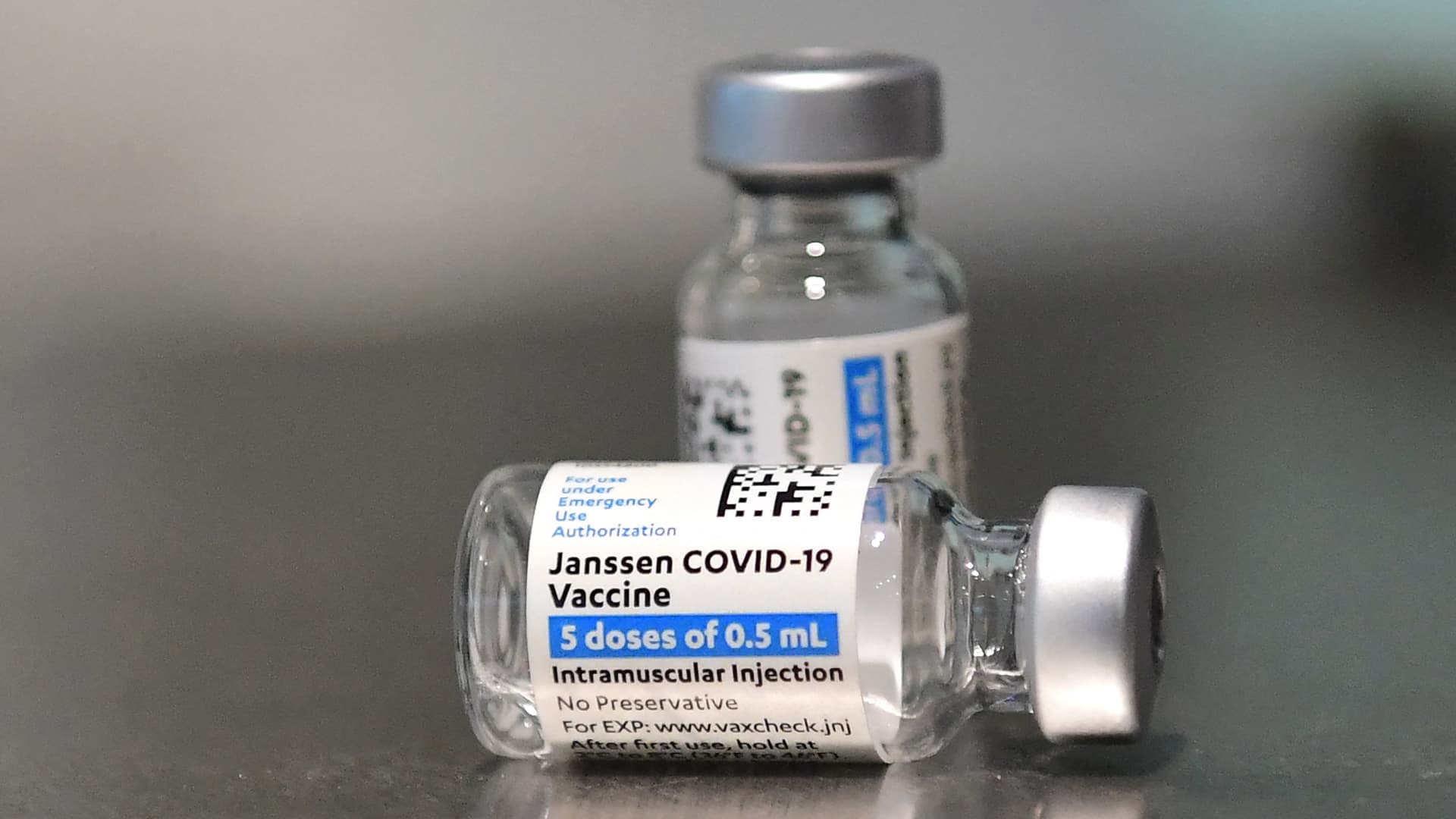

Look at out the firms building headlines in midday investing. Lockheed Martin — The defense enterprise gained about .6% right after it noted third-quarter benefits that defeat expectations. The company posted $6.73 in earnings for every share on $16.88 billion in income. Analysts surveyed by LSEG, previously known as Refinitiv, had forecast $6.67 in earnings for every share on $16.74 billion in earnings. Shares of protection peers also acquired on the information, with Circor Intercontinental leaping 5.5%. Nvidia — The chip stock dropped much more than 3% after the U.S. Division of Commerce mentioned Tuesday it plans to ban the export of a lot more synthetic intelligence chips to China. Other chipmakers also moved lower on the information, such as Marvell Know-how, Highly developed Micro Devices and Broadcom. Greenback Tree — The price reduction retailer jumped 4.1% soon after obtaining an improve from Goldman Sachs to buy from neutral. The expenditure bank sees strong earnings expansion likely and likes DLTR’s compelling valuation. Ollie’s Cut price Outlet , which was also upgraded to buy at Goldman, included 3.8%. Johnson & Johnson — The pharmaceutical big fell marginally despite putting up greater-than-predicted earnings and product sales for the 3rd quarter. J & J posted adjusted earnings per share of $2.66 on $21.35 billion in profits. Analysts polled by LSEG forecast an adjusted $2.52 in earnings for each share and $21.04 billion in income. The enterprise stated pharmaceutical revenue development was partly offset by a decline in revenue of its prostate cancer drug Zytiga and blood most cancers drug Imbruvica, as perfectly as its Covid vaccine. Tripadvisor — Tripadvisor rose additional than 1.5% right after Goldman Sachs initiated the inventory as a invest in and stated it sees upside to estimates for the travel site organization “on the again of quicker income advancement at [tourism company] Viator/Activities [and] scale/running efficiencies top to much better profitability.” Goldman Sachs — The economical firm’s shares fell a little bit following the bank’s 3rd-quarter report. Goldman Sachs earned $5.47 for every share on profits of $11.82 billion, exceeding LSEG estimates. All those figures depict 33% and 1% 12 months-over-calendar year drops on the bottom and leading line, respectively. Lucid Group — The electric motor vehicle maker drop 4% soon after its car or truck output fell 32% 12 months more than 12 months in the third quarter, coming in at 1,550 vehicles. In the meantime, the firm’s vehicle deliveries rose 4.2% from the prior calendar year to 1,457 motor vehicles. Bank of America — Shares extra 2.7% immediately after the