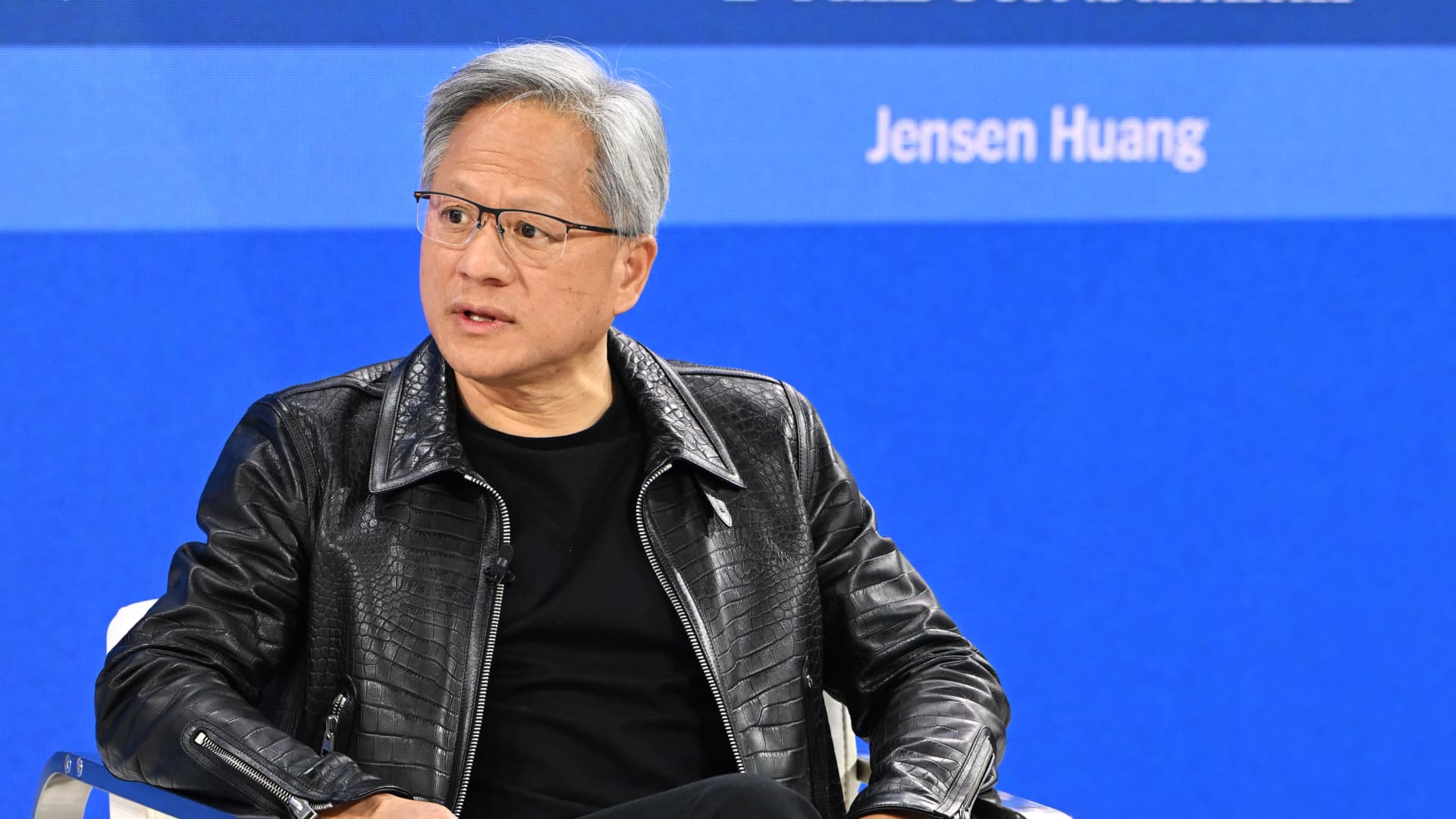

Jensen Huang speaks onstage through The New York Periods Dealbook Summit 2023 at Jazz at Lincoln Middle on November 29, 2023 in New York Town.

Slaven Vlasic | Getty Illustrations or photos

Nvidia CEO Jensen Huang made available a glimpse into his unconventional management fashion, which include having “50 immediate reports,” in an job interview with CNBC’s Andrew Ross Sorkin on Wednesday.

Huang co-started Nvidia in 1993, and as the chipmaker’s stock soars this 12 months simply because of its central part in the AI boom, his management design and style is being examined and emulated in the custom of other technology founder-operators these kinds of as Apple’s Steve Employment or Meta’s Mark Zuckerberg.

Huang says that he has so quite a few immediate reports — most executives only have 10 or so — because it keeps Nvidia from building unwanted levels of administration.

“The much more direct studies a CEO has, the fewer layers are in the organization. It permits us to keep data fluid,” Huang mentioned, adding that it makes Nvidia accomplish much better.

Huang reported senior executives ought to be equipped to run independently and really should involve “extremely very little management.”

“The men and women that report to the CEO should really need the minimum quantity of pampering and so I never feel they will need daily life tips. I you should not feel they have to have occupation assistance,” Huang explained. “They ought to be at the major of their game, amazingly very good at their craft.”

As a substitute of having a rigid management hierarchy, Huang also likes to get details instantly from rank-and-file staff by receiving brief weekly email messages that record the 5 most essential issues any specified employee is functioning on, according to a new New Yorker profile.

Huang also likes to create hundreds of brief e-mails for every day to his staff, several of which are only a couple text lengthy, in accordance to the profile.

Nvidia stock has risen in excess of 228% so significantly this year, driven by insatiable need for the firm’s large-finish graphics processors (GPUs), which are applied to prepare and work AI designs like OpenAI’s ChatGPT.

Nvidia’s success in AI GPUs this year is the outcome of various prolonged-shot bets about the earlier many years to develop computer software and applications to change chips beforehand made for 3D gaming into AI powerhouses, which has presented it a guide above other chipmakers this sort of as AMD.

The firm continues to be expecting enormous growth in product sales for AI chips, but is struggling with export constraints in China that could hamper a important progress market place.