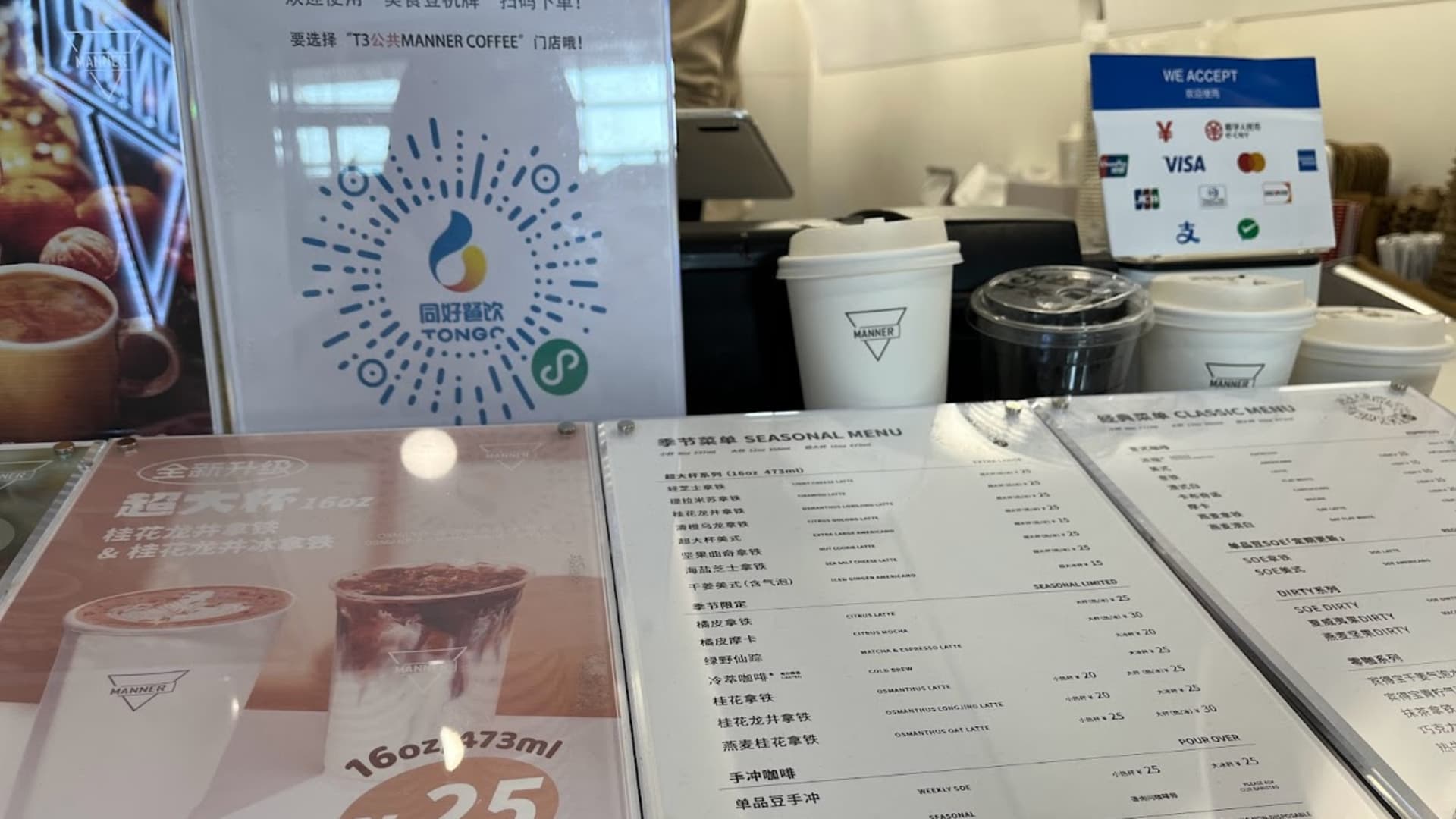

A coffee store at Beijing Funds Airport shows clients can use Visa, Mastercard, the electronic Chinese yuan and other payment strategies.

CNBC | Evelyn Cheng

BEIJING — China is encouraging financial institutions and neighborhood organizations to accept foreign bank cards and is thinking of other methods to make cell pay for international guests even less difficult, mentioned Zhang Qingsong, deputy governor of the People’s Bank of China.

“Banks and distributors (these as hotels, eating places, section merchants and even coffee outlets) are encouraged to acknowledge international bankcards,” Zhang explained.

His prepared responses, special to CNBC, come as Beijing has stepped up attempts to stimulate visits from foreign vacationers and small business folks. In the last several months, authorities have enacted visa-no cost vacation guidelines for people of many European and Southeast Asian international locations — just after stringent border controls during the pandemic.

Cellular fork out took off in China in the last a number of yrs. But although it can be been handy for locals to scan a QR code with a smartphone to fork out, monetary method restrictions have also intended foreigners normally discovered it difficult to make payments. Procuring malls have increasingly desired not to accept foreign credit playing cards.

But that is started out to transform in modern months.

Very last summer time, the two dominant cellular pay back apps WeChat and AliPay started off making it possible for verified end users to link their intercontinental credit history playing cards — such as people from Visa. Tencent owns WeChat, though AliPay is operated by Alibaba affiliate Ant Group.

“We are thoroughly informed that international people care quite substantially about their privateness,” Zhang mentioned “We just take this concern seriously and have place in area actions for facts defense.”

“Now, when using Alipay or WeChat Pay back, overseas guests do not need to supply ID facts if their whole once-a-year transaction volume is underneath $500,” he mentioned. “It is believed that above 80% transactions are underneath this threshold. We are also wanting at the likelihood of boosting the $500 threshold in the foreseeable future.”

Zhang and other officers attended an celebration Monday at Beijing Money Airport to formally open up a payments support heart for checking out foreigners.

Though their general public remarks described the electronic yuan, they focused on speaking about the availability of funds forex exchange, bigger acceptance of abroad playing cards and far more cellular pay out support.

The quantity of vacationers in and out of mainland China has “continued to boost but equally remained below 2019 concentrations,” Visa executives mentioned on an earnings call in late January, in accordance to a FactSet transcript.

International fiscal products and services corporations have also started to see enhanced accessibility to China, after decades of waiting for the duration of which global businesses criticized Beijing for favoring domestic gamers until they grew large plenty of.

Mastercard in November declared its joint undertaking in China obtained acceptance from the PBOC to start off processing domestic payments. The venture waited just about four many years considering the fact that its software to start out preparations was accredited in basic principle.

Zhang reported China’s program for supporting foreigners’ payments in the region would aim on making it possible for card transactions for substantial payments and cellular pay out for smaller quantities.

Customers of 13 foreign mobile wallet apps can also straight use QR payment codes in China, Zhang claimed, devoid of naming the apps.

“At the same time money is always out there and recognized,” he claimed.

Ant Group in September said users of 10 key cell payment apps in nations around the world these kinds of as Singapore, South Korea and Thailand could use the exact same applications to scan AliPay QR payment codes in mainland China — a item the corporation calls Alipay+.