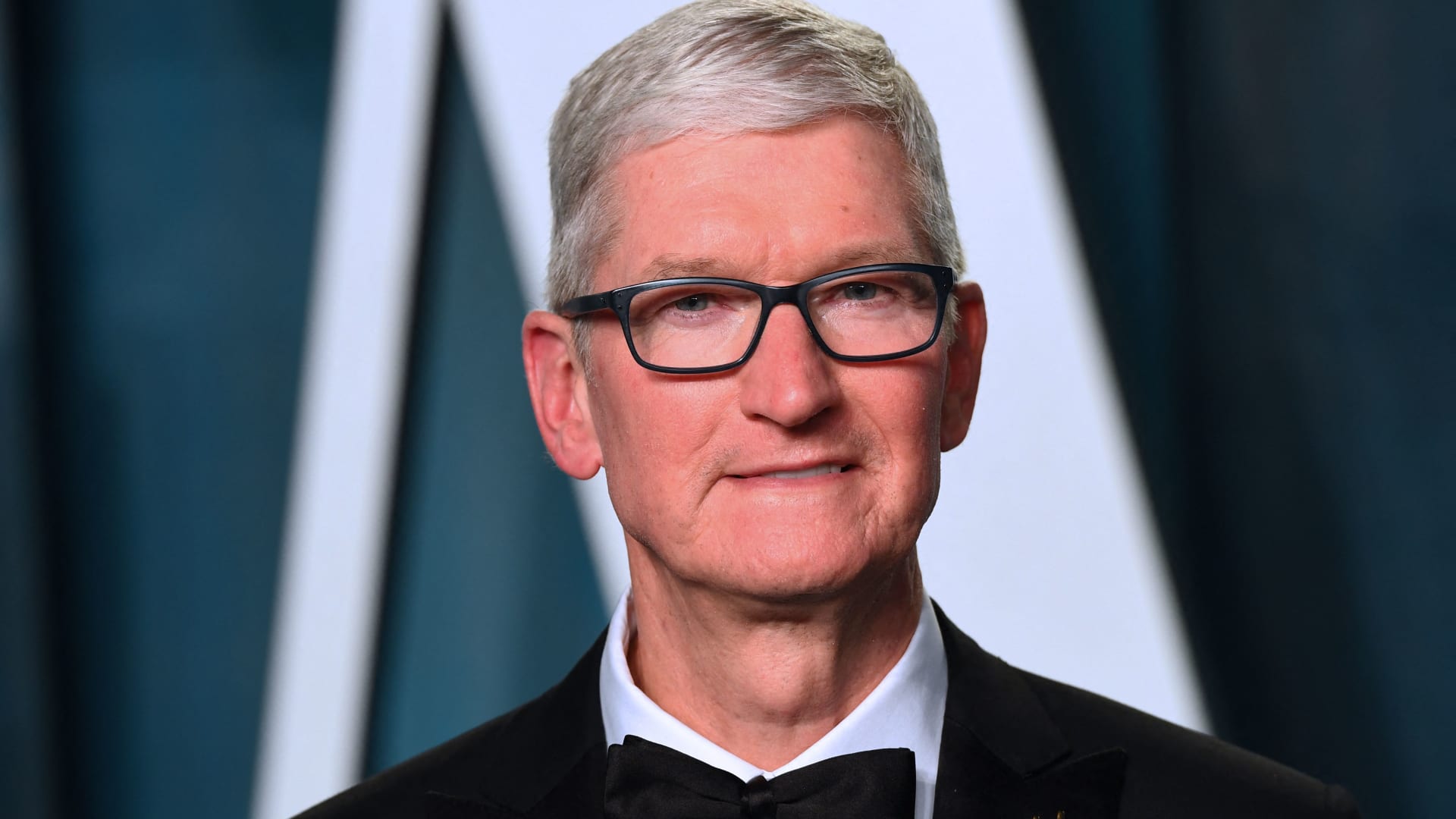

CEO of Apple Tim Cook attends the 2022 Vanity Fair Oscar Party following the 94th Oscars at the The Wallis Annenberg Center for the Performing Arts in Beverly Hills, California on March 27, 2022.

Patrick T. Fallon | AFP | Getty Images

Europe’s antitrust regulator accused Apple of restricting rivals’ access to its payment technology, a move that could potentially compel it to change how the company’s system works and open up the company to a large fine.

The European Commission said in a press release on Monday that it had “informed Apple of its preliminary view that it abused its dominant position in markets for mobile wallets on iOS devices.”

The statement of objections the Commission delivered to Apple outlines suspected violations of Europe’s antitrust rules, but does not necessarily determine the final outcome of the investigation. Apple will have the chance to review and respond to the Commission’s findings.

The Commission wrote that it had found Apple had restricted competition in the mobile wallets market on its iPhone operating system by limiting the technology used for contactless payments, known as near-field communication (NFC).

“In our Statement of Objections, we preliminarily found that Apple may have restricted competition, to the benefit of its own solution Apple Pay,” Margrethe Vestager, the Commission’s competition chief and executive vice president, said in a statement. “If confirmed, such a conduct would be illegal under our competition rules.”

The Commission argued that Apple’s decision not to make its NFC technology accessible to third-party app developers of mobile wallets “has an exclusionary effect on competitors and leads to less innovation and less choice for consumers for mobile wallets on iPhones.”

“Apple Pay is only one of many options available to European consumers for making payments, and has ensured equal access to NFC while setting industry-leading standards for privacy and security,” an Apple spokesperson said in a statement. “We will continue to engage with the Commission to ensure European consumers have access to the payment option of their choice in a safe and secure environment.”

Apple also expressed concern that changes to its payments system could result in a less secure process.

The Commission has separately probed Apple’s rules for developers who want to distribute apps on iOS. Europe also recently came to an agreement on new rules under the Digital Markets Act that seek to curb the dominance of digital platforms that act as gatekeepers to key services.

Lawmakers in the U.S. have similarly looked at Apple’s treatment of app developers and proposed new rules that would require Apple and others to provide a more open environment for potential rivals seeking to distribute apps on their phones.

Subscribe to CNBC on YouTube.

WATCH: Spotify files an EU antitrust complaint against Apple