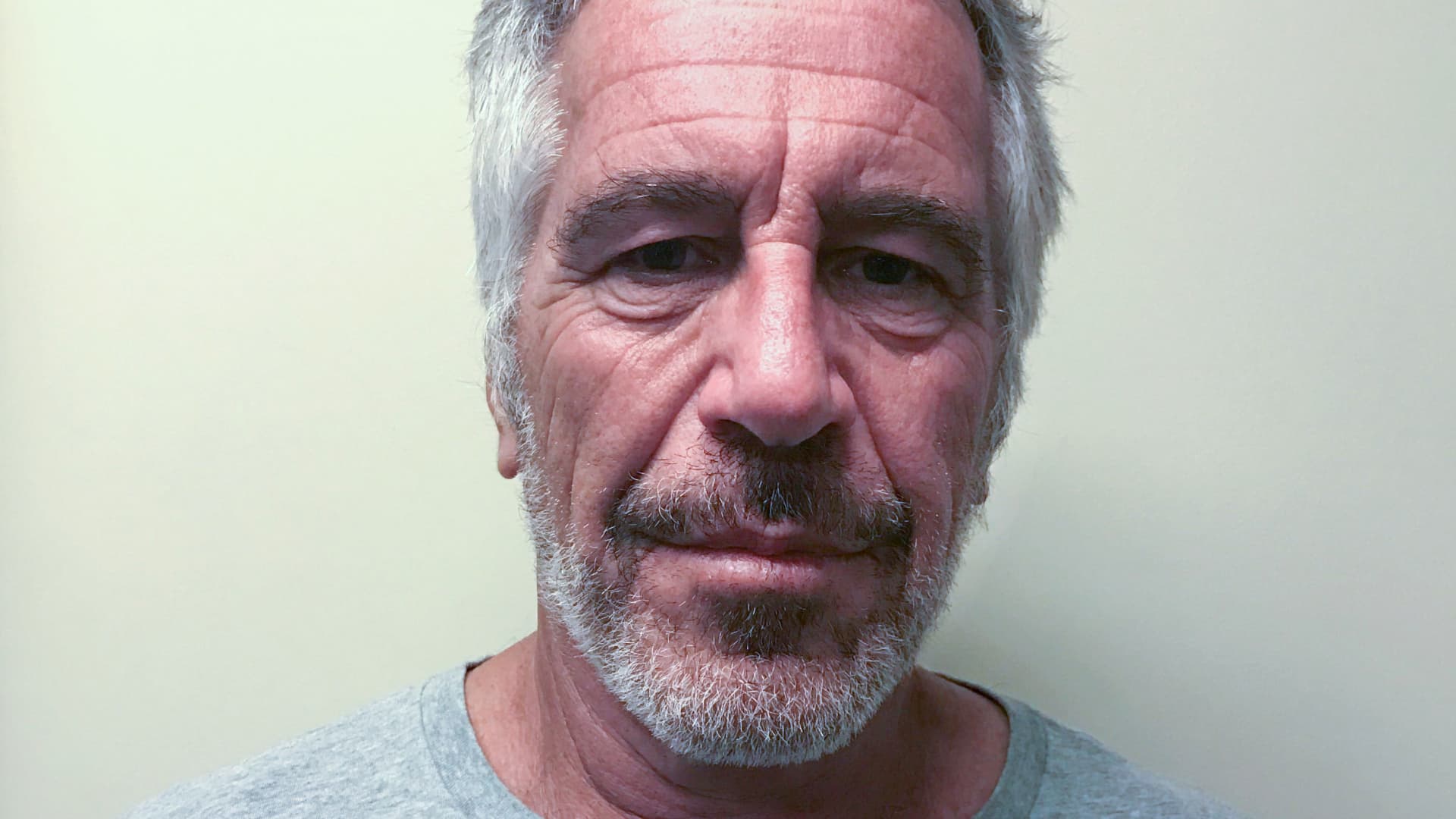

Cristiano Amon, president and CEO of Qualcomm Integrated, speaks all through an interview with CNBC on the flooring of the New York Stock Exchange (NYSE) in New York, April 28, 2022.

Brendan McDermid | Reuters

Qualcomm claimed fourth-quarter earnings on Wednesday that defeat expectations for income and earnings, in spite of significant calendar year-more than-calendar year declines and gave a solid forecast for the current quarter.

Qualcomm inventory rose about 3% in extended trading.

Here is how the chipmaker did for the 3rd quarter for each LSEG (previously Refinitiv) consensus expectations:

- EPS: $2.02, modified, compared to $1.91 for every share predicted

- Income: $8.67 billion, altered, versus $8.51 billion anticipated

Qualcomm stated it envisioned modified earnings of involving $2.25 and $2.45 for every share on amongst $9.1 billion and $9.9 billion of sales in the present-day quarter, vs . LSEG consensus expectations of $2.23 per share of earnings on $9.2 billion of gross sales.

At the midpoint of Qualcomm’s guidance, profits will increase a little during the present quarter compared to last 12 months.

Web earnings all through the quarter was $1.49 billion or $1.32 for each share, a 48% minimize from previous year’s $2.87 billion or $2.54 for every share.

Income through the quarter declined 24% year-over-yr from $11.39 billion past yr. All round adjusted revenue for Qualcomm’s fiscal calendar year fell 19% from very last yr to $35.83 billion.

Qualcomm’s fortunes are tied to the smartphone industry, which has been in a slump for approximately two years following the Covid pandemic established a increase in revenue. It will make the processors at the heart of most large-finish Android gadgets and several lessen-end phones as very well.

Handset chip product sales declined 27% to $5.46 billion, previously mentioned Street Account expectations of $5.34 billion. They’re described as element of QCT, Qualcomm’s greatest division that sells processors, which declined 26% to $7.37 billion in income through the quarter.

The company’s automotive small business was a shiny place for QCT, rising 15% calendar year-in excess of-year to $535 million in product sales all through the quarter, beating Wall Road anticipations. It truly is nevertheless a little company but proceeds to increase as Qualcomm convinces a lot more automakers and elements brands to use its chips in vehicles.

The company’s profitable licensing small business, QTL, described $1.26 billion in sales, a 12% lessen from final year, in line with Avenue Account expectations.

Qualcomm is eager for buyers to see it as an synthetic intelligence firm, supplied that it ships chips with AI functions to millions of smartphones, and could benefit from Wall Street’s current obsession with semiconductor shares for equipment mastering.

Earlier this thirty day period, it declared new Android and Home windows Pc chips with improved AI portions referred to as NPUs that could crank out AI images substantially speedier than previous year’s processors. In a statement, Qualcomm CEO Cristiano Amon drew trader interest to the firm’s roadmap for “generative AI and cellular computing effectiveness.”