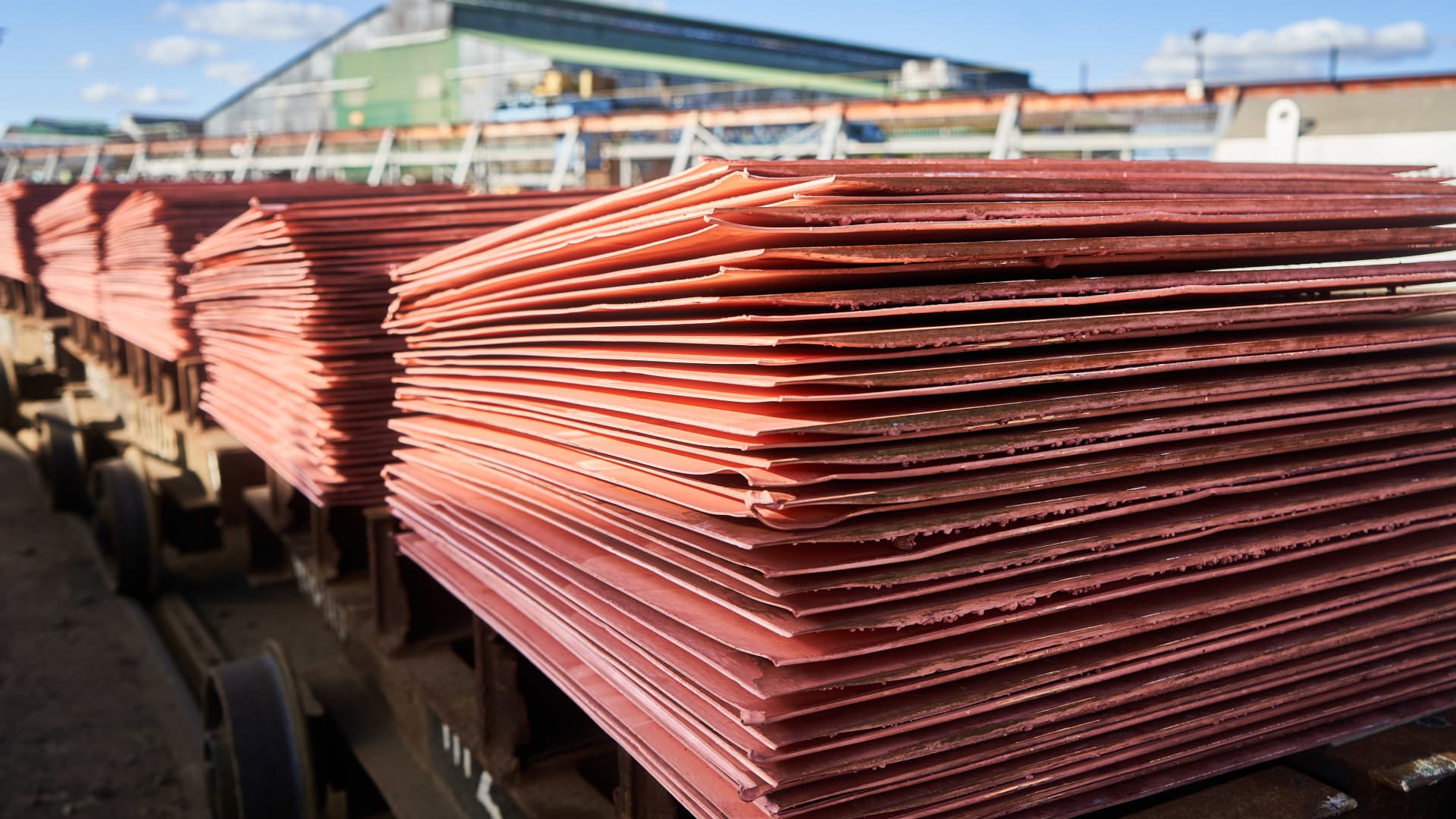

Copper plates on wagons completely ready for onward delivery at the Mufulira refinery, operated by Mopani Copper Mines Plc, in Mufulira, Zambia, on Friday, Might 6, 2022.

Bloomberg | Bloomberg | Getty Photographs

Soaring copper charges show no symptoms of slowing down, analysts say, with the pink metal’s rally fueled by provide hazards and increasing demand from customers prospective customers for electrical power changeover metals.

Copper selling prices with May well delivery traded at $4.323 per pound in New York as of Wednesday early morning, extending gains following settling at its optimum level considering that June 2022 in the previous session.

Copper briefly hit a significant of $4.334 in intraday trading on Tuesday, reflecting its best stage considering the fact that the middle of January previous calendar year.

Three-thirty day period copper charges on the London Steel Exchange traded .6% greater at $9,477 per metric ton.

Demand from customers for copper is commonly thought of a proxy for financial well being. The base metallic is critically vital to the energy transition ecosystem and is integral to producing electrical autos, electricity grids and wind turbines.

Wall Street banks are bullish on the outlook for copper selling prices as a result of to the end of the yr.

Earlier this 7 days, analysts at Citi mentioned that they feel the second secular bull sector of copper this century is now underway — roughly 20 several years soon after the 1st such cycle.

Citi claimed on Monday that it expects copper rates to pattern larger above the coming months, averaging $10,000 for every metric ton by the finish of the year and climbing to $12,000 in 2026, according to the bank’s foundation-case scenario.

“Explosive price upside is probable around the next 2-3 a long time way too, if a potent cyclical recovery happens at any time, with charges possibly growing extra than 2/3rds to $15k/t+ in this, our bull situation state of affairs,” analysts at Citi explained in a study be aware.

“Our $12k/t foundation case assumes only a smaller uptick in cyclical desire expansion above the class of 2025 and 2026,” they added.

‘Commodity markets often self-solve’

Independently, analysts at Lender of America have raised their 2024 value concentrate on for copper to $9,321, up from its previous forecast of $8,625.

The Wall Street lender claimed Monday that copper was at the “at the epicentre of the energy changeover, which suggests that the lack of mine source advancement is currently being felt acutely.”

“Limited concentrates availability is progressively capping manufacturing at China’s smelters and refiners, perhaps pushing buyers of refined metallic back again into international marketplaces,” analysts at Bank of The usa reported in a exploration notice.

“At the same time, desire in the US and Europe ought to bounce back again as economies bottom out this, alongside with increasing demand from customers from the energy transition, will probably go the copper industry into deficit this 12 months,” they added.

Not everyone’s certain copper selling prices will hold on to projected gains this calendar year.

“Commodity markets usually self-remedy,” Colin Hamilton, commodities analyst at BMO Money Marketplaces, advised CNBC’s “Avenue Signals Europe” on Tuesday.

“They usually discover means of softening items out. If we won’t be able to solve from the supply facet, properly guess what, we’ll hurt demand from customers and that is what inflation obviously does. Which is why we experienced underperformance for a lot of the earlier yr,” Hamilton mentioned.

“So, if copper gets say to let us say four instances the aluminum cost, you would are likely to see a bit of switching and substitution. I see some quite high copper selling price targets out there: we could access them temporarily, but then you would see demand from customers changing in key locations.”

— CNBC’s Michael Bloom and Lee Ying Shan contributed to this report.