A purchaser visits a grocery store in San Mateo, California, on Dec. 12, 2023.

Li Jianguo | Xinhua Information Agency | Getty Images

Inflation is retreating from its pandemic-period highs.

Financial jargon yields two similar conditions — “deflation” and “disinflation” — that may describe this pullback.

So, which is the U.S. suffering from? In quick: Disinflation.

What is disinflation?

In an financial system enduring disinflation, prices are continue to climbing. Even so, they’re rising at a slower tempo than they experienced been.

The inflation price is still favourable but at a decreased amount.

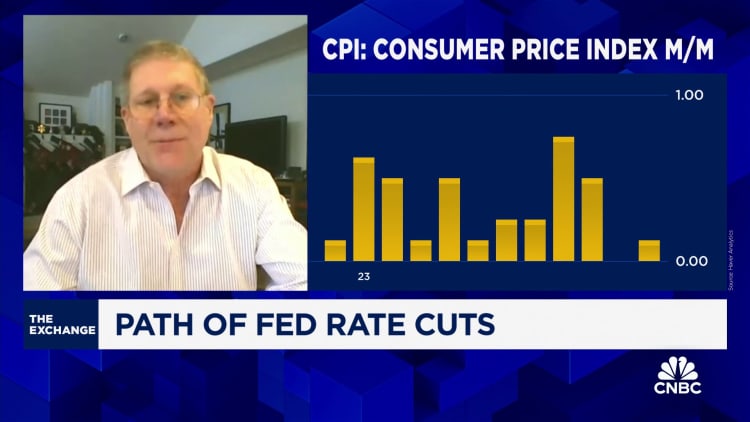

The customer selling price index — a essential inflation measure, which tracks ordinary costs throughout a wide basket of client products and providers — enhanced 3.1% in November 2023 relative to a 12 months earlier. That is a substantial minimize from the pandemic-era peak of 9.1% in June 2022.

“Disinflation is what we want to see suitable now,” claimed Sarah Dwelling, senior economist at Wells Fargo Economics. “It is the additional best outcome” relative to deflation, she explained.

What is deflation?

Deflation, by contrast, is when average selling prices are falling outright. The inflation charge flips adverse.

Some buyer classes — like used motor vehicles and gasoline — have deflated over the previous yr, in accordance to CPI info. Their prices have declined about 4% and 9%, respectively.

Nevertheless, wide, sustained deflation in the U.S. would commonly be a bad end result, economists said.

Far more from Individual Finance:

Why workers’ raises are smaller sized in 2024 — and may not go up from below

Rocky FAFSA rollout leaves hundreds of thousands of students, households discouraged

Tax filing time kicks off Jan. 29. This is what taxpayers require to know

For a person, if people count on prices to be cheaper in the long term, they may maintain off on buying goods and solutions. Minimized client demand may well crimp economic expansion and even further weaken selling prices, generating a self-reinforcing downward spiral.

Deflation can also trigger problems for people today who borrow funds, economists stated. The asset they very own — a car or a residence, say — may well be falling in price when personal debt payments continue to be the very same. If a borrower’s earnings declines, they have fewer dollars to shell out down personal debt.

The U.S. has almost never skilled deflation

The U.S. has knowledgeable number of deflationary episodes because the Good Depression, explained Andrew Hunter, deputy main U.S. economist at Funds Economics.

“It is really a little something you have a tendency to chat extra about in textbooks than in apply,” Hunter said.

Traditionally, wide deflation has occurred in intervals of “serious economic weakness,” he reported.

For instance, the U.S. annual inflation amount flipped destructive from March to Oct 2009, in the throes of the Wonderful Recession. It approximately did so in Might 2020, in the early days of the Covid-19 pandemic.

The U.S. has also seen deflation when oil charges have tumbled sharply, Hunter claimed. Power prices drag down the mixture inflation index.

That transpired for various months in 2015, for illustration. Oil charges collapsed 70% from mid-2014 to early 2016, driven by rising oil supplies that collapse was at the time a single of the three largest oil-cost declines considering the fact that Planet War II, in accordance to the Globe Lender.

These cases of deflation (linked to falling strength charges) can be a beneficial for people because of to falling prices at the gasoline pump, for instance, Hunter stated.

Individuals are unlikely to see decrease value tags

The U.S. Federal Reserve targets a 2% annual inflation amount in excess of the extensive phrase.

At this “benign” fee, inflation hardly occupies consumers’ or businesses’ mind energy: They normally do not think a lot about charges or pricing, or how income and profits are preserving rate with expenditures, Dwelling claimed.

The U.S. is on its way again to that target. The source-and-desire aspects that brought on inflation to surge in the pandemic period have mostly unwound, economists explained.

Having said that, the Fed’s goal underscores a potentially bitter truth for consumers: Shopper cost tags are not likely to deflate (i.e., decline) considerably if at all for quite a few goods and services. (Recall: Disinflation suggests a lessen price of selling price expansion, not an outright price tag drop.)

“Consumers have woken up to the fact that charges almost never go down in the mixture,” Household explained.

Of course, incomes and wages have exceeded inflation in the pandemic period, this means the average person’s getting electric power has actually elevated regardless of soaring price ranges.

The CPI is up about 19% from November 2019 to November 2023. Average hourly earnings are up 20% above that time period, when disposable particular money is up 25%.