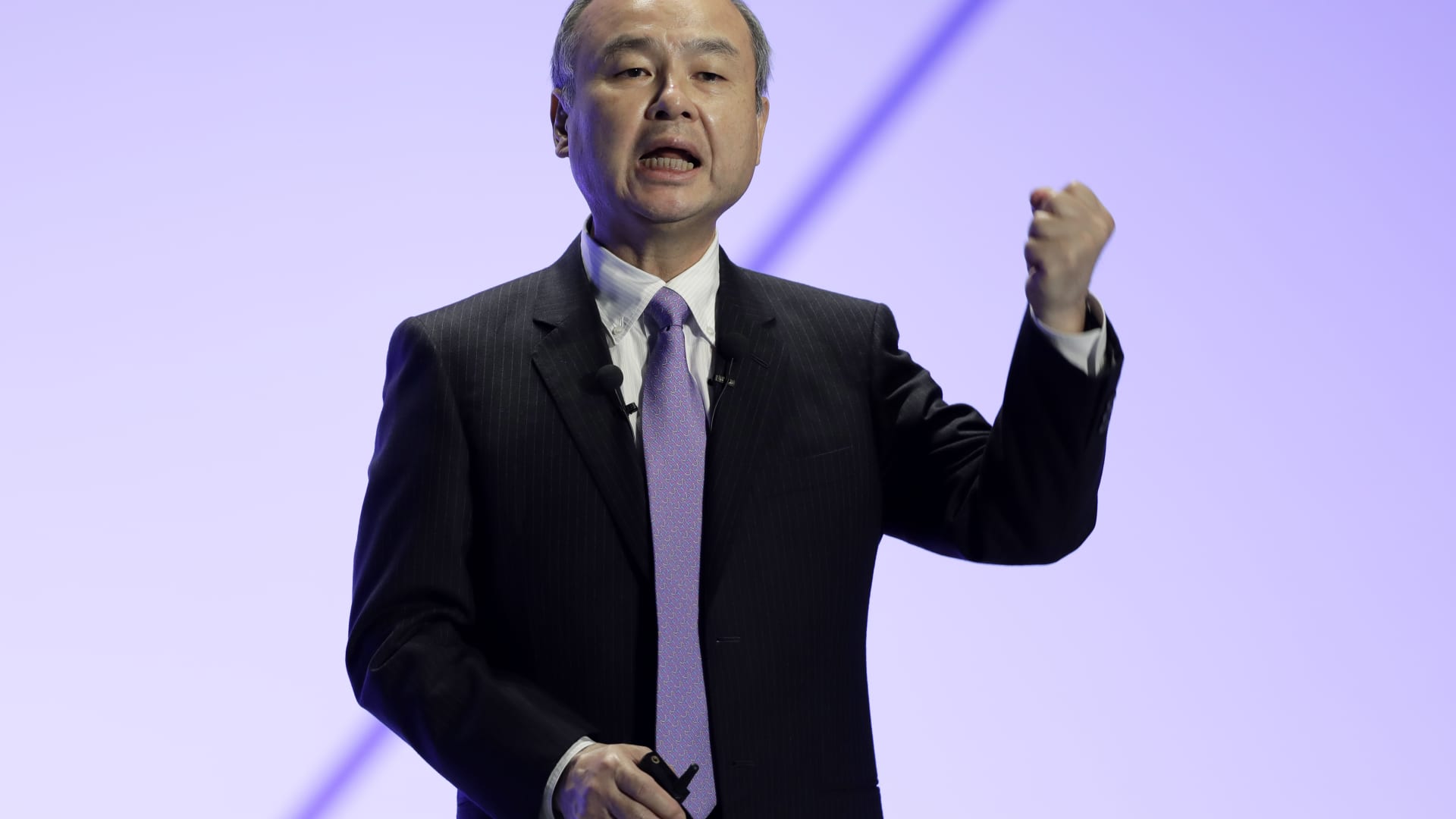

Masayoshi Son, chairman and CEO of SoftBank Group Corp.

Kiyoshi Ota | Bloomberg | Getty Pictures

Arm shares soared 29% on Monday, extending final week’s rally as investors keep on to applaud the chipmaker’s better-than-expected third-quarter earnings and its place in the synthetic intelligence growth.

Arm is now up 93% given that it described quarterly financials on Feb. 8, although without any apparent catalyst for Monday’s go. The inventory has just about tripled since Arm’s first community featuring in September, closing at $148.97, and is now truly worth virtually $153 billion, or a minor more than $30 billion underneath Intel’s market cap.

Previous week, Arm reported it could charge two times as considerably for its newest instruction set, which accounts for 15% of the company’s royalties, suggesting it can grow its margin and make far more funds off new chips. It also explained it was breaking into new markets, this kind of as cloud servers and automotive, thanks to AI demand from customers.

Its royalty energy mixed with Arm’s optimistic development forecast has produced the enterprise the most current AI darling amid buyers, in spite of a bigger earnings numerous than Nvidia or AMD.

Nevertheless, Arm’s benefit might come to be clearer future month when the 180-day write-up-IPO lockup expires. SoftBank still owns 90% of the remarkable inventory, this means its stake in Arm has elevated much more than $61 billion considering that the firm’s report previous week and is now worthy of upward of $131 billion.

For the next time in a few buying and selling classes, Arm’s each day quantity exceeded 100 million shares, or additional than 10 occasions the common for the stock .

Observe: Arm have a really obvious AI tale that will lead to progress

Never overlook these stories from CNBC Pro: