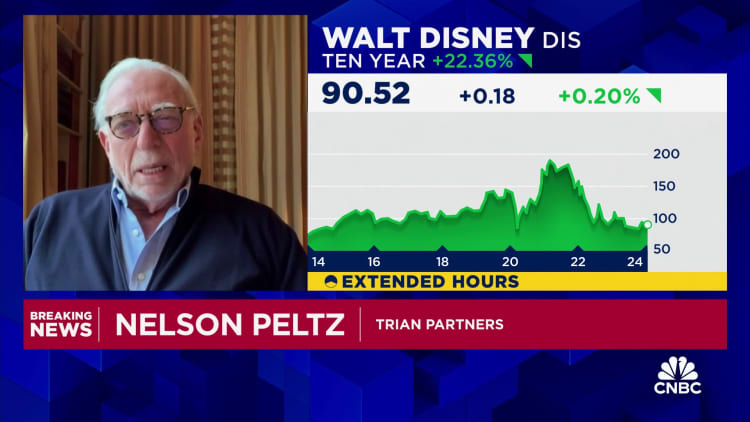

Activist trader Nelson Peltz is stating his situation for signing up for Disney‘s board.

Peltz’s Trian Fund Administration, in formally nominating Peltz and former Disney CFO Jay Rasulo to the media giant’s board of directors Thursday, created a list of initiatives and performance targets they’d pursue if elected.

In a proxy filing, Peltz and Rasulo promised to “at last complete a effective CEO succession,” alluding to CEO Bob Iger’s steady delaying of his retirement day and his return right after the firing of former main govt officer Bob Chapek.

Trian also claimed it will “align management pay back with efficiency,” contacting out Iger’s $31.6 million shell out bundle last yr even though Disney stock was little adjusted, underperforming the S&P 500 for 2023.

Trian also aims to concentrate on and attain “Netflix-like margins” of 15% to 20% by 2027, with Peltz incorporating that he thinks Netflix is Disney’s major opposition.

The proxy struggle comes as Iger tries to streamline the sprawling media business to rein in shelling out and make its Disney+ streaming platform financially rewarding. Iger has instituted wide restructuring, like hundreds of layoffs.

Peltz reiterated in a CNBC “Squawk Box” interview Thursday early morning that he believes Disney’s latest board oversight is “dreadful.”

“They mentioned I have no media expertise — I don’t declare to have any,” Peltz mentioned Thursday. “But I will notify you, I will not imagine they have a lot media knowledge.”

Disney has so significantly turned down Peltz’s push to be part of the board.

In the proxy filing, Peltz also touched on the long run of ESPN, which he identified as the “crown jewel” of the organization, with the aim of generating a solidified and specific payback period and business approach for setting up out the system. Iger has earlier explained Disney is prioritizing turning ESPN into the “preeminent” electronic sports activities platform.

And, Peltz termed for a board-led overview of studio creativity to “restore leadership accountability” and reclaim the firm’s foremost box office environment position.

Peltz and Rasulo intention to execute a apparent vision for the brand’s topic parks, focusing on “superior-one digit functioning earnings development,” in accordance to the filing.

Peltz explained to CNBC Thursday he compensated a pay a visit to to Disney Entire world past week.

“It was interesting because … we didn’t have any exclusive passes. We did not have any tour guides … Every person was wonderful. I signify, Magic Kingdom and the Hollywood Studios — marvelous,” he explained. “All the staff were smiling, and that’s almost certainly in substantial portion since they failed to own any Disney stock.”

This tale is acquiring. Remember to examine back for updates.