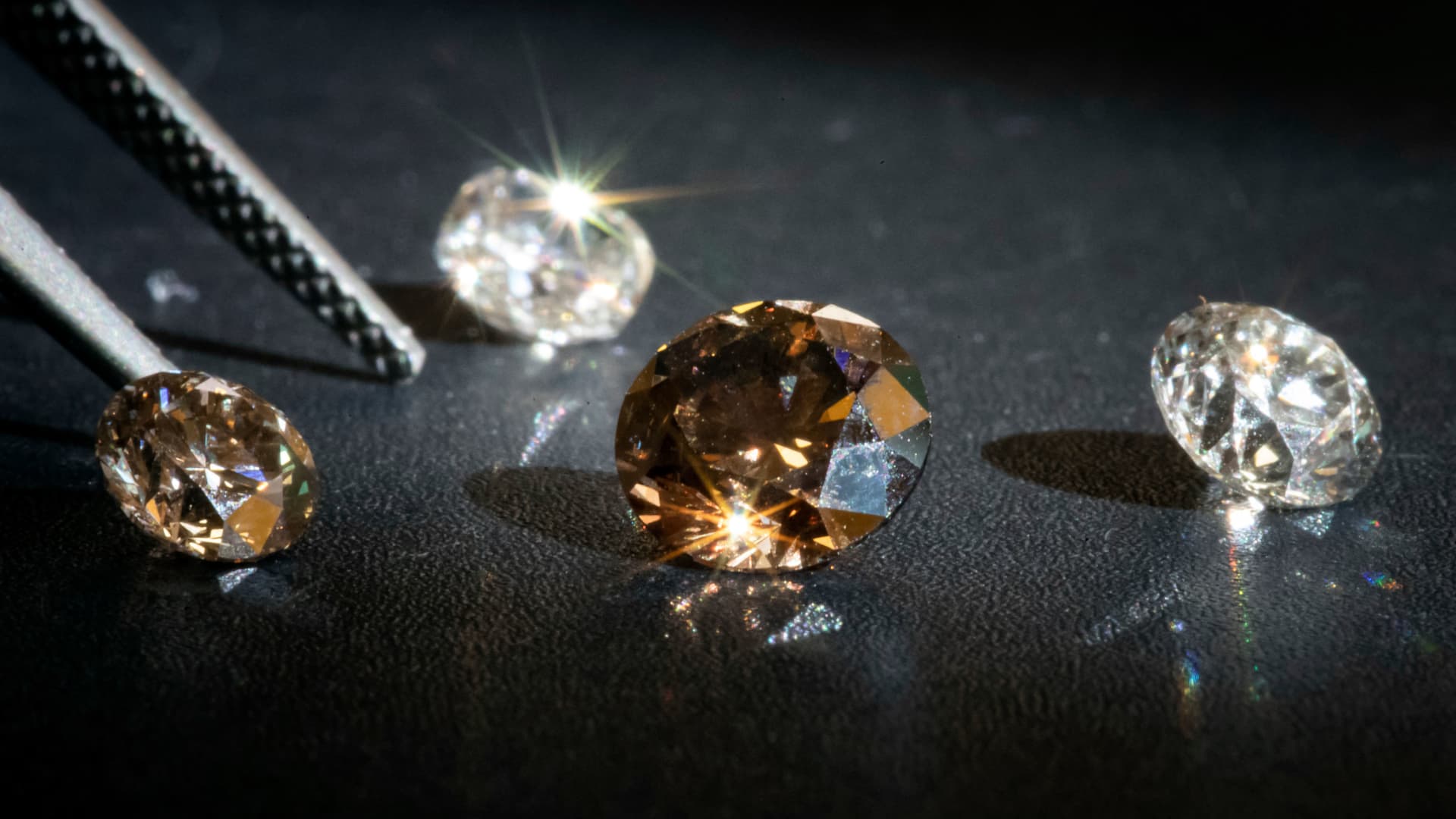

Very similar to a natural diamond, a lab-developed diamond is graded primarily based on the 4Cs — clarity, coloration, slice and carat weight.

Lionel Bonaventure | Afp | Getty Photos

Desire for lab-developed diamonds in India has grown steadily, but naturally mined diamonds is not going to be losing their sparkle any time before long, industry professionals say.

India currently has the world’s greatest youth population. Extra and additional millennial and Gen Z purchasers have been captivated by the so-termed LGDs simply because of their selling price point, analysts informed CNBC.

The cost of a lab-developed diamond can be five periods less expensive than a pure diamond, but they are each chemically identical.

According to Limelight Diamonds, a person of India’s largest LGD jewellery brands, a all-natural diamond is priced at about $6,000 per carat even though its LGD counterpart is just $1,200.

