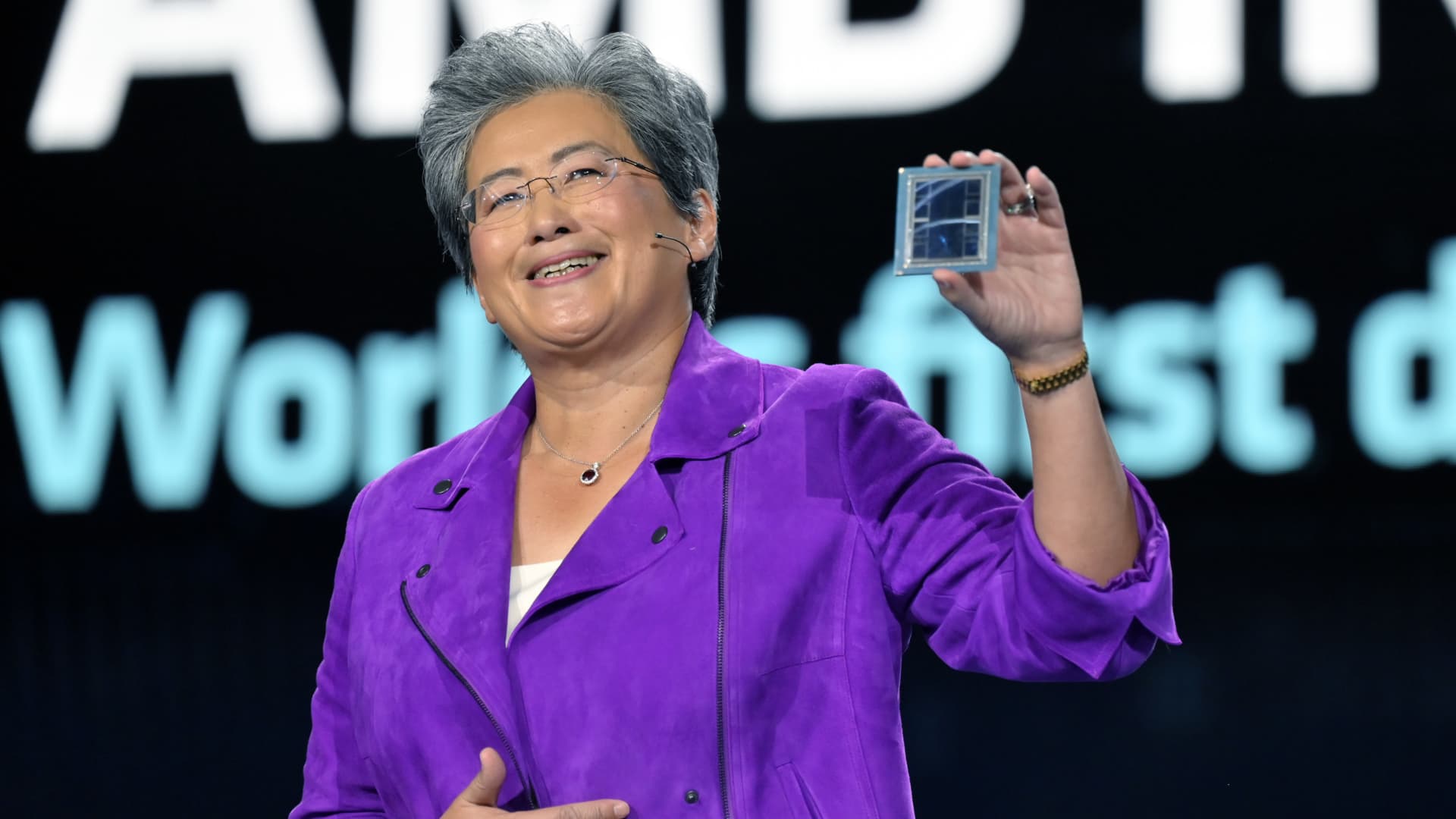

Lisa Su displays an AMD Intuition MI300 chip as she provides a keynote handle at CES 2023 in Las Vegas, Nevada, Jan. 4, 2023.

David Becker | Getty Photos

AMD shares rose 9.9% on Thursday to shut at $128.37, marking the stock’s ideal working day since Could and the highest shut because June. The surge comes a day soon after it launched new AI chips that will contend in opposition to Nvidia to electrical power synthetic intelligence programs.

On Wednesday, AMD CEO Lisa Su talked about the previously-announced Intuition MI300X, a big graphics processor designed for AI-oriented servers, and reported that Microsoft and Meta had dedicated to using the chip.

Nvidia has dominated the AI chip market place for the previous 12 months, but cloud providers and engineering organizations have been searching for an substitute to preserve costs and deliver adaptability.

Thursday’s increase in AMD shares suggests traders think the chipmaker can choose a chunk of the AI chip industry from Nvidia, even though the company jobs only $2 billion in AI GPU revenue in 2024 — lower than current market expectations for Nvidia AI profits. Wall Street expects Nvidia to article around $16 billion in data centre profits in the existing quarter by itself, while that metric includes other chips other than AI GPUs.

AMD’s new substantial-finish chip begins shipping in considerable portions future calendar year.

“We consider that today’s occasion highlighted how AMD stays really very well positioned to just take benefit of the swiftly expanding AI TAM, as they continue on to stack up buyer partnerships and roll out goods with outstanding (and exceptionally aggressive) overall performance metrics,” Deutsche Lender analyst Ross Seymore wrote in a take note on Thursday.

Citi analysts estimated in a take note on Thursday that AMD could conclude up with about 10% of the overall AI chip marketplace.

Su said at the launch occasion Wednesday that the enterprise thinks the total sector for AI chips could climb to $400 billion more than the future 4 years, two times as large as the enterprise previously thought. Su proposed to reporters that AMD isn’t going to want to beat Nvidia to do nicely in the current market for AI chips, simply because it will be so big.

“I feel it can be apparent to say that Nvidia has to be the extensive bulk of that correct now,” Su informed reporters on Wednesday, referring to the AI chip industry. “We believe that it could be $400 billion-in addition in 2027. And we could get a great piece of that.”