Snowflake Chairman Frank Slootman attends the Snowflake Summit 2022 in Las Vegas on June 14, 2022.

Snowflake | By way of Reuters

News of Snowflake CEO Frank Slootman’s retirement sparked an 18% plunge in the company’s inventory selling price on Thursday, its steepest selloff considering that the data analytics computer software seller debuted on the New York Stock Exchange in 2020.

Slootman’s departure was announced late Wednesday as part of Snowflake’s quarterly earnings report, which integrated disappointing direction. Analysts at Mizuho Securities wrote in a take note that the stock is finding hammered “as investors digest the resignation” of Slootman, who joined in 2019 and led the corporation via its blockbuster IPO the pursuing calendar year.

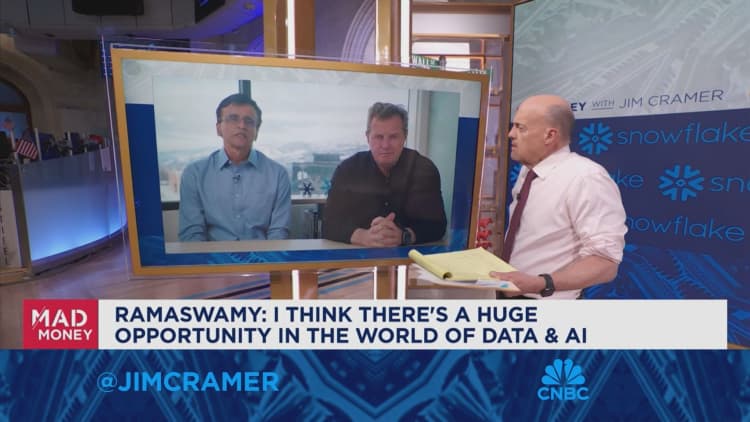

Whilst the announcement brought about consternation on Wall Street, Slootman explained to CNBC that he’s not worried about a wave of Snowflake staff next him out the doorway.

“This is not a personalized cult, Ok?” Slootman explained.

Slootman, 65, is getting succeeded by former Google ad chief Sridhar Ramaswamy, who joined Snowflake in June by way of the firm’s $185 million acquire of Neeva, a startup Ramaswamy co-founded in 2019.

Snowflake was the third enterprise know-how company that Slootman shepherded via the IPO course of action, subsequent Information Area in 2007 and ServiceNow in 2012. Snowflake marked his greatest money windfall. He controlled about 6% of the firm’s inventory at the time of the IPO, and owned 10.6 million shares as of Feb. 9, a stake that’s now really worth about $2 billion.

Additionally, Slootman’s overall compensation in 2023 amounted to $23.7 million, virtually solely from inventory and alternative awards.

In advance of becoming a member of Snowflake, Slootman used about 6 yrs as CEO of ServiceNow. He told CNBC that ServiceNow has ongoing to flourish considering that his departure. Annualized profits has grown from $1.5 billion to virtually $10 billion.

“Some people today are however there that I hired — rather a several of them, really,” Slootman mentioned. “There’s also new ones, of course.”

ServiceNow’s workforce stood at 23,668 by the finish of 2023, compared with 603 in December 2011, months soon after Slootman experienced joined, in accordance to regulatory filings.

“We put ServiceNow on the rails. We’ve completed that with Snowflake as effectively,” reported Slootman, who’s sticking all around as chairman.

Taking three businesses by way of major and effective exits is a uncommon feat in technology, and has received Slootman loads of acclaim. But he’s also captivated notice for stepping into controversy on concerns like the tech industry’s aim on diversity. In 2021, as corporate The usa was wading via the fallout of the George Floyd murder, Slootman mentioned that diversity should not trump benefit. He later on apologized.

In his 2022 reserve “Amp It Up,” Slootman offered guidance leaders on how to raise criteria within companies, citing Steve Jobs’ insistence on greatness at Apple. “You should not enable malaise set in,” he wrote.

Founded in 2012, Snowflake constructed a cloud-based mostly data warehouse for storing and analyzing corporate info. Now the company would like to assist customers develop synthetic intelligence products and programs on prime of the information.

Ramaswamy explained Snowflake has a apparent vision, with the info cloud at the centre and apps all around it.

“Just delivering on that at scale with speed is what I’m heading to do,” he explained.

The obstacle will be to retain the company’s momentum.

Snowflake generates about $3 billion in annualized profits, growing at about 32% a calendar year, as opposed with underneath $200 million ahead of Slootman replaced previous Microsoft government Bob Muglia as CEO in 2019. As it tries to carry on its swift growth, Snowflake faces competition from Databricks, valued at $43 billion previous calendar year in an investment spherical that involved Funds A person, which earlier backed Snowflake.

Following Snowflake acquired Neeva, Slootman stated he created an effort to get to know Ramaswamy. The business put Ramaswamy in the most crucial position at the time, top its AI initiatives. Slootman experienced a realization.

“Holy s—, this is the chance we have been ready for,” he claimed.

Ramaswamy stated he is been expending a ton of time with Slootman. They’ve traveled together to London and Berlin, together with domestic outings to Arizona and Las Vegas. Ramaswamy mentioned he is held discussions with above 100 purchasers, together with several with Slootman.

Now that he is at the helm, Ramaswamy has to deal with the naysayers.

“It is no question regarding to see Mr. Slootman, who has a strong keep track of history and is very well regarded by investors, action down soon after 5 decades in the function,” Deutsche Financial institution analysts wrote in a notice on Thursday, nevertheless they managed their obtain advice on the stock.

But no one has additional at stake in Ramaswamy’s achievement than Slootman, who continues to be a single of the firm’s largest buyers.

“Snowflake is in an extremely fantastic place, getting Sridhar at the helm,” he said.

Watch: Section of Snowflake’s downfall is relevant to CEO Slootman’s retirement