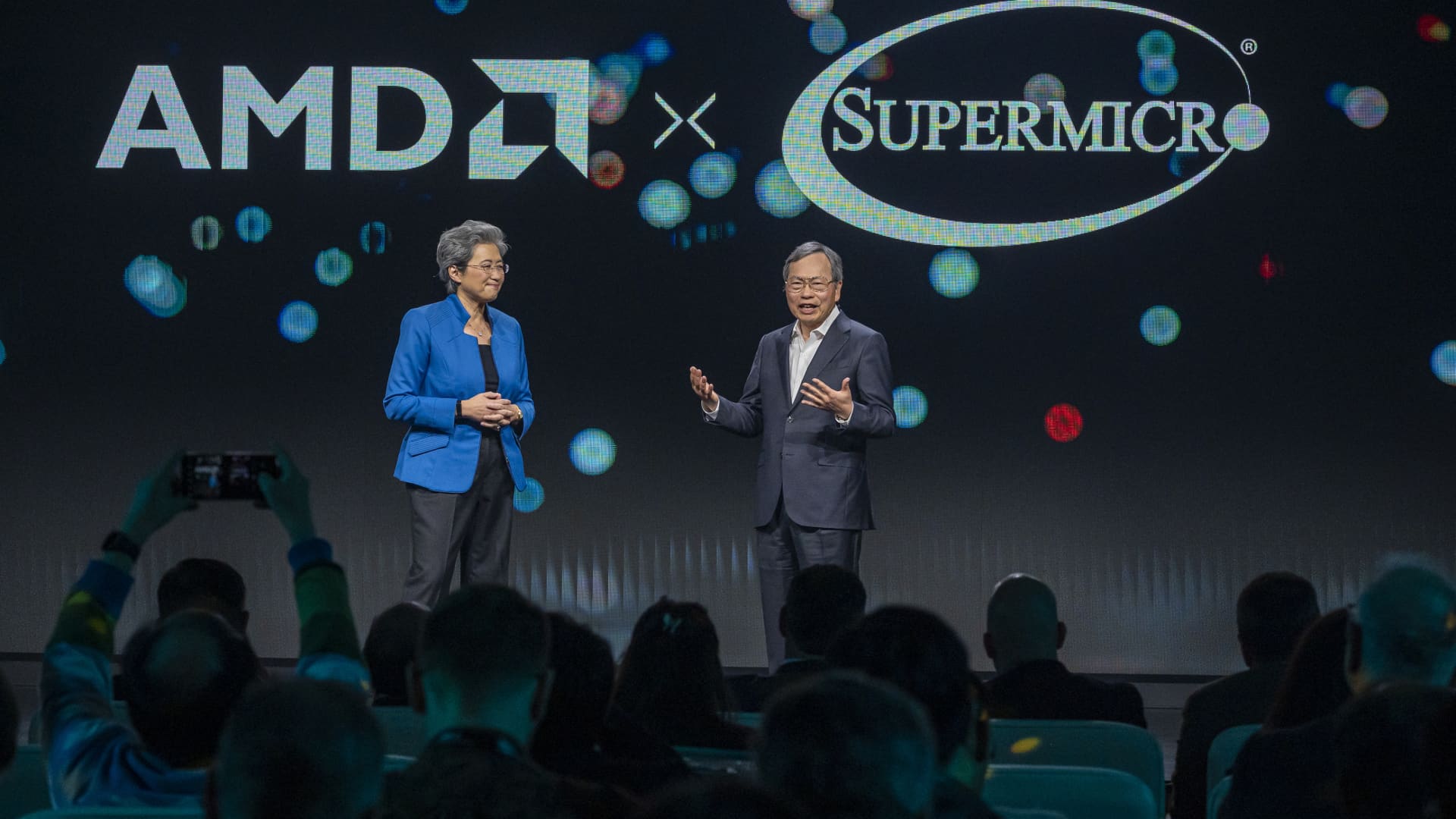

Lisa Su, chair and CEO of State-of-the-art Micro Gadgets, still left, and Charles Liang, CEO of Super Micro Computer, discuss at the AMD Advancing AI celebration in San Jose, California, on Dec. 6, 2023.

David Paul Morris | Bloomberg | Getty Photos

Super Micro shares slipped as considerably as 15% in extended buying and selling on Tuesday just after the server maker claimed marginally decreased earnings than predicted for its fiscal 3rd quarter, even as it gave optimistic best-line steering.

This is how the enterprise did in comparison with LSEG consensus:

- Earnings per share: $6.65 adjusted vs. $5.78 predicted

- Earnings: $3.85 billion, vs. $3.95 billion expected

The company’s revenue jumped 200% calendar year above 12 months in the quarter, which ended on March 31, in accordance to a statement. That compared with a 103% year-above-12 months maximize in the past quarter. Internet earnings arrived out to $402.5 million, or $6.56 per share, in contrast with $85.8 million, or $1.53 for each share, in the calendar year-in the past quarter.

Tremendous Micro is bumping up its fiscal 2024 profits steerage to $14.7 billion to $15.1 billion from $14.3 billion to $14.7 billion. Analysts surveyed by LSEG experienced expected $14.60 billion. The middle of the new array indicates somewhere around 582% yr-more than-12 months profits growth.

“We are expanding buyer foundation strongly now,” CEO Charles Liang mentioned on a meeting connect with with analysts.

Notwithstanding the soon after-hours shift, Tremendous Micro inventory is up 205% so much this year, though the S&P 500 inventory index has obtained 6%.

The business goes up from legacy IT devices vendors these types of as Hewlett Packard Enterprise. But previous year, traders were being keen to guess that Super Micro could become a essential supplier of servers that contains Nvidia graphics processing models for doing the job with artificial intelligence models, pushing up the inventory 246%.

In March, Super Micro took the place of Whirlpool in the S&P 500.

If not for a crucial ingredient lack, Super Micro would have sent a lot more during the quarter, Liang reported on the simply call. He mentioned he expects AI expansion to stay powerful for lots of quarters, if not several years, to appear. The fast growth required the organization raise money through a secondary giving this 12 months, Liang stated.

Super Micro’s supply chain proceeds to enhance, claimed finance main David Weigand.

The enterprise is eager to offer liquid-cooled servers that can final result in reduce power expenditures than air-cooled alternate options, Liang said.