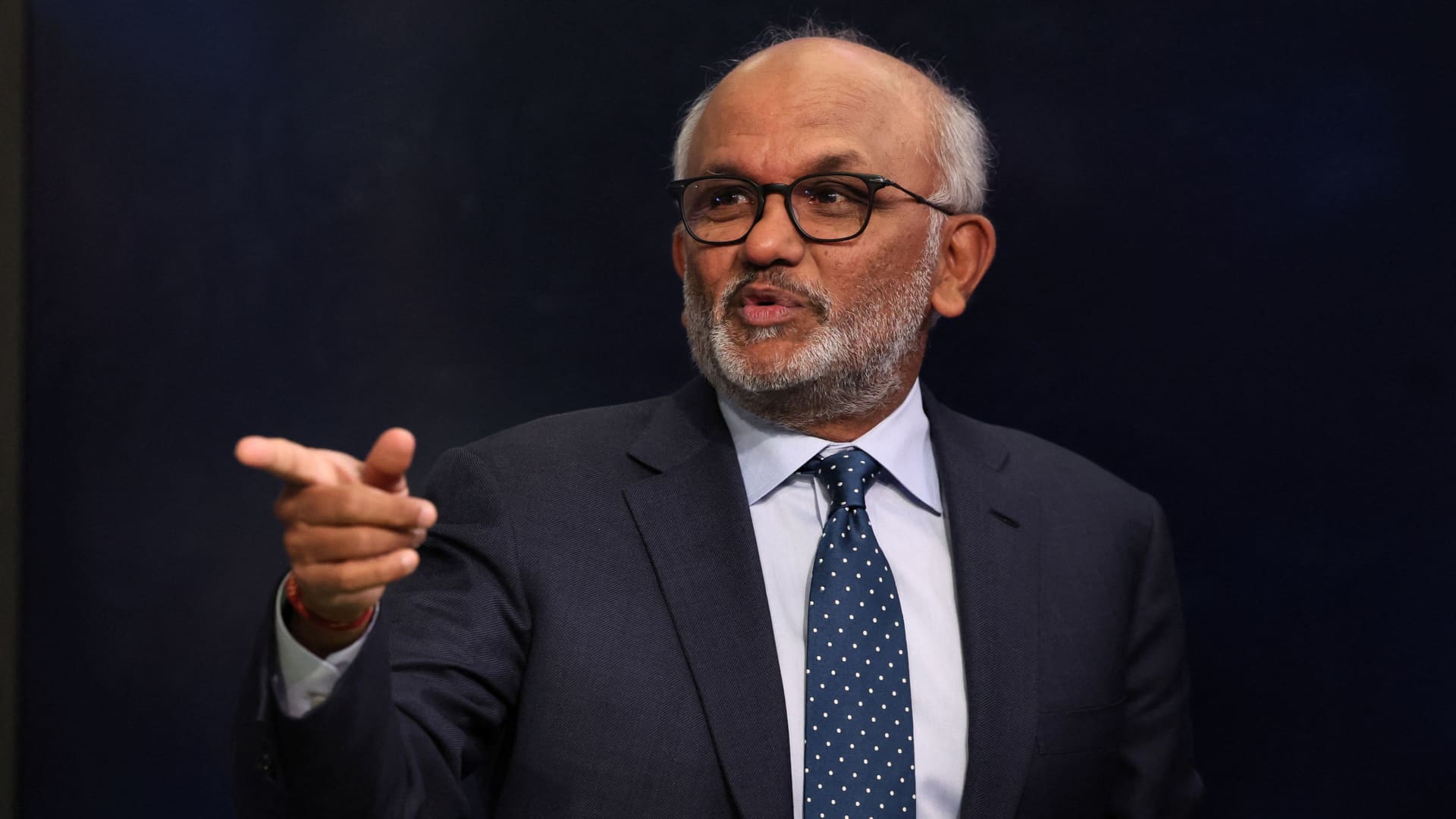

Adobe CEO Shantanu Narayen speaks through an job interview with CNBC on the flooring at the New York Stock Trade in New York Metropolis, Feb. 20, 2024.

Brendan Mcdermid | Reuters

Adobe shares fell 13% on Friday morning soon after the company described first-quarter outcomes that conquer estimates but delivered a gentle quarterly profits forecast.

The design and style program firm posted adjusted earnings for every share of $4.48, earlier mentioned the $4.38 analysts have been expecting, in accordance to LSEG, previously acknowledged as Refinitiv. Its income of $5.18 billion exceeded the $5.14 billion analysts approximated.

For the latest quarter, Adobe expects modified earnings for every share of $4.35 to $4.40, even though analysts have been anticipating $4.38. It claimed profits will total $5.25 billion to $5.30 billion, somewhat underneath the $5.31 billion estimated. The business also introduced a $25 billion share buyback.

Adobe also just lately released a new artificial intelligence assistant for its Reader and Acrobat programs that can aid customers digest facts from long PDF files.

Financial institution of America analysts, reiterating their purchase rating of Adobe shares, reduced their cost goal for the inventory to $640 from $700, expressing optimism about Firefly, the company’s generative AI picture generation tool.

“No adjust to our watch that Adobe is a major AI beneficiary,” the analysts wrote in a Thursday trader observe. “Whilst the monetization ramp is slower than anticipated, Firefly is a single of the [most] broadly applied generative AI choices, with probable for a number of paths to monetization.”

Barclays dropped its price tag goal for shares of Adobe to $630 from $700 even though maintaining an obese ranking for the inventory. Its analysts wrote on Friday that they be expecting the inventory to get well and “would be buying this dip due to the fact pricing is masking the fundamental energy in Resourceful Cloud.”

Analysts at Morgan Stanley held their overweight ranking of and $660 price tag concentrate on for Adobe stock, crafting on Friday that “far more endurance is likely warranted.”

“A more compact than envisioned beat in Digital Media Web New ARR very likely raises investor issues about aggressive pressures,” the analysts wrote. “However a rising number of vectors for monetizing GenAI and new monetizable alternatives coming on the web in 2H24 must help increase the narrative likely forward.”