The bitcoin halving is an occasion that transpires around just about every 4 decades where benefits to miners are minimize in halve, successfully restricting supply of the token.

S3studio | Getty Photos

Bitcoin, the world’s largest cryptocurrency by industry cap, extended a rally in Asia trading on Tuesday, reaching a two-yr higher of in excess of $56,000 and uplifting the broader crypto market amid good market place developments and getting from crypto bulls.

The price of bitcoin elevated around 10% inside two days, in accordance to information from CoinMarketCap, just after crypto investing and computer software organization MicroStrategy disclosed a obtain of about 3,000 bitcoins for $155 million on Monday.

MicroStrategy, primarily based in Virginia, is now the largest publicly traded operator of bitcoin. The business reported a keeping of about 190,000 of the cryptocurrency tokens before this thirty day period, which would be truly worth around $10.5 billion now.

In accordance to Greta Yuan, head of research at electronic asset system VDX, the sector was “encouraged by crypto bulls this kind of as MicroStrategy” as well as a “new report of Bitcoin ETF inflows.”

Most of the cryptocurrency current market seasoned a carry from the most current rally. Ethereum, the 2nd-greatest cryptocurrency by marketplace cap, achieved a multi-month high earlier mentioned $3,200.

Crypto-connected equities also surged in trading in the U.S. MicroStrategy and San Francisco-dependent crypto trade enterprise Coinbase both leaped about 16% on Monday and ongoing attaining in aftermarket buying and selling.

The two crypto-relevant corporations have witnessed their inventory prices improve 200% about the earlier year.

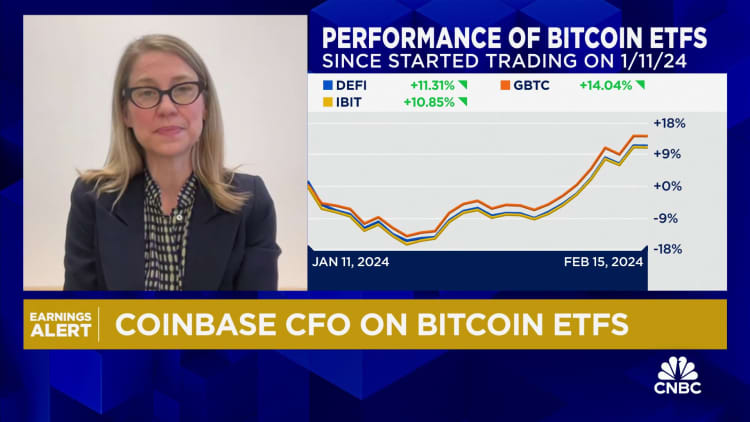

Talking to CNBC very last week, Alesia Haas, Coinbase’s CFO, attributed the company’s latest robust economic results to the regulatory acceptance of location bitcoin ETFs in the U.S. final month, which had brought on renewed fervor surrounding the cryptocurrency.

In accordance to VDX’s Yuan, the surging price of bitcoin also demonstrates the “bullish sentiment of buyers, in particular in the U.S.,” ahead of an upcoming “bitcoin halving” established for the second fifty percent of April.

A bitcoin halving event happens each and every 4 years, with the reward for bitcoin mining — the approach by which transactions are digitally confirmed on the blockchain — minimize in fifty percent, consequently cutting down the price at which new bitcoin tokens are created and decreasing the quantity of new source out there.

“As Bitcoin’s halving attracts closer, traders are speeding to the most effective positioning for the celebration. The new file of influx volume of Bitcoin ETFs is a further self confidence examine for bullish investors,” Yuan additional.

The solid bitcoin overall performance also comes amid the dollar trading down on Monday and Tuesday. Markets anticipate U.S. financial details this week that could sign how shortly the Federal Reserve may perhaps start cutting interest prices.

Bitcoin costs and the U.S. dollar index have historically proven an inverse correlation.