A trader reacts as a display displays the Fed rate announcement on the flooring of the New York Stock Trade (NYSE) in New York Town, U.S., January 31, 2024.

Brendan McDermid | Reuters

The U.S. inventory industry is in a “very unsafe” place as persistently solid work opportunities quantities and wage expansion propose the Federal Reserve’s desire level hikes have not had the preferred effect, according to Cole Smead, CEO of Smead Funds Administration.

Nonfarm payrolls grew by 353,000 in January, fresh new details confirmed very last 7 days, vastly outstripping a Dow Jones estimate of 185,000, when common hourly earnings elevated .6% on a month to month foundation, double the consensus forecasts. Unemployment held constant at a traditionally low 3.7%.

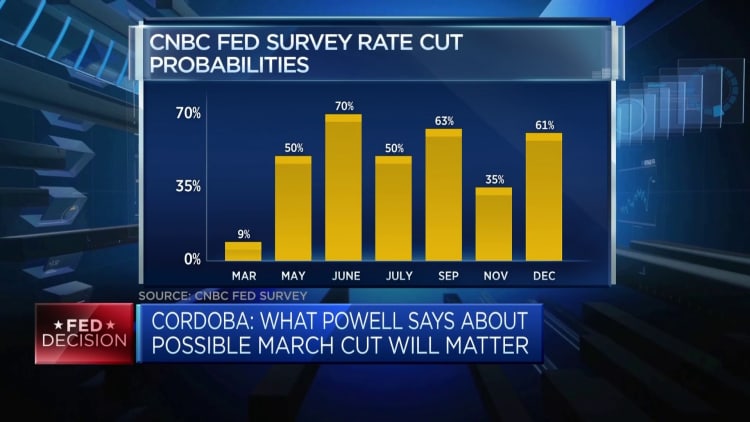

The figures came just after Fed Chair Jerome Powell said the central financial institution would likely not slice rates in March, as some industry participants had predicted.

Smead, who has consequently significantly the right way predicted the resilience of the U.S. consumer in the deal with of tighter financial coverage, instructed CNBC’s “Squawk Box Europe” on Monday that “the real hazard this total time has been how sturdy the overall economy has been” regardless of 500 foundation details of desire level hikes. Just one basis level equals .01%.

“We know the Fed has lifted charges, we know that brought on a banking operate past spring and we know which is ruined the bond current market. I feel the real question can be ‘do we know that the reducing of CPI has really been triggered by all those small-phrase policy tools they have utilized?'” Smead claimed.

“Wage gains go on to be quite strong. The Fed has not influenced wage progress, which carries on to outpunch inflation as we speak, and I glimpse at the wage expansion as a actually superior photo of inflationary pressures going ahead.”

Inflation has slowed appreciably from the June 2022 pandemic-era peak of 9.1%, but the U.S. buyer rate index increased by .3% thirty day period on thirty day period in December to bring the annual price to 3.4%, also above consensus estimates and greater than the Fed’s 2% focus on.

Smead contended that the fall in CPI ought to be chalked up to “fantastic luck” because of to the contributions of falling vitality prices and other factors outdoors the central bank’s manage, relatively than the Fed’s intense cycle of monetary coverage tightening.

Should toughness in the positions market, shopper sentiment and household stability sheets continue being resilient, the Fed might have to continue to keep fascination charges larger for for a longer period. This would sooner or later indicate a lot more and far more listed companies getting to refinance at a lot better concentrations than formerly and thus the inventory sector could not advantage from energy in the financial system.

Smead highlighted a period between 1964 and 1981 in which the overall economy was “generally solid” but the inventory market place did not proportionately advantage because of to the persistence of inflationary pressures and restricted financial problems, and advised the markets could be moving into a related interval.

The 3 key Wall Avenue averages on Friday shut out a 13th winning 7 days out of the final 14 in spite of Powell’s warning on price cuts, as bumper earnings from U.S. tech titans this kind of as Meta powered further more optimism.

“The improved question may possibly be why is the inventory market place priced like it is with the financial strength and the Fed currently being pigeonholed into acquiring to preserve these rates substantial? Which is a extremely dangerous matter for shares,” Smead cautioned.

“And to follow on that, the financial gain we are observing in the financial system has really very little tie to the inventory sector, it would not reward the stock market place. What did the inventory market place do past yr? It experienced valuations go up. Did it have a large amount to do with the earnings development tied to the economic climate? Not at all.”

Charge cut want turning out to be ‘less urgent’

Having said that, some strategists have been eager to position out that the upside from current data signifies the Fed’s attempts to engineer a “delicate landing” for the economic climate are coming to fruition, and that a recession is seemingly no for a longer period in the playing cards, which could restrict the draw back for the broader industry.

Richard Flynn, running director at Charles Schwab U.K., observed Friday that up until eventually just lately, these types of a strong employment report would have “established alarm bells ringing in the sector,” but that won’t appear to be to be going on any longer.

“And when lower interest fees would undoubtedly be welcomed, it is starting to be more and more crystal clear that markets and the financial system are coping perfectly with the superior fee surroundings, so traders are perhaps experience that the require for financial coverage to simplicity is much less urgent,” he mentioned in a be aware.

“[Friday’s] figures may perhaps be a different variable delaying the Fed’s initial fee reduce nearer to summer months, but if the economy maintains its cozy trajectory, that may possibly not be a poor point.”

This was echoed by Daniel Casali, chief investment strategist at Evelyn Companions, who claimed the bottom line was that investors are getting to be “a very little far more cozy that central banking institutions can balance expansion and inflation.”

“This benign macro backdrop is rather constructive for stocks,” he wrote in a note.