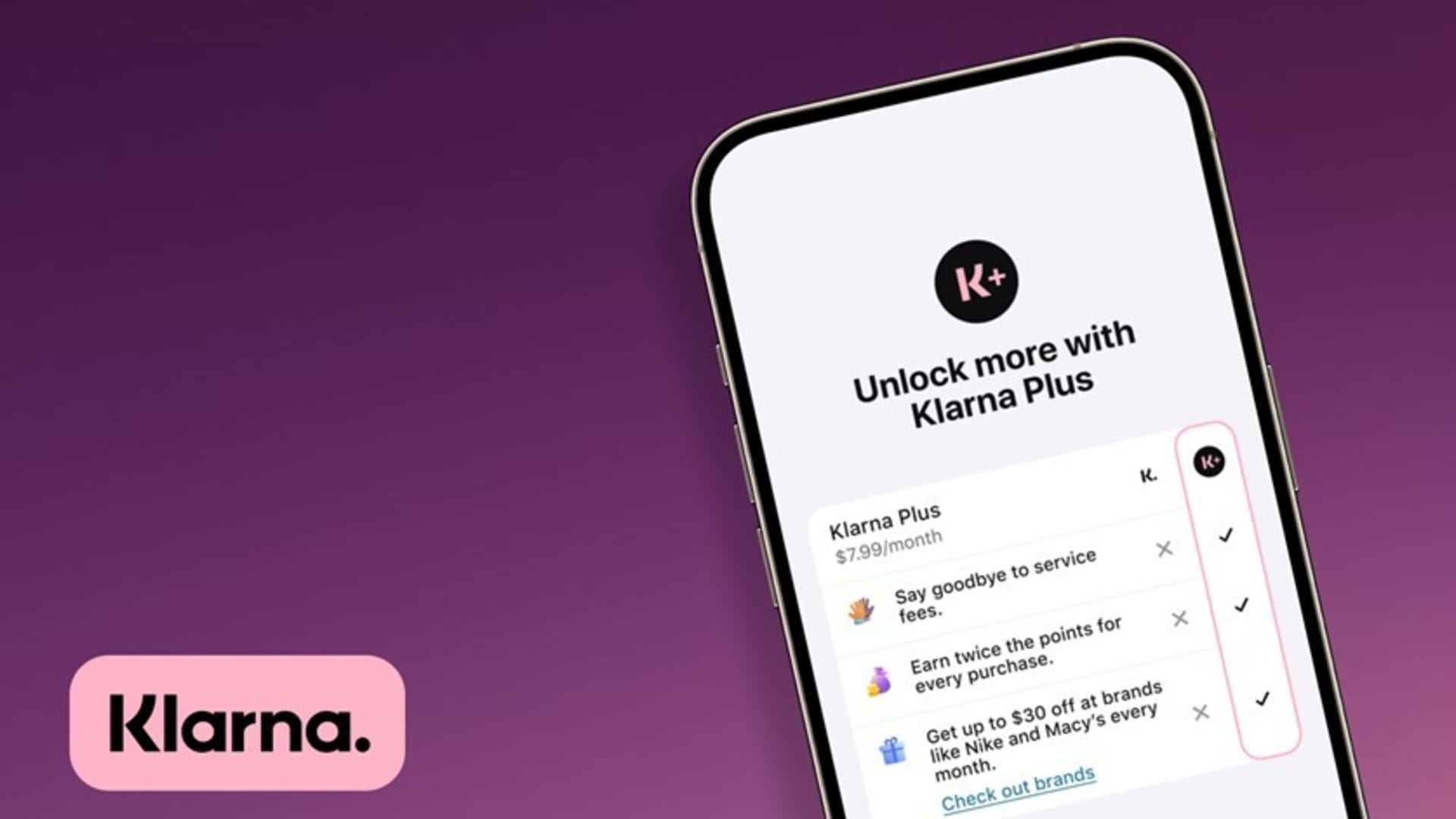

Swedish buy now, pay later firm Klarna unveils a $7.99 monthly subscription plan called Klarna Plus

Courtesy: Klarna

Swedish fintech firm Klarna is launching a monthly subscription plan in the U.S. to lock in its heaviest users ahead of an expected initial public offering this year, the company told CNBC.

The product is set to be announced later Wednesday and will cost $7.99 per month, the Stockholm-based company said.

Users of the subscription plan, named Klarna Plus, will get service fees waived, earn double rewards points and have access to curated discounts from partners including Nike and Instacart, according to Chief Marketing Officer David Sandstrom.

Buy now, pay later services such as Klarna and Affirm have surged in popularity in recent years as more Americans rely on a new, fintech-enabled form of credit. The services typically break up a purchase into four payments.

When Klarna users shop outside the firm’s network of 500,000 retailers — at places such as Walmart, Target, Amazon and Costco — they pay $1 to $2 in transaction fees.

“The main proposition of Klarna Plus right now is that you don’t pay any service fees,” Sandstrom said. “So if you love Klarna and if you love shopping at Target and Walmart, it makes a ton of sense financially.”

Klarna’s IPO year

Klarna’s monthly plan is the latest example of a fintech player building out its offerings to boost recurring revenue. Wall Street investors tend to favor subscription revenue because of its predictability versus one-time transactions. Rival Affirm has explored its own subscription plan, though it hasn’t released one yet.

The approach is especially timely as Klarna nears an IPO that could value it at more than $15 billion, Sky News reported in November. Klarna CEO Sebastian Siemiatkowski told Bloomberg this week that a listing in the U.S., the firm’s largest market, was probably imminent.

Achieving that valuation would be a redemption of sorts for Klarna. The company was Europe’s most valuable startup before a collapse made it the poster child for so-called “down rounds” of funding. Klarna’s valuation sank 85% to $6.7 billion in 2022 as rising interest rates reined in high-flying fintech firms.

Savings sweetener

Klarna Plus could help persuade investors that the company can grow beyond its core product. The subscription, which was piloted in Ohio for six months last year, is a “no brainer” for about 15% of the firm’s heaviest users, Sandstrom said. The company said it has about 37 million American customers.

“The thing we need to prove to ourselves and to the market is that we can add a new kind of revenue stream to Klarna,” Sandstrom said. “That’s something that a lot of companies have struggled to do.”

Up next for the U.S. is a high-yield savings account, Sandstrom said. Klarna Plus customers would probably earn a higher interest rate on savings than nonusers, he added.

“If you look at our business from the outside, it looks very much like ‘buy now, pay later,'” Sandstrom said. But “a world of opportunity opens up with someone you’ve helped in a financial relationship. You get to say, ‘Hey, wouldn’t it make sense to get the Klarna card?'”