In its brief 14-yr historical past, GlobalFoundries has risen to develop into the world’s third-largest chip foundry. Based in upstate New York, GlobalFoundries isn’t really a domestic name for the reason that it can be producing semiconductors that are developed and offered by other firms.

But it is really quietly assisting electric power nearly just about every connected system.

“Glance at just about every digital device in your property, and I would wager you income that each one particular of all those products has at the very least one GlobalFoundries chip in it,” Thomas Caulfield, GlobalFoundries CEO, told CNBC.

GlobalFoundries chips are inside of anything from smartphones and cars and trucks to clever speakers and Bluetooth-enabled dishwashers. They’re also in the servers operating generative synthetic intelligence styles, a sector which is booming so immediately that chipmaker Nvidia has surpassed a $1 trillion market cap and is forecasting 170% profits progress this quarter.

Within generative AI, GlobalFoundries is just not targeted on generating the highly effective graphics processing units (GPUs) utilised to educate substantial language products like ChatGPT. As a substitute, the business is production chips that carry out functions like energy management, connecting to shows, or enabling wi-fi connections.

Caulfield states AI is “the catalyst for our industry to double in the up coming eight yrs and GF will have its fair share, if not more, of that possibility.”

5 years back, GlobalFoundries created a bold move absent from foremost-edge chips, exiting a race that was won by Taiwan Semiconductor Producing Organization.

Now, as tensions with China elevate worries in excess of the world’s reliance on TSMC, and the U.S. and China engage in technological tug-of-war with export controls, GlobalFoundries finds itself positioned perfectly outside the house the geopolitical crosshairs. The firm has used about $7 billion to expand output in Singapore, Germany, France and upstate New York.

CNBC went to Malta, New York, for a firsthand appear at the fabrication plant exactly where GlobalFoundries is including 800 acres, to question how the business options to continue to be ahead although creating the more mature chips nevertheless vital for every day products.

‘It labored out for everybody’

The story commenced in 2009, when Sophisticated Micro Gadgets decided to split off its producing functions into a individual enterprise and concentration entirely on planning chips. The freshly shaped GlobalFoundries took in excess of AMD’s chip fabrication plant, or fab, in Dresden, Germany. At the time, it was a joint enterprise between AMD and the authorities of Abu Dhabi’s tech expense arm. Moorhead was performing at AMD.

“Our founder, Jerry Sanders, at AMD claimed, ‘real gentlemen have fabs.’ So the thought of spinning out the fab from AMD into its own organization was a truly significant deal,” Moorhead stated. AMD “experienced to do it,” he additional, because “the expenditures for a top edge fab ended up doubling each and every two or three years. And ideal now we are hunting at investments of campuses upwards of $100 billion.”

For the 1st several many years, AMD was GlobalFoundries’ only significant purchaser. AMD has since developed to come to be Nvidia’s main rival for designing GPUs.

“I believe it labored out for every person,” Moorhead explained.

GlobalFoundries begun setting up its new fab, and upcoming headquarters, in Malta in 2009. The following 12 months, it expanded into Singapore with the purchase of Chartered Semiconductor. By 2015, it experienced obtained IBM’s in-home semiconductor division, getting over creation web-sites in Vermont and New York. By 2018, GlobalFoundries was a $6 billion small business.

“Unfortunately, it had a system that was not capable to generate profitability or no cost cash move,” stated Caulfield. “So in 2018, when I grew to become the CEO of GlobalFoundries, we made the decision to make a strategic pivot to target all our energy, all our R&D, all of our cash deployment to go be the really ideal at these crucial chips. And that started a journey to turning our business all around to profitability.”

To this working day, GlobalFoundries only can make 12-nanometer chips and higher than, or what it calls “vital” chips.