bank’s third-quarter benefits topped Wall Street expectations. Bank of The united states noted 90 cents in earnings for every share on $25.32 billion of earnings. Analysts surveyed by LSEG had estimated 82 cents in earnings on $25.14 billion of revenue. Financial institution of New York Mellon — The bank stock rose 3% next a potent earnings report. The organization attained $1.22 for every share on $4.37 billion in income for the 3rd quarter. Analysts surveyed by LSEG forecast $1.15 in earnings for every share and earnings of $4.33 billion. Wyndham Hotels & Resorts — The resort operator jumped 7.9% after competitor Alternative Inns provided to obtain Wyndham for $90 for every share , valuing Wyndham at about $7.8 billion. Shares of Decision Motels fell extra than 5%. CyberArk — Shares of the information protection firm extra 2.5% subsequent an update to chubby from JPMorgan . Analyst Brian Essex cited an attractive setup and favorable competitive landscape as catalysts for the change. VF Company — The attire and footwear corporation jumped a lot more than 11% following The Wall Avenue Journal claimed activist trader Engaged Cash has constructed a stake in the corporation. The correct measurement of the stake is mysterious, the report reported. Viasat — Shares of the satellite broadband companies enterprise climbed 6.7% pursuing an up grade to obese from neutral by JPMorgan. The financial institution cited “increased price tag self-discipline” that ought to “inspire buyers” for the improve. Hannon Armstrong Sustainable Infrastructure Cash — Shares rose 4% after Morgan Stanley upgraded the local climate expense firm to overweight from equal excess weight. The lender mentioned the stock’s offer-off has been “overdone.” Fortrea — Fortrea shares received 3% following activist investor Starboard Benefit disclosed an 8.7% stake in the drug trial deal investigate organization. The firm’s Jeff Smith stated Fortrea is buying and selling at a low cost to peers. Array Systems — The photo voltaic power tech corporation received 3% immediately after Morgan Stanley upgraded shares to equivalent fat from underweight. The expenditure lender cited its interesting valuation subsequent a sell-off in clean power shares and expansion forecasts in the utility-scale photo voltaic marketplace. NetScout Programs — The cybersecurity firm dropped 16%, reaching a new 52-week small, immediately after its preliminary fiscal next-quarter earnings and 2024 fiscal-yr steerage came in beneath anticipations. NetScout’s management stated macro headwinds negatively impacting service service provider need. — CNBC’s Samantha Subin, Alex Harring, Lisa Kailai Han, Pia Singh, Sarah Min and Tanaya Macheel contributed reporting.