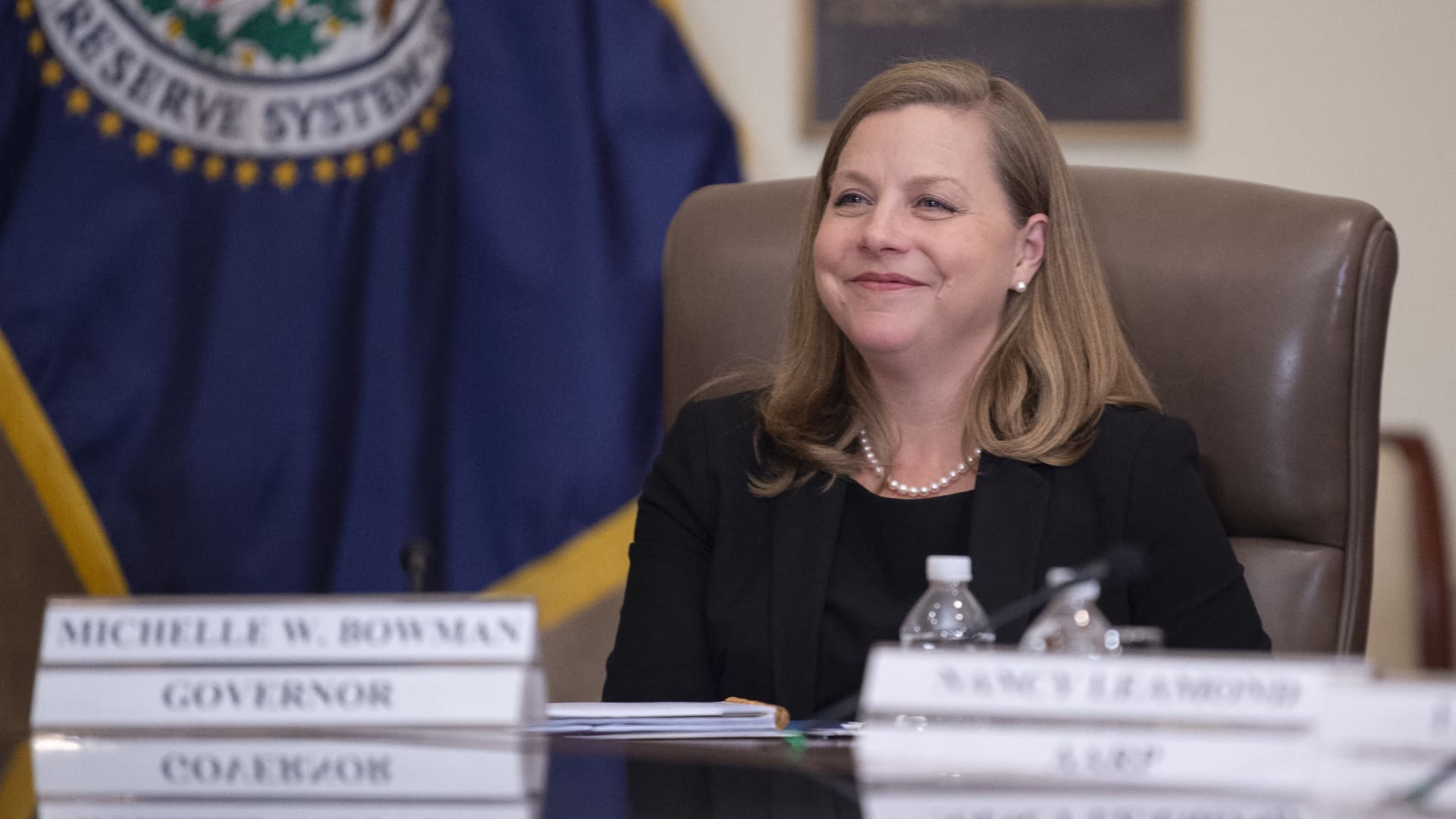

Federal Reserve Governor Michelle Bowman stated Friday that it truly is attainable interest fees may have to go bigger to control inflation, relatively than the cuts her fellow officers have indicated are very likely and that the market place is anticipating.

Noting a variety of probable upside risks to inflation, Bowman mentioned policymakers need to be mindful not to ease plan as well swiftly.

“Whilst it is not my baseline outlook, I continue on to see the threat that at a upcoming assembly we may perhaps need to maximize the policy level even further should really development on inflation stall or even reverse,” she said in prepared remarks for a speech to a group of Fed watchers in New York. “Cutting down our coverage price much too before long or far too quickly could end result in a rebound in inflation, requiring further more foreseeable future policy rate raises to return inflation to 2 % about the for a longer time operate.”

As a member of the Board of Governors, Bowman is a long lasting voting member of the fee-location Federal Open Sector Committee. Considering that taking office in late 2018, her community speeches have place her on the extra hawkish facet of the FOMC, meaning she favors a much more intense posture towards made up of inflation.

Bowman reported her most likely result stays that “it will at some point become correct to decreased” premiums, however she famous that “we are nonetheless not still at the level” of slicing as “I continue on to see a variety of upside risks to inflation.”

The speech, to the Shadow Open Marketplace Committee, arrives with markets on edge about the near-expression long run of Fed coverage. Statements this 7 days from many officials, which includes Chair Jerome Powell, have indicated a careful approach to chopping charges. Atlanta Fed President Raphael Bostic, an FOMC voter, advised CNBC he probably sees just a person reduction this yr, and Minneapolis Fed President Neel Kashkari indicated no cuts could occur if inflation does not decelerate additional.

Futures traders are pricing in three cuts this calendar year, though it has develop into a near connect with among June and July for when they get started. FOMC customers in March also penciled in 3 cuts this year, while just one unknown formal in the “dot plot” indicated no decreases until 2026 and there was substantial dispersion otherwise about how aggressively the central bank would shift.

“Specified the dangers and uncertainties concerning my economic outlook, I will continue on to observe the knowledge carefully as I evaluate the appropriate path of monetary coverage, and I will remain cautious in my strategy to thinking of long term modifications in the stance of coverage,” Bowman claimed.

Weighing inflation dangers, she claimed that supply-side advancements that helped provide numbers down this year may perhaps not have the identical influence heading ahead. Moreover, she cited geopolitical threats and fiscal stimulus as other upside pitfalls, along with stubbornly better housing prices and labor industry tightness.

“Inflation readings over the past two months recommend development may perhaps be uneven or slower going forward, specially for core services,” Bowman stated.

Fed officials will get their upcoming search at inflation data Wednesday, when the Labor Section releases the March customer rate index report.