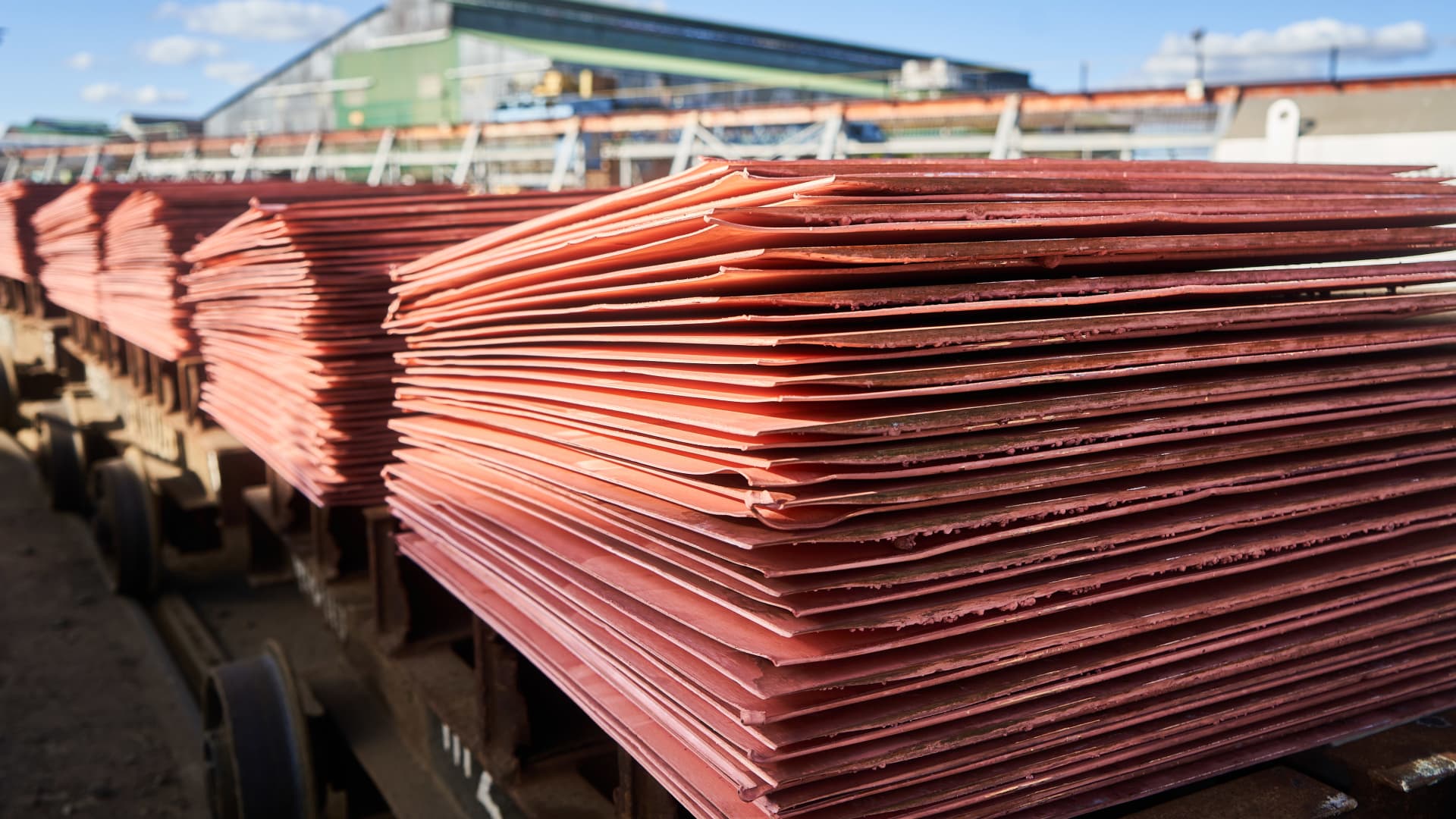

Copper plates on wagons all set for onward shipping and delivery at the Mufulira refinery, operated by Mopani Copper Mines Plc, in Mufulira, Zambia, on Friday, Could 6, 2022.

