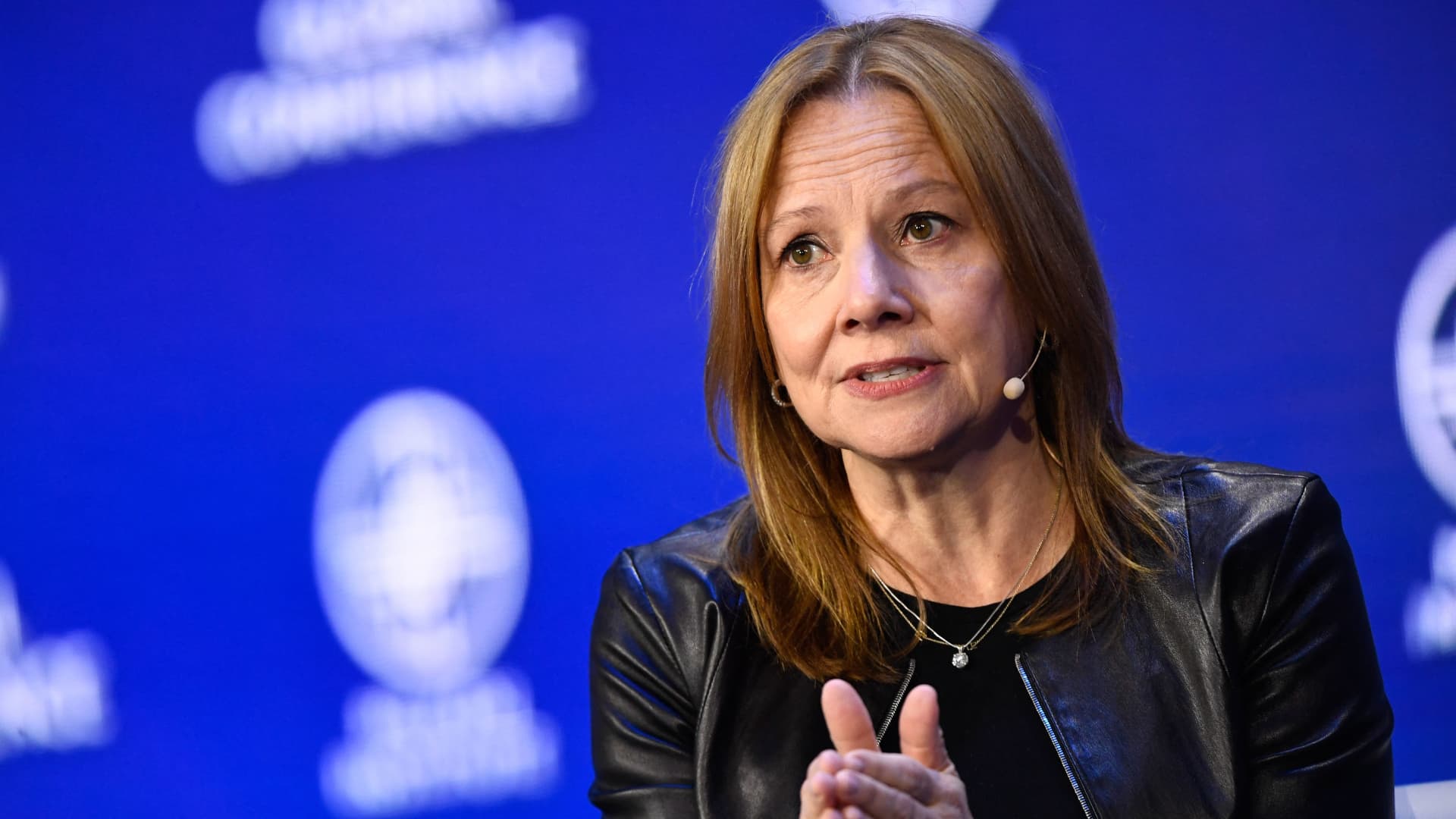

Mary Barra, Chair and CEO of the General Motors Company (GM), speaks during the Milken Institute Global Conference in Beverly Hills, California, on May 2, 2022.

Patrick T. Fallon | AFP | Getty Images

DETROIT — Shares of General Motors on Thursday hit a new 52-week low and opened at their lowest price since November 2020, after Wells Fargo downgraded the stock and significantly slashed its target price for the company.

Wells Fargo analyst Colin Langan lowered GM’s rating after market close Wednesday to “underweight” from “overweight” and cut the company’s price target from $74 a share to $33 a share.

This year could represent a profit peak for legacy automakers, with the shift toward electric vehicles eroding profits in the years ahead, he said in a note to investors.

“We see headwinds from price normalization, inflationary costs, and the 2023 UAW contract negotiations. Therefore, we are concerned that 2022 could be the peak profits as GM will be increasingly forced to absorb BEV losses to meet high 2026 US regulatory hurdles,” he said.

For the same reasoning, Langan on Wednesday also downgraded Ford Motor to “underweight” and cut its price target in half from $24 a share to $12 a share.

GM shares fell about 6% to $35 Thursday morning after opening at their lowest point since November 2020. The company’s market cap is about $51 billion.

Shares of Ford declined more than 4% to $12.27. The stock’s 52-week low is $11.28 a share from May 2021. Ford’s market cap is about $49 billion.

Ford Chair Bill Ford during the company’s annual shareholder meeting Thursday said he remains bullish on the automaker’s long-term business plans, despite the stock’s performance this year.

“2021, our stock was on fire. This year it’s come back to Earth a bit. The whole market is coming back to Earth, but I’ve never been more confident of our future,” he said. Later adding, “you can’t manage the business for stock price, you manage the business to build a great and enduring company.”

Shares for the Detroit automakers were already under pressure before the double downgrade from Wells Fargo. Both stocks have declined nearly 40% this year.