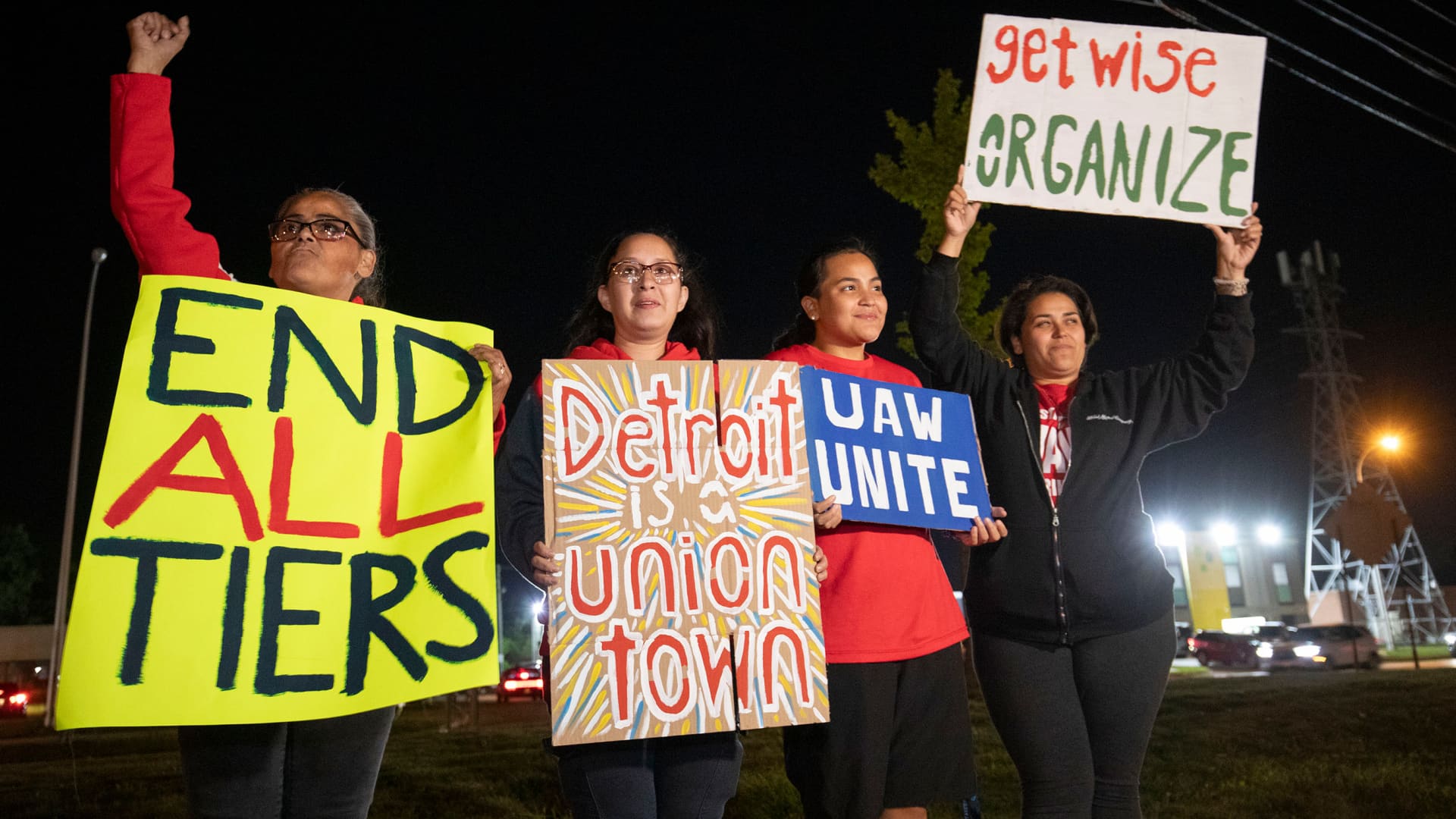

Supporters cheer as United Auto Workers members go on strike at the Ford Michigan Assembly Plant on September 15, 2023 in Wayne, Michigan.

Bill Pugliano | Getty Images News | Getty Images

The United Auto Workers labor union launched targeted strikes against the three Detroit automakers early Friday morning. The stoppages affect three plants that make popular models such as the Ford Bronco, Chevrolet Colorado and Jeep Wrangler.

It’s the first time in history that the UAW has struck all three of the Detroit automakers at once. But while the strikes began at the same time, they may play out very differently in the days to come — with Stellantis potentially facing a tougher road to a deal than its crosstown rivals Ford Motor and General Motors.

Stellantis has a problem that its local rivals don’t. The company, formed in early 2021 from a merger between Fiat Chrysler Automobiles and French automaker Peugeot, has more production capacity around the world than it needs. Stellantis has signaled that it intends to close or sell 18 of its U.S. facilities, including factories and parts depots. The company has a total of about 35 factories and parts distribution centers in the U.S. now.

That’s a plan that the union is unlikely to accept willingly.

It’s possible that Stellantis has been preparing for a lengthy strike with that in mind: The company had more vehicles in its U.S. dealer inventories at the beginning of September than either of its crosstown rivals.

The auto industry measures inventory in terms of “days’ supply,” based on the rate of sales of each model over the previous 30 days. According to data from Cox Automotive, all four of Stellantis’ U.S. brands had more than 100 days’ worth of vehicles on dealer lots or in transit to dealers as of the beginning of September. GM’s Cadillac and Chevrolet brands had just 46 days’ and 51 days’ worth of vehicles, respectively; the Ford brand had 77 days’ worth.

The industrywide average was 58 days’ supply as of the beginning of the month. Historically, the Detroit automakers have tended to have somewhat larger supplies on hand because their full-size pickups are offered in many different configurations.

In contrast to the strike against Stellantis, the UAW’s strike against Ford could be relatively brief. From comments made by UAW President Shawn Fain and Ford executives in recent days, it appeared that Ford was the closest of the three automakers to a deal with the union. The UAW may have recognized that when it chose to strike only part of Ford’s Michigan Assembly Plant, the areas where vehicles are painted and where final assembly happens. All of the UAW-represented workers at GM’s assembly plant in Wentzville, Missouri, and Stellantis’ Jeep Wrangler factory in Toledo, Ohio, walked out last night.

General Motors may also be spared a protracted strike. Details made public from GM’s final offer before the strike, on Thursday, suggested that its offer was similar to Ford’s, with a 20% wage increase over the four-year term of the contract, more vacation days and two weeks of parental leave, among other concessions.

If Ford reaches agreement with the UAW soon, GM could follow soon after by using Ford’s deal as a template.

But as of Friday morning, Stellantis seemed to be buckling down for a long battle.

“We are extremely disappointed by the UAW leadership’s refusal to engage in a responsible manner to reach a fair agreement in the best interest of our employees, their families and our customers,” the company said in a statement following the walkouts. “We immediately put the Company in contingency mode and will take all the appropriate structural decisions to protect our North American operations and the Company.”

In line with past practice following a strike, the UAW and the automakers will take a break from negotiations on Friday. Meetings are expected to resume this weekend.