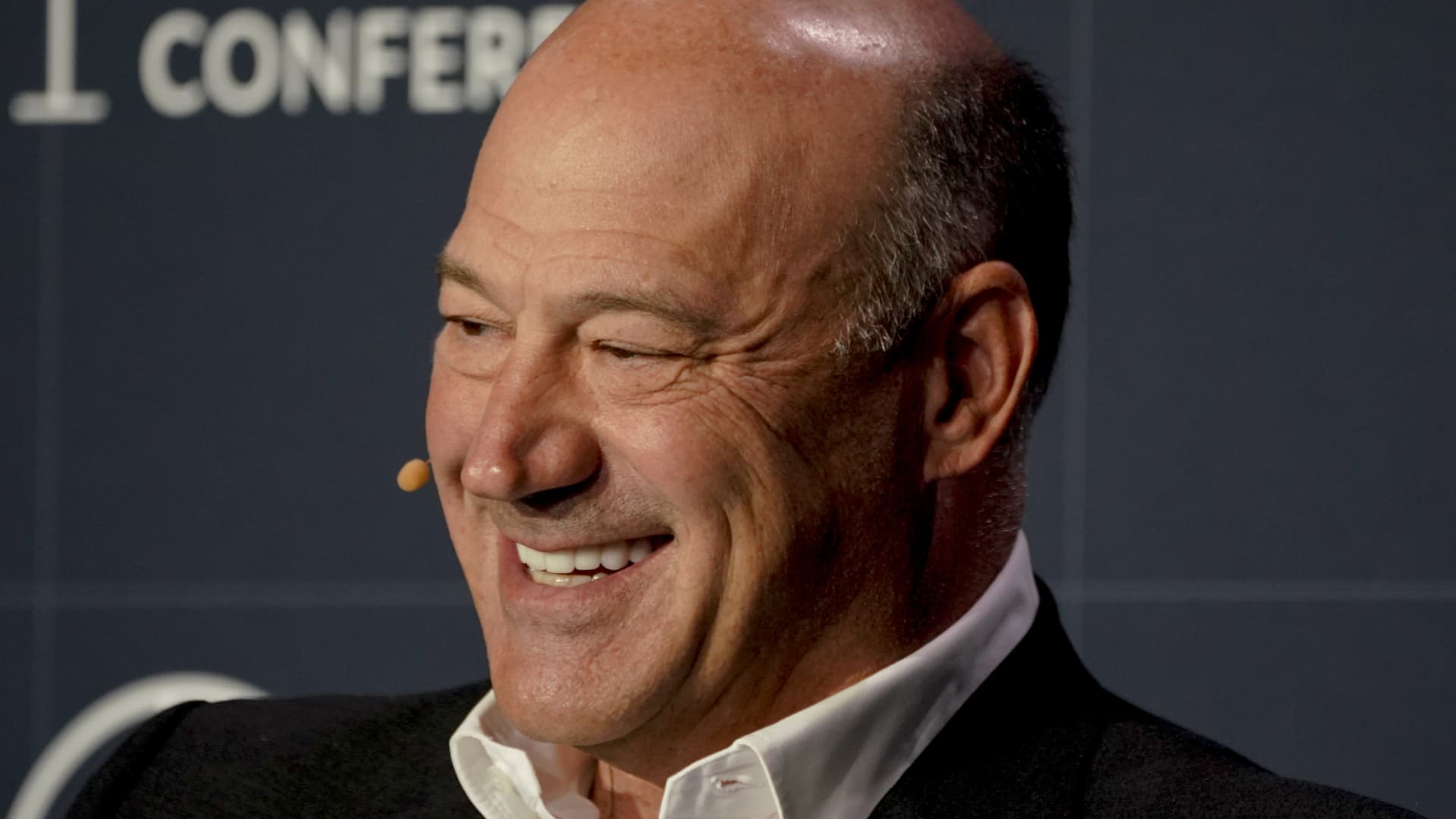

Gary Cohn, vice chairman of Global Business Machines Corp. (IBM), in the course of the Milken Institute World Convention in Beverly Hills, California, U.S., on Tuesday, Oct. 19, 2021.

Kyle Grillot | Bloomberg | Getty Visuals

The U.S. economic climate is “back to usual” for the first time in two decades, but the marketplace is getting forward of the very likely tempo of interest rate cuts, according to IBM Vice Chairman Gary Cohn.

The industry is narrowly pricing a first price reduction from the Federal Reserve in Might 2024, in accordance to CME Group’s FedWatch instrument, with all-around 100 basis points of cuts anticipated across the yr.

The central lender in September paused its historically aggressive financial tightening cycle with the Fed funds amount goal range at 5.25-5.5%, up from just .25-.5% in March 2022.

Cohn — who was main financial advisor to previous U.S. President Donald Trump from 2017 to 2018 and is a former director of the Nationwide Economic Council — does not see the Fed beginning to unwind its placement until finally at the very least the next 50 % of following calendar year, right after identical moves from other significant central financial institutions that started climbing quicker.

“You do not want to be early to go away when you are the last just one to occur to the party. You have to be the last one to go away the get together, so the Fed is heading to be the very last a person to go away this party,” Cohn explained to CNBC’s Dan Murphy on phase at the Abu Dhabi Finance 7 days meeting on Wednesday.

“The financial system will obviously transform down ahead of the Fed had starts to slash curiosity fees, so I strongly believe that that for the to start with 50 percent of ’24, we will see no amount activity in the Fed. It’s possible [in the third quarter], we will begin listening to rumblings of some forward assistance of decrease prices.”

The U.S. buyer cost index elevated 3.2% in October from a year in the past, unchanged from the former month but down significantly from a pandemic-period peak of 9.1% in June 2022.

Regardless of the sharp rise in interest charges, the U.S. overall economy has so significantly remained resilient and prevented a widely predicted economic downturn, fueling bets that the Fed can engineer a fabled “tender landing” by bringing inflation down to its 2% target more than the medium phrase without having triggering an economic downturn.

Cohn highlighted that U.S. purchaser personal debt has soared to report highs of around $1 trillion, and that client shelling out is persisting irrespective of tightening economical problems. He claimed the buyer and the broader economy is “again to a typical, but we all forgot what regular is.”

“We have not noticed ordinary for more than two a long time. We went by a ten years furthermore of zero fascination costs, we went via a 10 years of quantitative easing, zero curiosity rates and the Fed attempting to see if they could make inflation,” he said.

“We’ve long gone from the Fed not remaining in a position to make inflation — we now know the response, the Fed can not build inflation, but the marketplace can — to us attempting to unwind a shorter expression inflationary shock. We are again into a typical earth.”

He observed that the 100-yr average for 10-12 months U.S. Treasury yields is around 4.5%, and that the 10-calendar year generate has moderated from the 16-calendar year superior of 5% logged in October to all around 4.3% as of Wednesday morning. In the meantime, inflation is “operating back again towards the signify” of in between 2% and 2.5%.

“So every piece of financial facts, if you glance, is type of heading back again towards its extremely prolonged term normal. If you glimpse at these more than 100-calendar year generational cycles, we seem to be to be working into that stage appropriate now,” Cohn added.