of The usa analysts reiterated their purchase ranking on Super Micro when reducing their selling price goal from $1,280 to $1,090, composing in a Wednesday trader notice that their “bullish thesis continues to be intact,” citing the company’s favorable direction and capability to capture desire from other chipmakers outside of Nvidia, among other variables.

“Super Micro stays a pure perform AI server seller and we count on continued favourable estimate revisions in the extended phrase,” the analysts wrote.

Analysts at JPMorgan, who level the inventory as overweight at a selling price goal of $1,150, praised Super Micro’s business outlook, writing that it “still left tiny to be worried” about demand and source gains. However, they mentioned considerations about the company’s readiness to sacrifice on the margins and its require for more capital raises that could dilute earnings.

“We proceed to be positively stunned by the strong profits momentum and the sustained sector demand from customers momentum, with Tremendous Micro’s ramp reinforcing its sturdy top posture in the market place,” the analysts wrote in a Tuesday be aware.

Also on Tuesday, Wells Fargo analysts, maintaining an equivalent excess weight ranking on Tremendous Micro inventory, dropped their rate focus on from $960 to $890. Analysts at Barclays retained a neutral score and lifted their rate concentrate on from $961 to $1,000.

“SMCI maintains a strong aggressive moat dependent on our supply chain checks,” the Barclays analysts wrote.

— CNBC’s Michael Bloom contributed to this report.