Bloomberg | Bloomberg | Getty Visuals

KoBold Metals, a mining startup backed by billionaires including Bill Gates and Jeff Bezos, is bullish on the discovery opportunity of some of the most sought-following energy changeover metals.

It arrives soon following the Silicon Valley-based metals exploration business declared the exceptional discovery of a broad copper deposit in Zambia.

Josh Goldman, president of KoBold Metals, advised CNBC that the firm’s traders have been thrilled by the discovery, especially at a time when the mining market is battling to hold rate with a metals-intense vitality changeover.

“They are emotion delighted about this information due to the fact this is what we set out to do. The point of the firm is to learn, obtain and develop mineral assets that we require for the energy changeover,” Goldman mentioned by way of videoconference.

“This is the to start with major acquire for the enterprise, and it is between the most extraordinary ore bodies in the earth,” he added.

KoBold Metals states it makes use of synthetic intelligence to generate a “treasure map” to assistance obtain new deposits of components this kind of as copper, lithium, cobalt and nickel. The corporation at this time has extra than 60 exploration-phase assignments throughout many nations.

The issue of the company is to be serially productive in exploration — and to enhance exploration results general and to lessen the capital depth of discovery.

Josh Goldman

President of KoBold Metals

The startup’s investors include U.S. undertaking cash agency Andreessen Horowitz, Norwegian electrical power giant Equinor, the world’s most significant mining group BHP, and Breakthrough Power, a climate and know-how fund founded by Invoice Gates in 2015.

Breakthrough Energy’s backers incorporate Bridgewater Associates’ Ray Dalio, Virgin Group’s Richard Branson, Alibaba’s Jack Ma and Amazon’s Jeff Bezos.

KoBold Metals is now focusing on advancing its Mingomba undertaking in Zambia, which it expects to begin making copper inside of 10 years, and identifying the next trove of significant minerals, in accordance to Goldman.

“The Central African copper belt is the aspect of the globe wherever you can discover points of this amazing quality. And that’s why we are there. The geology is incredible,” he explained.

“It is not just that there haven’t been deposits like this. It is that there are far more to be uncovered. Listed here is Mingomba — and then in which is the up coming Mingomba right after this? This is the portion of the world and style of deposit in which we can find means of this scale and excellent, and Zambia supplies an running environment that is truly amazing,” he included.

Copper is in significant desire owing to its use in renewable energy infrastructure, strength storage devices and electric cars. Zambia is Africa’s 2nd-biggest copper producer following the Democratic Republic of the Congo.

‘The likely for discovery is great’

KoBold Metals explained that most copper at this time getting mined has an ore quality of around .6%, while its Mingomba deposit has copper ore grades of far more than 5%.

“That usually means that you have to mine a whole lot a lot less rock in buy to get the very same amount of copper,” Goldman claimed.

“For a .5% ore deposit, you have to mine 200 kilograms of rock to get 1 kilogram of copper. For a 5% ore deposit, you have to mine 20 kilograms of rock to get 1 kilogram of copper. So, that’s a lot significantly less Earth that you have to disturb, which is a whole lot significantly less squander that you develop.”

Workers watch electrolytic baths at the Mufulira refinery, operated by Mopani Copper Mines Plc, in Mufulira, Zambia, on Friday, May possibly 6, 2022.

Bloomberg | Bloomberg | Getty Visuals

Goldman claimed KoBold Metals plans to checklist shares publicly in the subsequent a few to four many years.

“We do count on in owing training course that getting a public business is likely heading to be the most effective way to finance the organization,” he additional.

“The position of the organization is to be serially profitable in exploration — and to enhance exploration accomplishment general and to decrease the cash intensity of discovery,” Goldman mentioned. “We imagine the likely for discovery is terrific. There is a lot far more to be observed in Zambia.”