Equally are also graded primarily based on the 4Cs — clarity, colour, slash and carat — the greatly acknowledged standard qualities to identify a diamond’s price and high quality.

Gross sales of LGDs have skyrocketed as consumers in India who have been formerly not able to purchase diamonds owing to their superior value now feel they can enter the marketplace.

“Formerly, considerably less than 5% of Indian women have been ready to manage all-natural diamonds,” said Pooja Sheth, founder and managing director of Limelight Lab Developed Diamonds.

“But people are emotion it truly is far more worth for funds to invest in a lab developed diamond and there is a huge total of incremental need from new buys who have in no way bought a diamond right before,” she commented.

India is now the 2nd-greatest lab-developed diamond producer, driving China which accounts for at the very least 50 percent the world’s manufacturing.

Edahn Golan, the CEO of Edahn Golan Diamond Investigation and Details, claimed he is optimistic the South Asian country could shortly be No. 1.

China’s LGD industry is larger in phrases of manufacturing, but it is not sharpening as lots of gems as India, Golan discussed. “The know-how that is employed in India is far more subtle, and has a lot far more room for enhancement above time in the future,” he instructed CNBC in a cellphone interview.

“China can make additional diamonds with the technologies they are utilizing, but India can make much more, and make them improved.”

Probability to up grade?

Limelight Diamonds has sold 10,000 carats truly worth of LGD jewellery from April 2022 to March this calendar year, according to the business. Sheth claimed the business has by now viewed practically 2 times as a lot profits from just April to September this 12 months.

Nevertheless, Sheth pointed out that numerous customers are not automatically expending considerably less when purchasing LGDs.

“Lab developed diamonds have offered a purchasing improve. Even nevertheless prices are cheaper, many are not decreasing their budgets,” she mentioned.

“They are possibly upgrading them selves with a larger rock, or purchasing a pendant and [a pair of] earrings with that.”

Initial lady Jill Biden, U.S. President Joe Biden and Indian Prime Minister Narendra Modi take part in an arrival ceremony at the White Property on June 22, 2023.

Anna Moneymaker | Getty Images Information | Getty Photos

Much of the optimism surrounding LGDs in India can be attributed to Primary Minister Narendra Modi’s point out pay a visit to to the White Residence in June when he gifted First Lady Jill Biden a 7.5 carat gem that was designed in the South Asian country.

“The perception towards lab developed diamonds instantly improved and that actually altered the progress of lab developed diamond acceptance in the state,” Sheth said.

“It truly is about opening up an full segment of Indian audiences that have not been in a position to invest in diamonds right before.”

Purely natural diamonds even now dazzle

Despite substantially optimism, LGD customers nevertheless view the jewel as an entry stage to the diamond marketplace and will most probable acquire pure diamonds when they have a a lot more buying electrical power in long run, analysts informed CNBC.

“Lab-grown diamonds are now the communicate of the working day. But If you have ample money floating all over, you’ll primarily get a naturally mined diamond,” said Tehmasp Printer, CEO of the Worldwide Gemological Institute.

“Millennials and Gen Zs may opt for a LGD when they want to get married, but switch to a normally mined diamond down the street,” Printer told CNBC.

“If you have a Toyota, you are going to want to purchase a decreased finish BMW just after prior to you ultimately get a [Mercedes-Benz] S-Course. It’s a problem of enhance.”

Spending on jewelry greater for the duration of the pandemic when money could not be spent on journey or services

Manufacturer X Pictures | Stockbyte | Getty Images

Paul Zimnisky, CEO of Paul Zimnisky Diamond Analytics, agreed.

The development of the LGD market will not make a marginal shift on organic diamond gross sales, Zimnisky explained.

“Person-built diamonds represent all-around 20% of the whole business in the benefit bought. It was generally zero 10 many years back, so it has been increasing promptly on a relative basis,” he said.

“But it would be incorrect to say that that’s the purpose why the diamond cost is softer this calendar year. It is largely a return to normalization.”

Zimnisky highlighted that expending on jewelry enhanced when Covid constraints were lifted globally, pushing diamond selling prices to their peak in February 2022.

Prices have appear down by 25% given that then, according to Zimnisky’s World wide Rough Diamond Index.

Data from the analytics organization predicted that desire for global diamond jewelry will slide to $81 billion this year from $89 billion in 2023, which is nonetheless better than $75 billion in 2019, in advance of the pandemic strike.

On the other hand, Zimnisky cautioned that hassle could be round the corner for LGDs if costs for the gem continue on to slide also due to the fact of how swiftly they are getting manufactured.

“I imagine the value of retail isn’t really reflective of how reduced the uncooked product prices are and the retail value for the male-made diamond will continue to go decrease … which is the threat for the lab diamond marketplace,” he warned, predicting that a a few-carat LGD solitaire ring will shortly sell “effectively beneath $1,000.”