Companies like Getir and Gorillas guarantee to supply objects to shoppers’ doors in as minimal as 10 minutes.

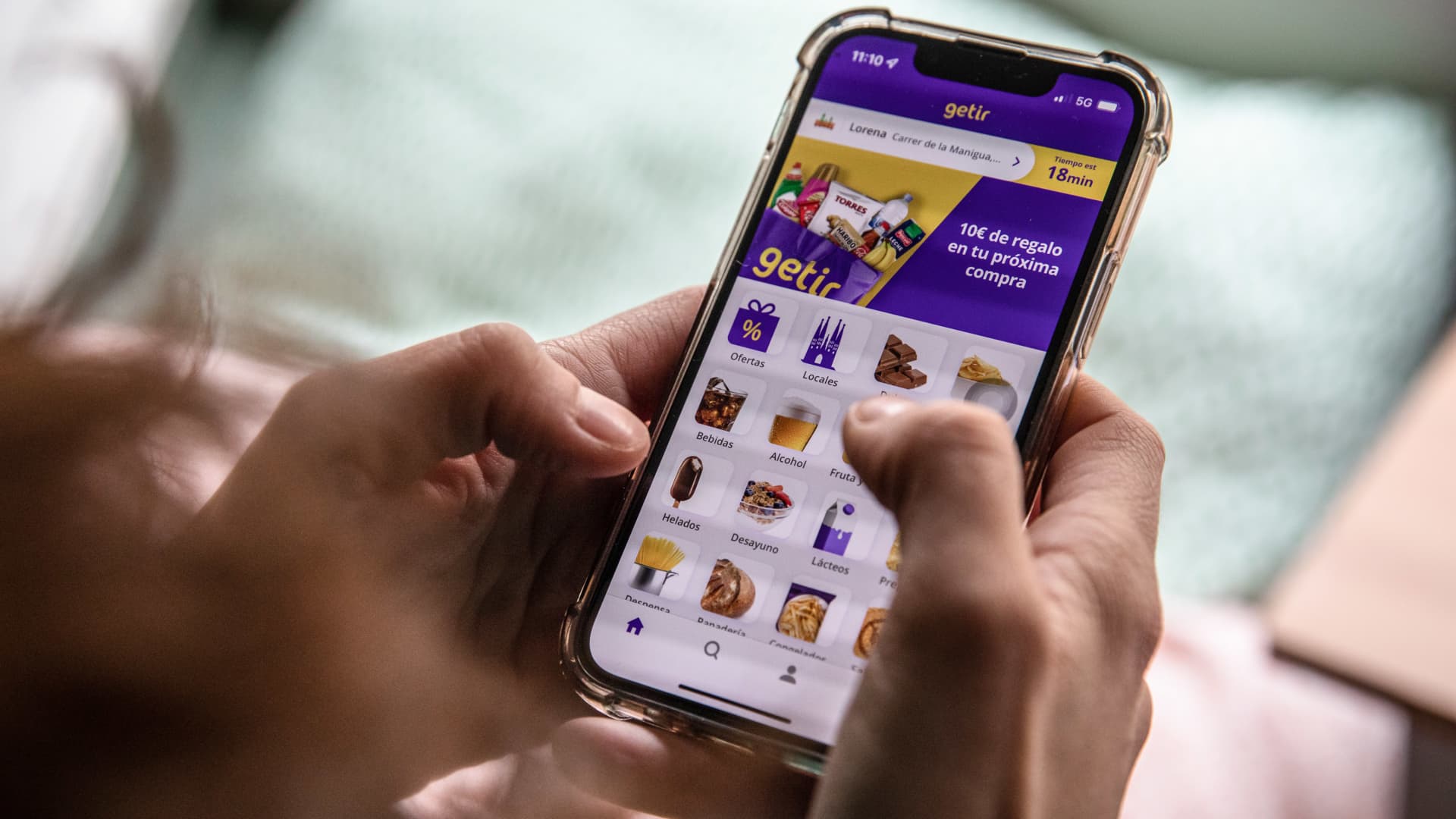

Angel Garcia | Bloomberg by way of Getty Photographs

Grocery delivery startup Getir declared Monday that it is quitting international markets together with the U.K., Germany, the Netherlands, and the U.S., marking a key setback for the when hyped on line grocery market.

The Istanbul, Turkey-based organization said in a assertion that it was withdrawing from its U.S. and European markets and would now refocus its money resources on Turkey.

The enterprise mentioned it lifted a new investment round led by Abu Dhabi sovereign prosperity fund Mubadala and venture funds firm G Squared “to bolster its aggressive place in its main meals and grocery shipping organizations in Turkey.”

Getir explained it generates 7% of its revenues from the U.K., Germany, the Netherlands, and the U.S.

“Getir expresses its sincere appreciation for the dedication and hard do the job of all its workforce in the British isles, Germany, the Netherlands, and the U.S.,” the corporation said.

Pandemic grocery hoopla fades

Getir was just one of the most hyped on the net grocery shipping firms at the height of the coronavirus pandemic in 2020 and 2021, when people today all-around the planet flocked to on-line products and services for their buying purchases.

The organization, which was started in 2015, has raised a whopping $1.8 billion to day. Getir elevated $768 million of that sum in 2022, at a sky-significant valuation of $11.8 billion.

Getir’s valuation has since sunk considerably, with the company possessing reportedly observed billions of dollars wiped off its current market worth.

Getir raised cash from essential backers including Mubadala, G Squared, and ex-Sequoia Funds husband or wife Michael Moritz, at a $2.5 billion valuation, according to a September 2023 Monetary Moments report, citing unnamed sources common with the make a difference.

That would mark a significant 79% low cost to Getir’s earlier disclosed valuation. CNBC was not able to independently validate the FT report.

Battling house

Getir’s vibrant purple and yellow branding experienced develop into a typical sight on mopeds whizzing all over the metropolis to provide groceries on-need in bustling cities like London and New York.

Getir’s organization, and some others like it, count on a model the place groceries are packed at neighborhood so-named “dark shops” peppered about a important metropolis in spots that are close to regions with a dense city populace.

Groceries would be packed up by staff at Getir’s stores, and then shipped by its fleet of drivers in a matter of minutes. Getir touted supply moments of as very little as 10 minutes.

Gorillas, a different grocery supply enterprise with a design related to Getir’s, confronted financial struggles in 2022 when superior fascination fees and soaring inflation place stress on its business enterprise. The brand was acquired by Getir in December 2022 for $1.2 billion.