ExxonMobil CEO Darren Woods speaks at the Asia-Pacific Economic Cooperation (APEC) Leaders’ 7 days in San Francisco, California, on November 15, 2023.

Andrew Caballero-reynolds | Afp | Getty Photos

Exxon Mobil submitted a lawsuit against U.S. and Dutch activist investors in a bid to quit them from distributing local climate proposals through the oil giant’s yearly shareholder conference.

It marks a 1st for the U.S. oil big and is the most recent stage in an intensifying fight among businesses and environmental campaigners.

The grievance was submitted Sunday in the U.S. District Court docket for the Northern District of Texas versus Massachusetts-based mostly financial commitment company Arjuna Money and Adhere to This, an Amsterdam-based activist trader team.

An Exxon Mobil win in the proceedings could have a chilling effects on long term shareholder petitions.

The Securities and Exchange Fee, the U.S. monetary regulator, has overseen a growing variety of environmental and social shareholder proposals in the course of the past two proxy seasons.

In an emailed statement, Exxon Mobil said “the breakdown of the shareholder proposal procedure, one particular that lets proponents to progress their agendas by a flood of proposals, does not provide the passions of buyers.”

The corporation extra, “We are just inquiring the court docket to apply the SEC’s proxy regulations as written to stop this abuse and do away with the significant resources necessary to tackle them.”

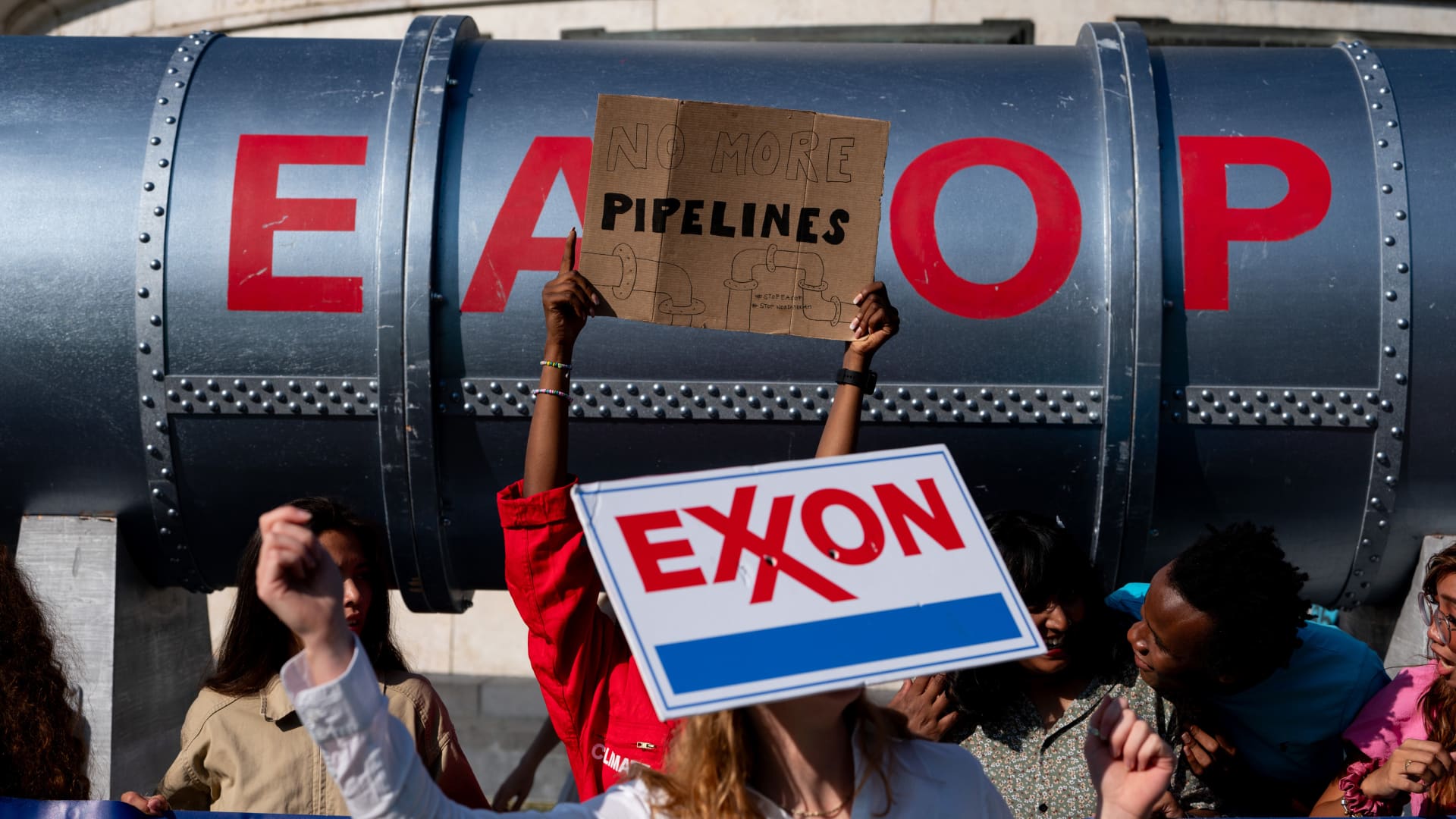

Climate activists holds an Exxon Mobil Corp. brand through a protest against the East African Crude Oil Pipeline (EACOP) task on the sidelines of the Worldwide Weather Summit in Paris, France, on Friday, June 23, 2023.

Bloomberg | Bloomberg | Getty Images

The oil key has accused Arjuna Money and Abide by This of currently being pushed by an “extraordinary agenda” and claimed they both of those submit shareholder proposals to undermine the firm’s organization.

In its filing, Exxon Mobil claimed that it involves aid from the court docket by March 19, due to the fact it have to file its proxy assertion by April 11. The Houston-primarily based agency is scheduled to maintain its yearly shareholder conference on Might 29.

“With this remarkable stage, ExxonMobil clearly wants to stop shareholders utilizing their legal rights,” Adhere to This’ Mark van Baal said in a statement. “Evidently, the board fears shareholders will vote in favour of emissions reductions targets.”

He additional, “Perhaps they see the composing on the wall.”

Comply with This stated that it and Arjuna Money filed a proposal, frequently referred to as a climate resolution, for Exxon Mobil’s impending yearly conference in compliance with their shareholder legal rights and SEC regulations.

Arjuna Cash did not straight away reply to a CNBC request for comment.

Scope 3 emissions

Arjuna Cash and Stick to This have sought to put force on oil majors to establish so-called “Scope 3” targets to reduce greenhouse house gasoline emissions generated when burning oil and gas.

Scope 3 refer to the emissions made from across a firm’s total price chain, and normally account for the lion’s share of a firm’s carbon footprint.

Scope 1 emissions meanwhile refer to a firm’s direct greenhouse gasoline emissions, although Scope 2 are indirect emissions that stem from the production of the electrical power used on a firm’s behalf.

Exxon Mobil has introduced options to achieve net zero by 2050 for Scope 1 and Scope 2 emissions. This focus on does not incorporate Scope 3 emissions, and shareholders of the company overwhelmingly voted to reject calls for more powerful steps to mitigate climate change past 12 months.

— CNBC’s Spencer Kimball contributed to this report.