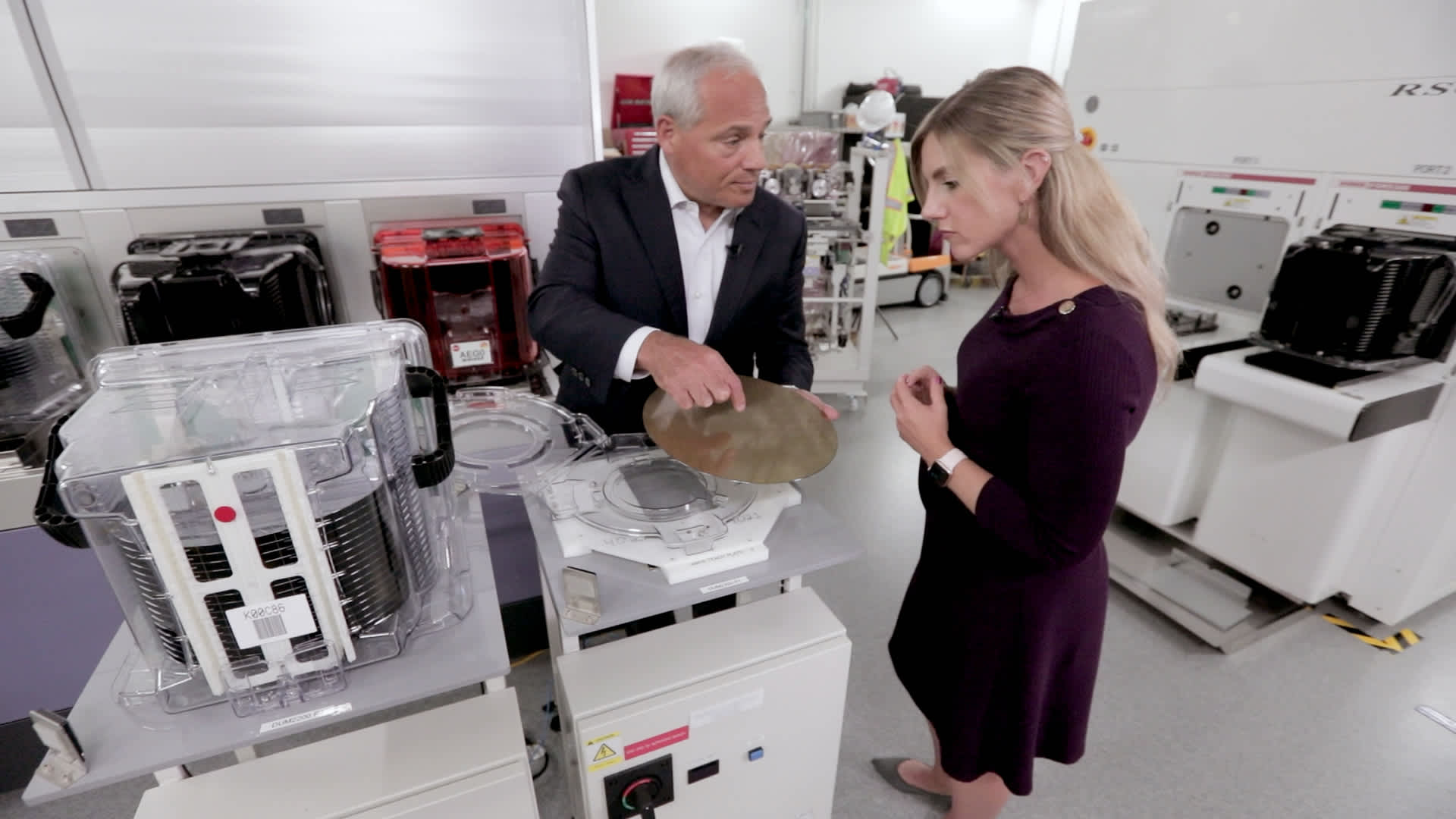

GlobalFoundries CEO Thomas Caulfield exhibits a 300mm wafer to CNBC’s Katie Tarasov at Fab 8 in Malta, New York, on September 5, 2023.

Carlos Waters

“If you do secure spend transactions, whether it’s on your credit rating card or on your intelligent cell unit, we make the chip that does that,” Caulfield reported. “Do you like the images your digital camera usually takes? Well, we make impression sensor processors that push that camera. Do you like the battery life on your cellular phone? We make the PMICs, the ability management ICs that make confident that electricity is managed on these devices.”

Throughout the 2021 chip lack, GlobalFoundries told CNBC it offered out totally. That similar calendar year, the enterprise went general public on the Nasdaq.

“Eventually, we truly need to have these chips,” said Daniel Newman, CEO of exploration business Futurum Group. “We found that out mainly because we had parking loads full of pickup vans that could not be delivered mainly because they could not put the Ecu in or they couldn’t install energy seats. So GlobalFoundries had a truly strong industry requirement.”

World development

GlobalFoundries is the only a single of the world’s leading five chip foundries centered in the U.S. The other 4 are Semiconductor Production Intercontinental in China, Samsung with fabs in South Korea and the U.S., and United Microelectronics and TSMC, which are each in Taiwan.

“Not only do we have a superior focus of semiconductor production in Taiwan in between TSMC and UMC, but TSMC is 2 times the dimension of the other four providers blended,” Caulfield reported.

TSMC can make a lot more than 90% of the world’s most-advanced microchips, producing vulnerability through source chain backlogs as effectively as challenges tied to China’s ongoing threats to invade Taiwan. Like GlobalFoundries, TSMC also makes more mature nodes. Caulfield stated GlobalFoundries is certainly likely immediately after TSMC.

“Not only do we have aspirations, we believe in sure spots we have won,” Caulfield mentioned. He pointed to his company’s radio frequency chips and silicon on insulator technological know-how.

“Silicon on insulator is a huge differentiator when it will come to electric power, and TSMC does not use that,” Moorhead mentioned.

At a time of geopolitical turmoil, GlobalFoundries is investing about $7 billion to include capability in areas of the planet with decreased threat.

