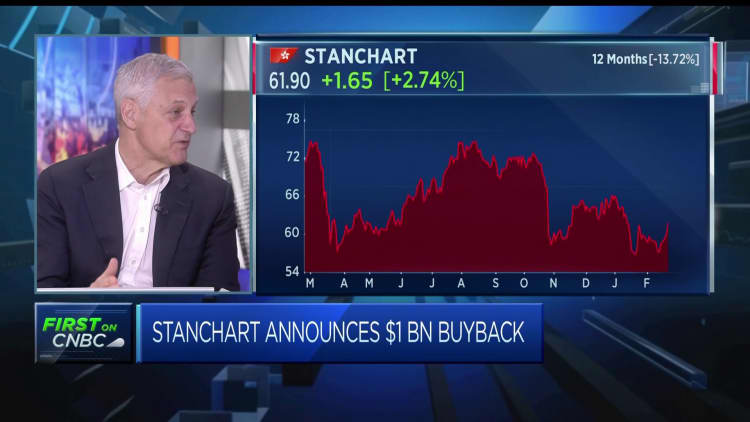

Regular Chartered on Friday rewarded shareholders with dividends and a refreshing $1 billion buyback as gain rose 18%, but set out modest progress forecasts that will issue investors amid problems about world-wide banks’ publicity to China.

The financial institution described 2023 statutory pre-tax financial gain rose to $5.09 billion, in line with forecasts, and introduced a soar in dividends along with the buyback.

But the Asia-concentrated loan provider set out restrained new advice, saying it anticipated revenue to expand at the increased close of 5-7% in 2024, lessen than the former estimate of 8-10% specified very last Oct. The loan provider booked 13% income growth in 2023 in continuous forex terms.

StanChart also said it would aim to raise returns on tangible equity, a important profitability metric, “steadily” from the latest 10% to 12% by 2026, abandoning a former forecast to strike 11% this year.

StanChart took a $850 million impairment primarily from its stake in Chinese financial institution Bohai Bank, its second time producing down the benefit of the unit as the loan provider was strike by escalating poor loans as progress in the world’s second-biggest economic system sputtered.

The hefty decline in China, a core goal for StanChart’s technique, underlines the problem it faces to increase in the nation as policymakers struggle to arrest a deepening home disaster and revive weak buyer self-assurance.

A new $150 million writedown of its stake in Bohai Financial institution, pursuing a $700 million hit previously this yr, minimized its price to $700 million from $1.5 billion at the start out of the calendar year.

As perfectly as hurting the value of StanChart’s expense in Bohai Lender, China’s true estate woes also hit the British bank specifically as it took a further $282 million provision on anticipated personal loan losses relating to the sector.

That introduced complete provisions for its China actual estate exposure to $1.2 billion in the last 3 yrs.

HSBC on Wednesday reported a shock $3 billion cost on its stake in a Chinese lender, the major nevertheless by an overseas financial institution, amid mounting poor loans in the region, sending the British bank’s shares plunging and having the glow off its document once-a-year income.