Christine Lagarde, president of the European Central Bank (ECB), at a rates final decision information meeting in Frankfurt, Germany, on Thursday, Sept. 14, 2023. The ECB elevated curiosity charges again, acting for the 10th consecutive time to choke inflation out of the euro zone’s progressively feeble economic climate.

Bloomberg | Bloomberg | Getty Images

The central banking institutions of some of the world’s greatest economies are now extensively considered to have attained, or be at the brink of reaching, the best amount they will acquire interest charges.

The European Central Financial institution final week signaled that its Governing Council feels costs may have received there.

Subsequent a extensive deliberation in excess of its updated forecasts for inflation and economic expansion and what they must signify for financial policy, the ECB hiked its vital charge to a history higher of 4%. Even though its accompanying statement by no suggests ruled out additional hikes entirely, it stated premiums have been at degrees that if “maintained for a adequately long period, will make a sizeable contribution to the timely return of inflation to the target.”

The quick-time period inflation outlook stays grim, and established to hit households challenging. ECB employees macroeconomic projections for the euro area now see inflation averaging 5.6% this year, from a prior forecast of 5.4%, and 3.2% future calendar year, from a past forecast of 3%.

But the forecast for 2025, a person of its most carefully viewed metrics measuring the medium-phrase outlook, was nudged down from 2.2% to 2.1%.

Dialogue will now change to how extended premiums will plateau at the present degree, economists like Berenberg’s Holger Schmieding, explained subsequent the anouncement.

Analysts at Deutsche Bank explained they saw no cuts in advance of September 2024, implying a 12-thirty day period pause at 4%.

Issues to this remain, even so, with a person staying the prospect of drastically increased oil charges. Crude futures a short while ago climbed to a 10-month significant, which could impact goods fees and inflation expectations in Europe as nicely as the U.S.

Raphael Thuin, head of funds marketplaces strategies at Tikehau Money, explained that even with consensus all over the end of the ECB climbing cycle, “an choice and a lot less optimistic state of affairs continues to be doable: inflation is astonishingly sturdy and resilient, and seems to be structural.”

“Modern disinflationary elements (products and commodity selling prices) appear to be running out of steam … There is a possibility that, in the absence of a more convincing downward craze in prices, the ECB will take into consideration its fight towards inflation unfinished, with the chance of more fee hikes on the horizon,” Thuin claimed in a observe.

“In this respect, macroeconomic data developments in excess of the coming weeks will be decisive.”

Federal Reserve

Fed Chair Jerome Powell built apparent last month that even more hikes had been on the table, and the central lender is deeply involved about inflation encountering a clean acceleration if monetary disorders simplicity.

In its June forecast, which is possible to be revised in an up-to-date projection this week, it did not see inflation reaching 2.1% right until 2025.

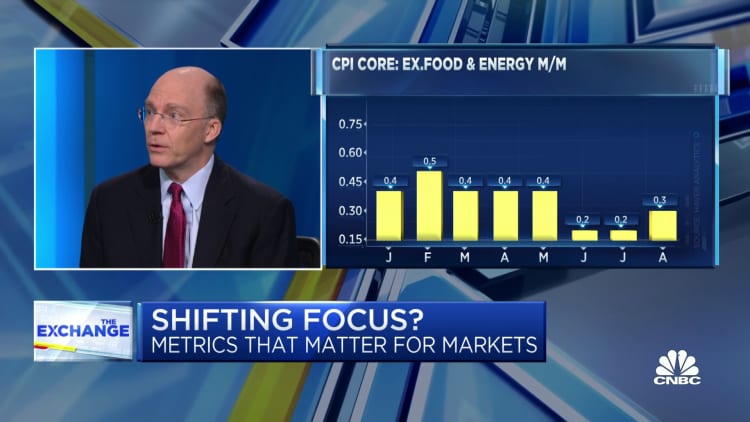

Regular facts displays continuing cost pressures. The shopper cost index rose at its speediest month to month charge this yr in August, mostly driven by power charges, and was 3.7% calendar year-on-12 months. Core inflation arrived in at .3% on a regular monthly basis and 4.3% on an annual basis, though producer selling price inflation showed the major regular monthly gain due to the fact June 2022.

But markets are all-but specified the U.S. Federal Reserve will hold charges regular in September, and are break up on no matter if a different hike will be shipped this year. In a Reuters poll of economists, 20% predicted at least a person.

“Specified the comparatively solid economic info and sticky inflation, [the Fed] will preserve a hawkish bias,” economists at J. Safra Sarasin claimed in a take note.

The Federal Open Sector Committee “will almost certainly depart a ultimate hike by yr stop in its current dot plot, even even though we really don’t believe they will comply with in the long run by with it.” The dot plot refers to the interest price projections unveiled quarterly by Fed policymakers.

Marketplaces proceed to hope Fed fee cuts subsequent 12 months, nevertheless some argue this could be untimely. In the identical Reuters poll, 28 economists expected a 1st slash in the 1st quarter, although 33 put it in the 2nd.

Financial institution of England

Expectations for the Financial institution of England are for one particular final hike in September, as it weighs up inflation of 6.8%, with indicators of stresses on the financial system and renewed converse of a “moderate economic downturn.”

In its August report, the Monetary Policy Committee said it expected inflation to strike 5% by the conclusion of the 12 months, to halve by the conclusion of up coming yr, and attain its 2% focus on in early 2025.

“The Lender is no for a longer time in a apparent space where fascination amount hikes are unequivocally essential,” mentioned Marcus Brookes, main financial investment officer at Quilter Investors, pointing to weak gross domestic products info for July.

Analysts at BNP Paribas mentioned they anticipated a ultimate “dovish hike” in September, as wage advancement and inflation pressures merge with softening activity indicators.

Wage development figures for May to July held constant at 7.8%, keeping their record large amount, but there have also been indications of a cooling work market place, with unemployment growing .5 proportion points in the similar period of time.

The mortgage loan market is one more area of weak point, with payments in arrears spiking to a 7-year superior in the a few months to June.

James Smith, created marketplaces economist at ING, famous anticipated selling price development and anticipated wage expansion had both fallen, while fewer corporations reported battling to uncover staff.

“A November hike is achievable, but assuming we are proper about the direction of the dataflow and on the basis of recent BoE remarks, we imagine a pause is however much more very likely at that assembly,” Smith reported.