A common perspective of the exterior of the headquarters of Norfolk Southern on April 1, 2023 in Atlanta, Ga.

Icon Sportswire | Getty Images

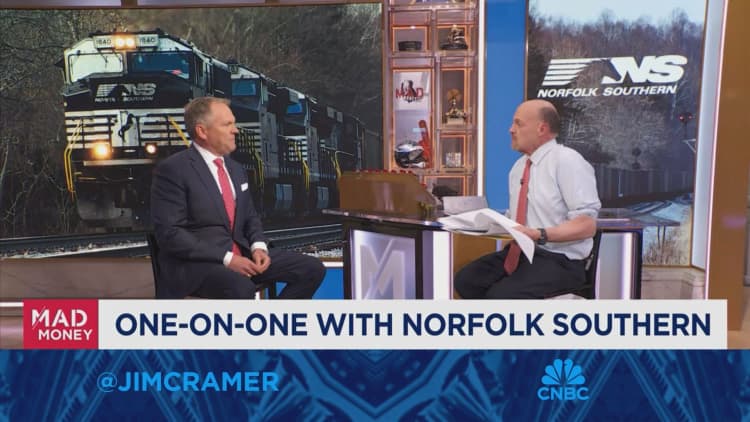

Norfolk Southern is almost two months into a fight with activist trader Ancora, which is striving to shake up the railroad’s board and oust CEO Alan Shaw.

Now the company is taking aim at Norfolk Southern’s new running chief John Orr over what the activist calls an “too much” buyout bundle and a career marred by allegations of racial and sexual discrimination.

Final month, Norfolk Southern hired Orr away from rival CPKC, paying out tens of hundreds of thousands of bucks to buy him out of his contract. The move was commonly observed as a reaction to Ancora’s operational criticisms and obtained praise from various Wall Road analysts.

In a letter to Norfolk Southern shareholders on Friday, Ancora highlighted previous misconduct by Orr that raises questions about his hiring, even as the executive has overseen improvements in the railroad’s operations in his 3 months on the occupation.

Ancora documented both equally alleged and substantiated office misconduct by Orr, dating back to his time as a mid-degree govt at Canadian National. An appointee of the Canadian Arbitration Board substantiated allegations that Orr employed verbally abusive language in the direction of a woman personnel in the early 2000s.

The staff and a further witness informed the employment tribunal at the time that Orr frequently cursed and shouted at the personnel, and referred to as her a “f—— b—-” and a “f—— fool.” A witness informed the arbitrator that, in one particular instance, Orr told the staff that she “was so f—— silly it was embarrassing.”

The arbitrator identified the promises credible.

Ancora also flagged a lawsuit submitted in 2019 by a Black govt, who explained Orr’s procedure of personnel and subordinates as “abysmal.” The suit was submitted versus Canadian National, alleging racial discrimination.

Orr’s behavior was allegedly “so negative” that Canadian Countrywide was compelled to provide govt coaching for him, according to a 2020 filing in the lawsuit. Orr’s deposition is sealed and the case was settled in 2022.

Prior to the announced choosing of Orr, Ancora drew interest to promises about his habits in e-mails to two Norfolk Southern board users that CNBC obtained.

Ancora stated in its assertion on Friday that the using the services of of Orr was a high priced proposition that’s harming shareholders. As portion of the settlement, Norfolk Southern reported it would pay back Orr’s prior employer $25 million in funds and present extra unspecified concessions for a essential rail hub and route in the southern U.S. Norfolk Southern values that certain aspect of the route at all-around 1% of its revenues.

When it declared Orr’s selecting, Norfolk Southern did not disclose the initial effect of the concessions or the approximated knock-on outcomes in the decades to appear.

‘Flawed premise’

Norfolk Southern explained to CNBC in a statement that Ancora’s examination of the worth of the route — the Meridian Speedway arrangement — “is totally inaccurate and primarily based on a flawed premise,” in that it assumes Norfolk Southern is forgoing far more earnings than it in fact is.

“As we formerly mentioned, this revised arrangement is by no means a consequential concession,” the corporation stated.

Ancora is trying to get to oust Norfolk Southern CEO Alan Shaw together with Orr in favor of former UPS CEO Jim Barber and former CSX Executive Vice President Jamie Boychuk, respectively. The activist has said that Norfolk Southern is significantly underperforming its friends, and has laid the blame at the ft of Shaw and the board.

Pertaining to Orr, Norfolk Southern mentioned he has a “keep track of file of bettering performance when running safely and securely and with integrity.”

“Ancora’s endeavor to malign John by dredging up claims from his previous employer, a person of which is from about 20 a long time back, is very little additional than an attempt to distract from the facts about their deeply flawed COO prospect, Jamie Boychuk,” a company spokesperson explained to CNBC. “Mr. Orr and Mr. Boychuk’s keep track of data and field reputations are just not comparable.

Jamie Boychuk and John Orr.

Courtesy: Longacre Square Companions and Norfolk Southern

In February 2023, a Norfolk Southern freight train derailed in East Palestine, Ohio, releasing toxic chemical compounds into the natural environment and prompting a political fight with regards to railroad security. Given that then, the stock is around flat though the S&P 500 is up 26%.

Norfolk Southern’s shareholder meeting is scheduled for Might 9.

Ancora has gained the backing of other stakeholders in its fight with the company. Neuberger Berman, which retains a compact position in Norfolk Southern, explained on Friday that it would assist Ancora’s slate, citing a “record of weak governance that has very long preceded” the railroad’s transformation attempts.

A settlement concerning the two sides appears unlikely, Gordon Haskett analyst Don Bilson explained in a Friday observe to shoppers. Shaw previously told CNBC that the firm offered Ancora a “couple” of board seats in a settlement offer you.

Ancora told CNBC that it is made recurring tries to settle with the company, each directly and through advisors. Any settlement, from Ancora’s standpoint, would be contingent on a board refresh and Shaw’s ouster. The board has frequently expressed self-confidence in Shaw and has mentioned it is just not intrigued in a settlement that would direct to his departure.

Observe: Barclays upgrades Norfolk southern