In Singapore, the enterprise just accomplished a $4 billion growth that it claims will make it the country’s most-highly developed fab. In June, it finalized a offer with STMicroelectronics to build a jointly owned fab in Crolles, France.

Not all world expansion endeavors have absent efficiently, however. In 2017, GlobalFoundries manufactured large options for a fab in Chengdu, China. In 2020, it backed out.

“It turned out we had a few reasonably substantial amenities around the planet already that were severely underloaded,” Caulfield said. “Adding much more capacity at a time when we couldn’t fill our present capability was just likely to produce a greater financial hole for us.”

The U.S. has not too long ago enacted a sequence of export bans on chip businesses sending state-of-the-art tech to China. By only developing older nodes, GlobalFoundries states it really is been “really minimally” impacted.

Earning chips in the U.S.

Whilst GlobalFoundries’ chips are regarded as legacy nodes, the course of action and assets essential are nevertheless unbelievably sophisticated. Caulfield reported each and every silicon wafer goes through at minimum 1,000 methods over 90 times in the Malta fab. The process involves intensive cleansing, cooling and chemical treatment, which uses a ton of h2o. GlobalFoundries says Fab 8 uses about 4 million gallons of drinking water a day, reclaiming 65% of that.

“Upstate New York is a quite fantastic place for entry to higher-high-quality and considerable water,” Caulfield said.

All the weighty equipment also necessitates about 2 gigawatts of electrical power for every working day, in accordance to Hui Peng Koh, who heads up the Malta fab. She claimed it truly is enough power to “operate a modest metropolis.”

“I would say our most affordable-price tag electrical power is in the U.S.,” Caulfield explained. “A ton of our electricity in upstate New York, where by this facility is at, will come from hydroelectric, so it truly is a greener power. In both equally Europe and Singapore, a great deal of that electricity will come off of organic gasoline.”

Then there is the manpower. GlobalFoundries has 13,000 staff members globally. About 1,500 folks report to Koh in Malta. She informed CNBC it truly is “hard to draw in expertise to this section of the earth.”

GlobalFoundries not too long ago set up the 1st apprenticeship software that’s registered in the U.S. to help develop a semiconductor workforce in Vermont and New York. In July, TSMC blamed a scarcity of competent labor for delays to its fab remaining developed in Arizona.

The significant cost of supplies and building function also make setting up a fab in the U.S. more high priced than in a great deal of Asia, so community subsidies have been vital for reshoring generation. GlobalFoundries explained New York pitched in extra than $2 billion for the Malta fab. The business also utilized for funds from the $52 billion national CHIPS and Science Act. Concentrating on 12-nanometer and earlier mentioned also will help the company hold fees down.

GlobalFoundries’ Fab 8 in Malta, New York, where by Gear Engineering Supervisor Chris Belfi led CNBC’s Katie Tarasov on a tour on September 5, 2023.

GlobalFoundries explained it truly is putting out 400,000 wafers per year from its Malta fab. Even though Caulfield wouldn’t put a greenback figure on the wafers, he reported at any provided time, there is certainly “about a 50 %-billion pounds worth of stock that’s jogging above all those 90 times to make solution.”

GlobalFoundries’ principal buyers for this significant output of vital chips are the world’s greatest fabless chip corporations, including Qualcomm, AMD, NXP and Infineon.

At some point, several of its chips stop up in the auto, aerospace, and U.S. protection industries.

GlobalFoundries is identified for producing “specialty chips” in significant, exclusive bargains, like a single with Lockheed Martin in June for onshoring production of particular chips, and a recent $3 billion settlement with the U.S. Section of Protection.

Newman mentioned GlobalFoundries has all around 50 these types of extended-time period agreements.

“Correctly they’re expressing, ‘We will develop a secure margin dedication potential and if the market place shifts, we are likely to stand by the letter of our settlement,'” he claimed.

For providers hit hardest by the chip lack, a deal with GlobalFoundries is a hedge in opposition to it going on yet again. In February, General Motors established apart special generation capability at the Malta fab.

“GM, their lines got held up for pretty lower-cost factors for the reason that they could not get enough,” Moorhead mentioned. “What GM made a decision is that this is much too much source chain risk. We are going to go instantly to GF.”

GlobalFoundries says automotive is one particular of its swiftest-developing segments. It would make numerous distinct varieties of chips for vehicles: the microcontrollers for energy seats, airbags and braking the sensing chips for cameras and Lidar and battery administration chips for electric automobiles.

Meanwhile, the progress of GlobalFoundries’ smartphone enterprise is decelerating, along with an industrywide slowdown. GlobalFoundries laid off 800 personnel in December and January, and issued weaker-than-anticipated revenue guidance for the 3rd quarter.

“Intelligent cellular equipment final year represented 46% of our earnings,” Caulfield stated. “Though it grew past yr, it was 50% the calendar year before. So we’ve been striving to build our other company and to get much more well balanced, alternatively than having this kind of a substantial publicity to sensible cell equipment.”