Lisa Su, president and CEO of AMD, in the course of an interview with Mad Dollars, broadcasting from CNBC’s San Francisco bureau on November 21, 2019.

Jacob Jimenez | CNBC

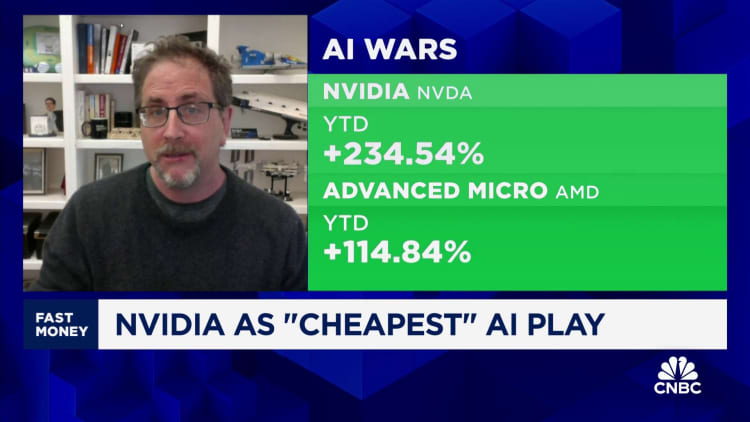

The big winner for traders this year in the generative AI boom was Nvidia. The firm’s stock selling price rocketed 234% as desire soared for the chipmaker’s processors that are built to tackle the hefty compute masses necessary to teach and run huge language types.

The LLMs from Microsoft-backed OpenAI and others relying on Nvidia’s know-how can transform users’ textual content-based mostly prompts into photographs, poems or PowerPoint presentations.

Even though Nvidia sucked up the bulk of the income — web money by way of the to start with three quarters of the 12 months jumped sixfold from 2022 — it was not the only stock that captivated Wall Street’s consideration in the race to make funds from synthetic intelligence.

Software vendors CrowdStrike, HubSpot and Salesforce all at the very least doubled this calendar year, far outperforming the Nasdaq, which was up 43% as of Friday’s near. People firms obtained a raise following announcing enhancements that draw on generative AI.

But when it will come to the hardware and infrastructure fundamental the advancements in AI and making certain that there’s more than enough capability heading forward, traders are hunting at who, other than Nvidia, stands to get. The iShares Semiconductor ETF has rallied 64% this year. The details center is yet another source of optimism, and a few cloud provider companies are positioned to earn small business as organizations boost expending on technologies to help them operate generative AI expert services.

In this article are three other stocks gaining momentum because of to the generative AI wave:

AMD

As the enterprise whose technology is viewed as most probable to problem Nvidia’s AI chip monopoly, AMD has a major cheering section in the computer software developer community. The inventory is up 116% for the 12 months as of Friday’s close.

AMD just released its MI300X AI processors, pursuing a sector for AI chips that CEO Lisa Su jobs will climb to $400 billion in excess of the upcoming 4 many years. Meta introduced in December its strategies to use the new processors, and Microsoft is also a committed shopper.

Su pointed to functionality positive aspects in comparison with Nvidia’s H100 chip.

“AMD continues to be exceptionally very well positioned to get edge of the rapidly increasing AI TAM, as they continue on to stack up customer partnerships and roll out products and solutions with amazing (and very competitive) functionality metrics,” Deutsche Lender analysts wrote in a take note to consumers following the announcement earlier this month.

The stock rose rose practically 10% the working day immediately after the start.

Arista Networks

Due to the fact its general public market place debut practically a ten years ago, Arista has been getting on Cisco in the market for details center networking equipment. Enjoyment all around its place in AI helped press the inventory up 96% this yr.

In October, Arista added AI to a vital buyer segment so it’s now termed Cloud and AI Titans. Around 40% of the firm’s 2022 revenue came from Meta and Microsoft. The next thirty day period, Arista CEO Jayshree Ullal declared a objective of $750 million in 2025 AI networking earnings, prompting Citi analysts to carry their cost target on the stock to $300 from $220.

Corporations have been picking Arista components to connect their GPUs to the world wide web. As designs get even bigger and workloads extra intricate, Arista has an opportunity to link GPUs to 1 a different to assist scale the technological know-how.

Arista executives see a moderation in enterprise spending in 2024 soon after decades of cloud growth, with organizations screening out units in advance of making massive-scale AI deployments that could start in 2025.

Cloudflare

For yrs, Cloudflare has ensured that on line material can be promptly served up to end users by producing a worldwide network of facts facilities that shields world wide web internet sites from attempted takedowns.

A person crucial consumer is OpenAI. When a end users tries to obtain OpenAI, Cloudflare’s engineering verifies that it truly is a person and not a bot on the other finish. The organization is now aiming to turn into section of the cloth for functioning AI versions and making certain rapid reaction. In September, the business declared a services identified as Workers AI, which operates on Nvidia’s GPUs and will be spread across 100 metropolitan areas.

“With a consumption pricing design, these expert services could push significant upside to earnings as adoption ramps as a result of 2024,” Morgan Stanley analysts, who have the equivalent of a maintain ranking on the inventory, wrote in a November report.

Cloudflare shares have jumped 87% so considerably in 2023.

View: Nvidia is ‘the cheapest’ AI perform out there, major Bernstein analyst suggests