Michael Sonnenfeldt, Tiger 21

Scott Mlyn | CNBC

Non-public fairness is currently “king” among members of Tiger 21 — a community of ultra-large net worthy of entrepreneurs and traders — in accordance to its founder and chairman, Michael Sonnenfeldt.

The personal fairness business experienced an in particular tough 2022 right after a decade-extended bull run, but has picked up so far this calendar year.

Sonnenfeldt advised CNBC on Friday that Tiger 21 customers, who collectively manage around $150 billion in property, have increased their allocation to personal fairness threefold over the previous 10 years, and see additional chances amid an expected boom for corporations uncovered to AI and weather.

Most Tiger 21 users are business people who have bought their companies and are now in the business of wealth preservation.

“Cash holdings are all-around 12%, they have trimmed down community equities, but our serious estate came down a year or two ago due to the fact of increasing fascination prices, and non-public fairness is now king — that’s where by enterprises are still scaling,” Sonnenfeldt explained.

“Of system, the availability of credit score will make it a little far more tricky, but personal equity is where by our associates are truly centered due to the fact when you have basic businesses that are developing fast, that can outperform the marketplace.”

Personal fairness has developed as a percentage of members’ portfolios from 10% to 30% over the very last ten years, Sonnenfeldt revealed, with venture funds comprising a larger portion than at any time in advance of.

“A lot of our users have observed that AI is a enormous possibility, climate is a huge chance and obviously the power markets have completed properly, so our members truly imagine that the basic progress more than the extensive phrase is heading to be favored,” he additional.

According to a quarterly report from EY, private equity activity climbed 15% in the second quarter of 2023 versus the 1st, with complete deal values hitting $114 billion on the again of a steep increase in Europe.

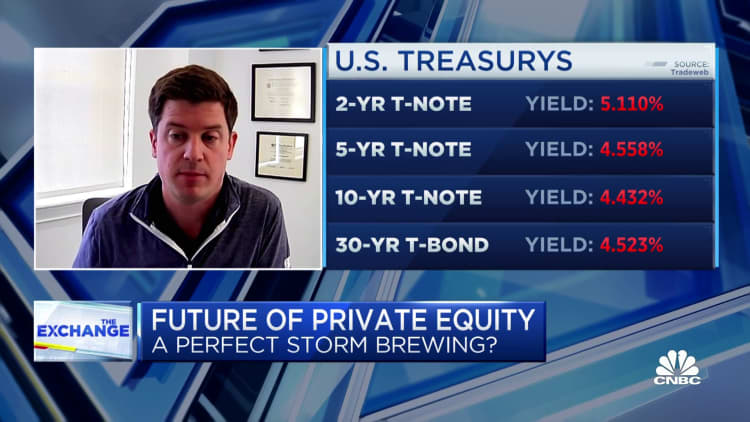

But not every person is confident that the optimism is justified. Dan Rasmussen, founder and chief investment officer at hedge fund Verdad Advisers, explained to CNBC on Friday that the marketplace is going through a “ideal storm” in the wake of sharp rises in desire premiums and slipping tech valuations.

“There are three large complications going through private fairness. The to start with is that most of personal fairness is leveraged — about 60% internet credit card debt to organization value for the regular buyout — and pretty much all of that debt is floating charge,” he claimed.

As fascination rates have risen radically, the common interest fees for non-public equity companies have spiked. The median interest expenditures as a percentage of EBITDA (earnings right before fascination, tax, depreciation and amortization) in the personal fairness and undertaking cash sector was 43% in 2022, whilst the median throughout businesses on the S&P 500 index was 7%, according to Verdad Advisers.

“The second challenge is private equity is 40%-moreover uncovered to the technological know-how sector, engineering valuations have been falling, and so as you see multiples coming down, which is creating an added challenge,” Rasmussen claimed.

Cumulatively, this usually means the non-public fairness market has been getting businesses at top quality valuations versus public markets, with greater degrees of credit card debt.

Though some major tech corporations with major publicity to AI have found valuations soar this yr, dragging up the averages for the wider sector, scaled-down corporations with higher leverage have typically not observed the same boon.

The U.S. Federal Reserve has increased interest costs by much more than 500 foundation factors about the earlier 18 months, from a concentrate on range of .25-.5% in March 2022 to 5.25-5.5% in July.

While the Federal Open Market Committee opted this thirty day period to pause its amount hiking cycle, the central financial institution has suggested premiums will keep larger for more time, which is typically adverse for highly leveraged portions of the marketplace focusing on speedy expansion.

“From a quantitative viewpoint, the fundamentals of sponsor-backed corporations seem horrifying,” Rasmussen claimed in a investigate take note before this year.

“Yet non-public equity stays the darling asset course of innovative investors, with lots of endowments and loved ones workplaces nearing a 40% allocation. The economic fundamentals appear significantly a lot less eye-catching than one particular could assume, offered these types of large degree of enthusiasm.”