The brand of U.S. program company Palantir Technologies is viewed in Davos, Switzerland Januar 22, 2020.

Arnd Wiegmann | Reuters

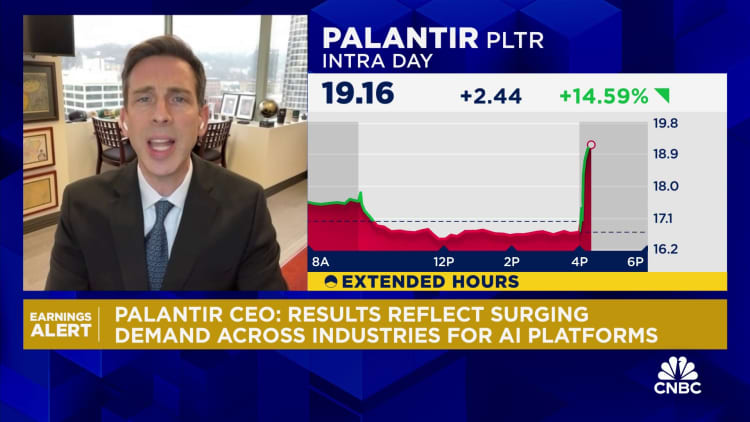

Shares of Palantir popped additional than 25% Tuesday, a day soon after the corporation produced fourth-quarter earnings that surpassed analysts’ anticipations for earnings and showed strong need for its synthetic intelligence offerings.

Palantir, acknowledged for its protection and intelligence operate with the U.S. federal government, noted that profits in the quarter improved 20% to $608.4 million, up from the $602.4 million anticipated by Wall Street. Palantir stated it expects to report in between $612 million and $616 million in profits all through its initially quarter, shy of the $617 million analysts were anticipating.

In a letter to shareholders, CEO Alex Karp reported demand for large language products in the U.S. “proceeds to be unrelenting.” Palantir has been scaling its Synthetic Intelligence System, or AIP, and Karp reported the business carried out almost 600 pilots with the know-how previous calendar year.

Analysts at Citi upgraded Palantir shares to neutral from provide and lifted their focus on cost from $10 to $20. They said Palantir shipped a “stronger-than-expected” fourth quarter pushed by “breakthrough momentum” in the company’s business device, but they nevertheless have some reservations about its conservative whole-12 months guidance for its non-U.S. business sectors.

“We see these hazards well balanced by probable phone solutions on new AI Monetization (AIP) and improving upon U.S. Authorities contracts into 2024,” the analysts wrote in a take note Tuesday.

Jefferies analysts also upgraded the stock and claimed Palantir shipped an “spectacular” quarter led in portion by its commercial expansion in the U.S.

Jefferies analysts claimed they had downgraded shares of Palantir at the starting of the calendar year since they thought it would choose time for its AI system to have a authentic impression, but now, they feel the organization is at an “inflection issue.”

“We are amazed with AI Platform (AIP) ramping faster than our initial anticipations and feel it can be correct to upgrade shares to replicate the momentum,” the analysts wrote in a Tuesday take note. “We were being wrong, but we are not stubborn.”

On the other hand, the Jefferies analysts explained they continue to have some issues about Palantir’s valuation considering that shares are investing at a “23% top quality to the significant cap ordinary,” so the analysts will “remain on the sidelines.”

Financial institution of The united states analysts reiterated their purchase rating on the stock and stated that whilst AIP is nevertheless in its early times, it is already impacting the company in a “meaningful way.” The analysts said they expect Palantir’s momentum with AI to proceed, and they also see “substantial options” for the company’s application within just the U.S. govt.

“We consider this exceptional expansion is a indicator of Palantir’s unique situation as an enabler of AI-driven info-pushed conclusion-earning in a tangible, accessible, and operational way,” the analysts wrote Tuesday.

CNBC’s Michael Bloom contributed to this report.