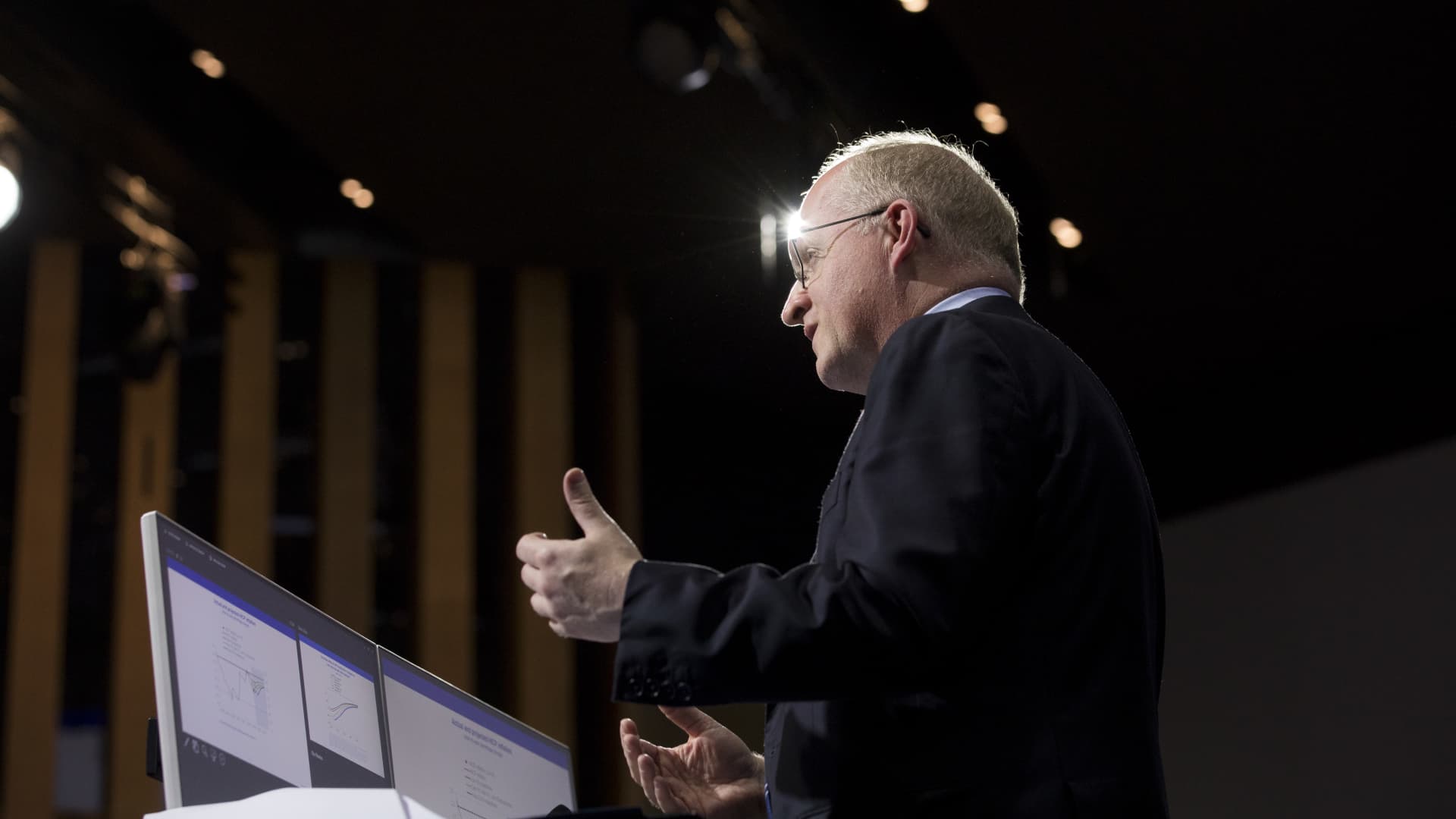

Philip Lane, main economist of the European Central Financial institution (ECB), gestures as he delivers a speech on monetary coverage at Bloomberg’s European headquarters in London, U.K., on Monday, Sept. 16, 2019.

Bloomberg | Bloomberg | Getty Photos

The European Central Bank have to acquire its time to get interest charge cuts ideal, its main economist, Philip Lane, reported Thursday.

“A whole lot of evidence is accumulating, but what is actually also honest to say is that the changeover from this keeping period, we’ve been on hold considering the fact that last September given that a substantial mountaineering cycle, we do have to consider our time to get that right, from keeping to dialing back limits,” Lane explained to CNBC’s Steve Sedgwick.

This is a breaking news story. Be sure to examine again for updates.