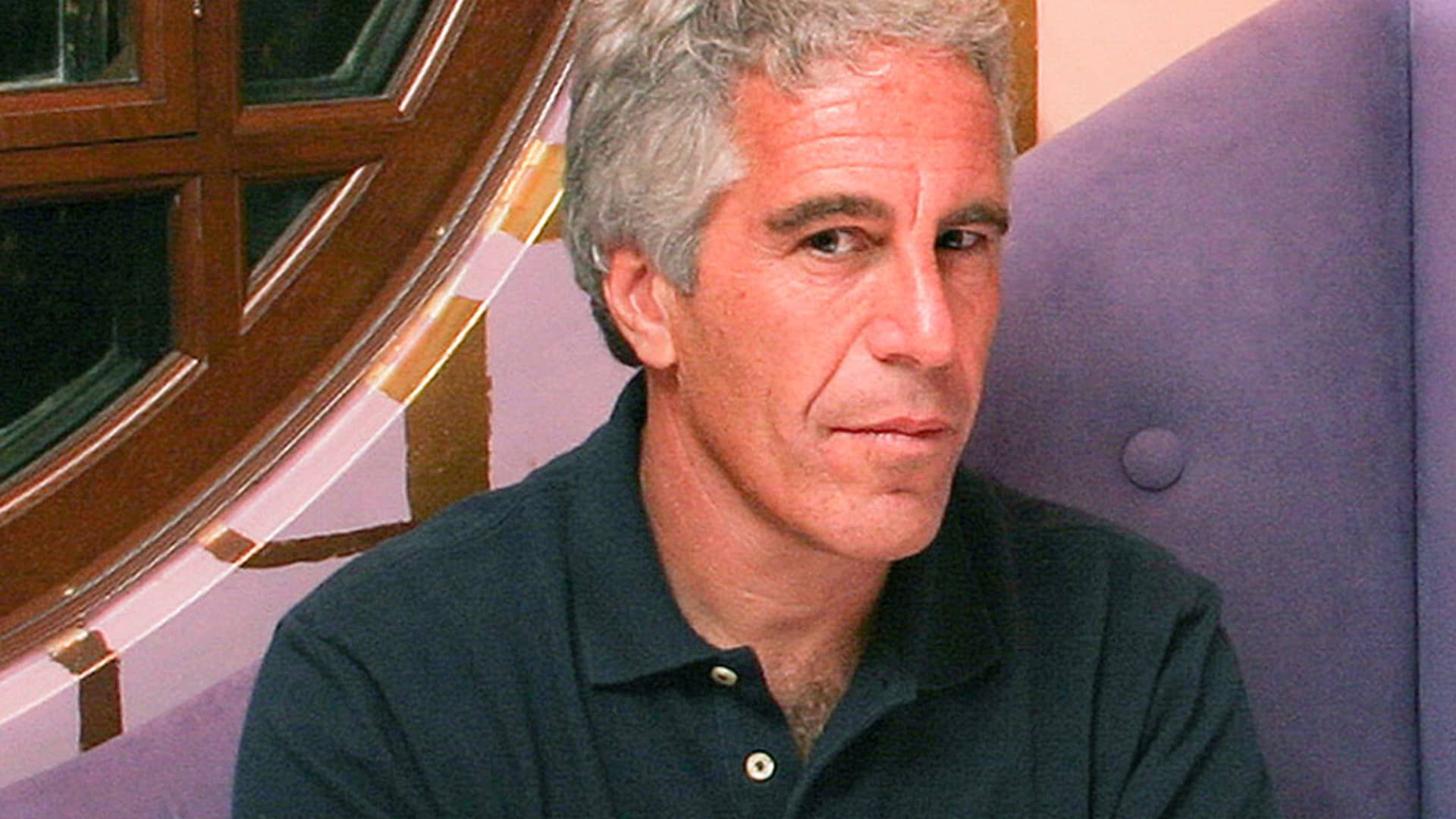

An artwork juxtaposing Chinese yuan cash expenses with the China’s flag

Javier Ghersi | Minute | Getty Visuals

China’s economical establishments need to offer powerful support to the country’s beleaguered true estate sector and not “blindly withdraw” financing for projects dealing with difficulties, in accordance to a senior Chinese fiscal regulatory official.

His strongly worded opinions stick to the Chinese central bank’s biggest slice in mandatory hard cash reserves for financial institutions given that 2021. Beijing also lately produced a clean policy mandate aimed at easing the cash crunch for Chinese developers, which have struggled below the crackdown on the sector’s bloated personal debt.

“The monetary sector has an unshirkable accountability and will have to present sturdy assistance,” claimed Xiao Yuanqi, deputy director of China’s National Economical Regulatory Administration, at a push conference in Beijing on Thursday, in accordance to a CNBC translation.

“We all know the authentic estate business chain is extensive and includes a vast range of parts. It has an crucial effects on the nationwide economy and is closely relevant to people’s life,” he extra.

China’s true estate problems are closely intertwined with neighborhood governing administration funds due to the fact they generally relied on land profits to builders for a major part of profits.

The assets sector slumped just after Beijing cracked down on developers’ significant reliance on credit card debt for expansion in 2020, weighing on shopper development and broader progress in the world’s next-largest economic climate.

“For initiatives that are in problem but whose resources can be balanced, we should not blindly withdraw loans, suppress loans, or lower off loans,” Xiao said. “We ought to supply larger support by extending present financial loans, adjusting repayment arrangements, and introducing new loans.”

Continue to, Xiao cautioned the newest leisure of funding guidelines, which is only valid through the close of the 12 months, is built to be targeted.

“China’s state banks will situation running residence loans to true estate providers on the basis of controllable dangers and industrial sustainability,” Xiao mentioned.

“Eligible residence builders may then use these loans to repay existing financial loans of real estate providers and open market place bonds they have issued,” he reported.

Beijing’s stimulus announcement on Wednesday also marked a unusual selection to release information at a push briefing, suggesting the Chinese federal government is signaling its intent at a time when the country’s stock marketplaces are teetering on the edge of capitulation.

These policy moves are commonly only released on the web and disseminated by way of condition media. But the People’s Bank of China Governor Pan Gongsheng declared the forthcoming reserve ratio prerequisite reduce and true estate policy in man or woman.

— CNBC’s Evelyn Cheng contributed to this tale.