Marc Andreessen and Ben Horowitz

Getty Images

Andreessen Horowitz stated Tuesday that it elevated $7.2 billion throughout five various cash, a sign of optimism in the tech startup earth, which has noticed a dearth of sizeable exits around the earlier two many years.

“This marks an significant milestone for us,” Ben Horowitz, who co-launched the company with Marc Andreessen in 2009, wrote in a blog put up.

The most significant chunk of new funding is in Andreessen Horowitz’s progress fund, which reeled in $3.75 billion. That funds gets invested in later-stage businesses that are seen as closer to likely community, or funds-intense corporations that need big checks.

Horowitz said in the submit that $1.25 billion will be dedicated to infrastructure, which incorporates artificial intelligence investments, though $1 billion will go to app investments, $600 million to game titles and yet another $600 million to what the agency calls American Dynamism, or “founders and corporations that guidance the national curiosity.” That contains aerospace, protection, schooling and housing.

The agency experienced originally aimed to raise $6.9 billion from investors for a new set of resources, which includes two with an AI concentrate, Bloomberg previously described. AI investing has been crimson sizzling in Silicon Valley and past, whilst the broader current market has been in a downturn.

Considering that 2021, when tech IPOs and startup investing surged to a record, undertaking investors have closed their wallets. Soaring inflation and increasing desire costs in 2022 pushed traders out of risky belongings and compelled dollars-burning startups to substantially minimize charges. Even with the stock market place recovering, undertaking offers have remained frustrated.

Deal volume for U.S. undertaking investments in the initial quarter sank to its lowest stage due to the fact 2017, according to data published previously this thirty day period by PitchBook. The tale was very similar throughout the world, with globally volume achieving its cheapest considering the fact that 2016 and complete offer benefit falling to a degree not witnessed because 2019.

In the meantime, there have been incredibly handful of tech IPOs considering that the conclusion of 2021. Reddit and Astera Labs went public in the initially quarter, the initial venture-backed tech companies to debut considering that September. They accounted for 73.4% of whole exit benefit in the U.S. in the time period, according to PitchBook.

Horowitz produced no reference to the current market slowdown in his article. Nor did he propose that any new funding will be dedicated to cryptocurrencies, an area where by Andreessen Horowitz was particularly bullish through the crypto fad that lifted bitcoin to a report in 2021. The firm raised a $4.5 billion crypto fund in 2022, bringing its overall volume elevated for crypto and blockchain investments to $7.6 billion.

Andreessen Horowitz stays on keep track of to raise much more funds for its crypto fund and a separate biotechnology fund, a person familiar with the issue advised Bloomberg. The business failed to immediately answer to a request for remark.

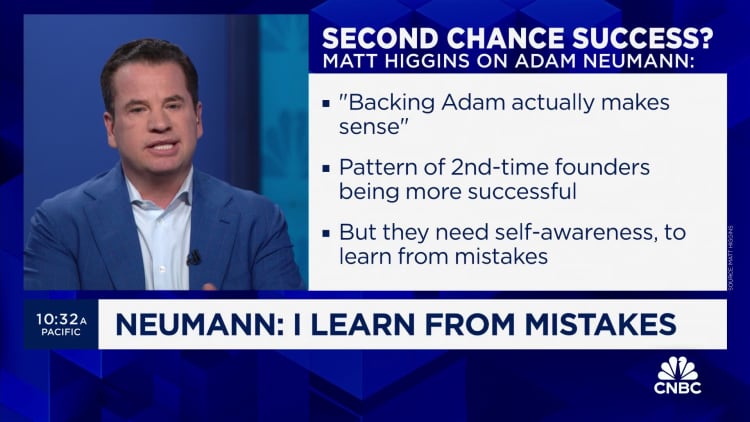

A person of Andreessen Horowitz’s extra notable bets of the past couple a long time concerned WeWork’s controversial co-founder Adam Neumann and his new startup known as Movement. Andreessen Horowitz wrote a $350 million check to the corporation, which was just getting started out and has but to make inroads in the residential actual estate industry.

Andreessen Horowitz claimed in a blog site submit at the time that Neumann’s endeavours to redesign the business office encounter at WeWork are “typically less than appreciated” and that the business loves “looking at repeat-founders create on past successes by increasing from classes realized.”

View: Adam Neumann justifies next shot, CEO says