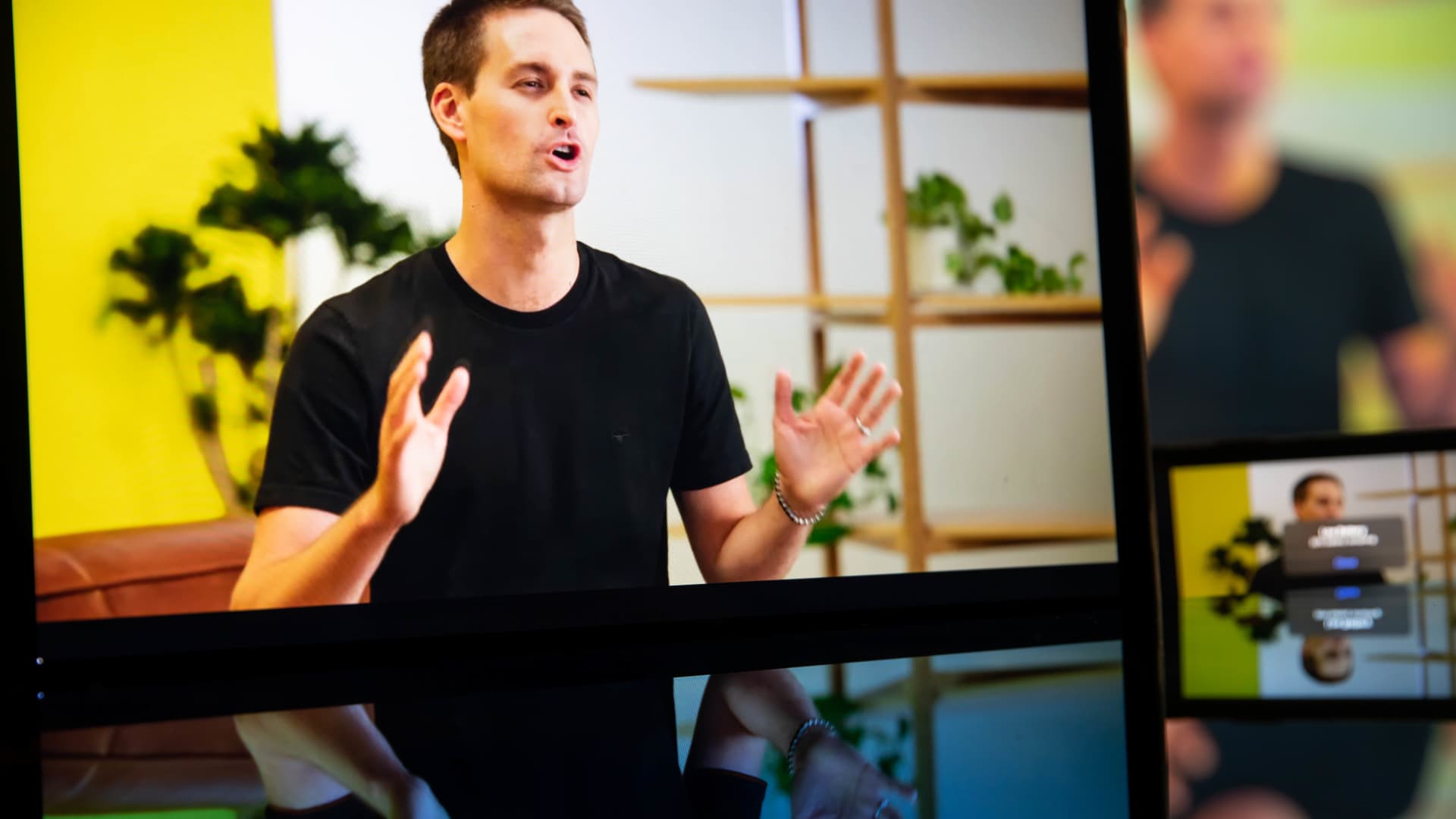

Evan Spiegel, co-founder and main govt officer of Snap Inc., speaks in the course of the virtual Google Pixel Tumble Start event in New York, on Tuesday, Oct. 19, 2021.

Michael Nagle | Bloomberg | Getty Visuals

Snap shares rose 8% on Tuesday right after the organization confirmed a deal with Amazon that allows end users buy solutions from the on the internet retailer with out leaving the application.

The agreement follows a similar deal among Meta and Amazon and is designed to make purchasing much easier for Snap end users.

“Consumers in the U.S. will see true-time pricing, Key eligibility, shipping estimates, and solution details on select Amazon products ads in Snapchat as element of the new experience,” an Amazon spokesperson said in a statement. “In-app searching with Amazon is offered for decide on products marketed on Snapchat and bought by Amazon or by independent sellers in Amazon’s keep.”

The Data was 1st to report on the agreement.

Snap is searching to reignite progress, which has plummeted given that Apple’s iOS privacy transform in 2021 produced it a lot more tricky for social media providers to goal customers with adverts. Past thirty day period, Snap documented a 5% raise in yr-above-12 months profits for the 3rd quarter following two straight durations of shrinkage.

Nevertheless, the corporation claimed it was not providing formal advice, warning buyers that it “observed pauses in shelling out from a significant selection of principally manufacturer-oriented advertising campaigns straight away adhering to the onset of the war in the Middle East.”

Last 7 days, Meta debuted a new attribute as element of a offer with Amazon that allows Fb and Instagram people website link their accounts so they can additional effortlessly purchase goods they see in Amazon ads with no leaving the Meta applications.

Maurice Rahmey, co-CEO of digital marketing agency Disruptive Digital, advised CNBC at the time that the Meta-Amazon offer signifies a “get-win for all people” and underscores how “these two walled gardens are variety of coming with each other.”

Analysts from Bank of America wrote in a report on Monday that the “collaboration must increase best-of-thoughts products awareness for Amazon’s stock supplied Meta’s powerful targeting capabilities and possible increase advert conversion given a lot less friction ahead of obtain.”

Even though investors have flocked backed to Meta this 12 months, pushing the stock up almost 180%, they have been far more restrained with Snap, whose shares are now up about 37% in 2023 just after Tuesday’s rally.

Enjoy: Buying on weak spot in Google stock is the “suitable go for Meta.”