You can view David Faber’s job interview with Arm CEO Rene Haas and SoftBank CEO Masayoshi Son on CNBC Pro.

Arm’s China subsidiary is “doing nicely” with strong potential in information centre and automotive applications, irrespective of the geopolitical tumult of the last couple of decades, Arm Holdings CEO Rene Haas claimed in an interview with CNBC forward of the company’s Thursday Nasdaq debut.

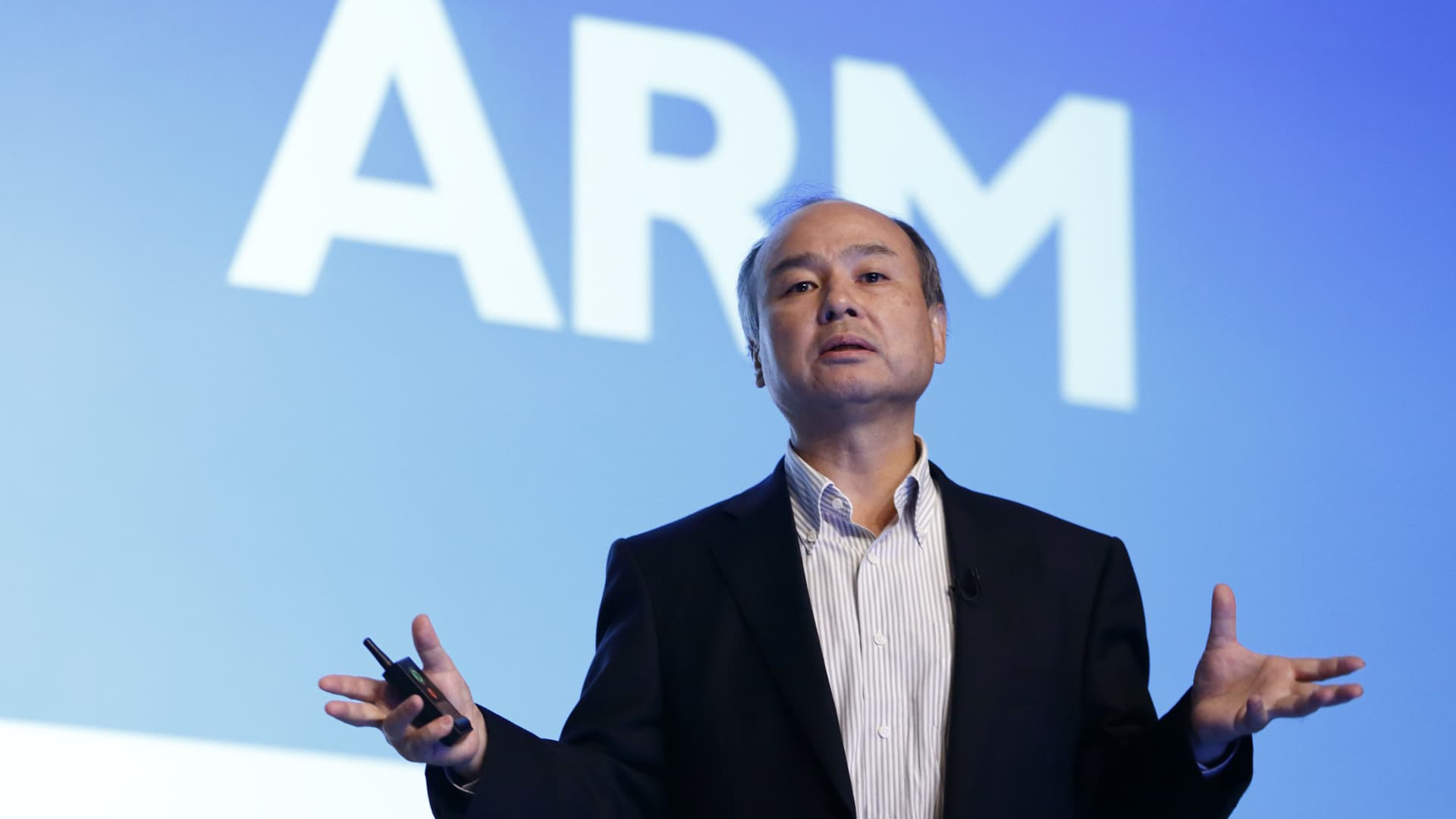

But SoftBank CEO Masayoshi Son, who built a fortune by Chinese juggernaut Alibaba, reported SoftBank experienced minimized its “publicity in China” by a major sum.

Complicating that assertion, on the other hand, is Arm’s dependence on Chinese buyers who, for now, are nonetheless in a position to purchase the firm’s semiconductor technology and designs.

Neither Arm nor SoftBank, which obtained Arm for $32 billion in 2016, immediately management their China subsidiaries. In 2018, SoftBank bought a managing stake in the China business to a team of Chinese traders. Arm now only directly owns all around 5% of Arm China, but the group nonetheless accounts for approximately a quarter of Arm’s fiscal 2023 earnings, according to pre-featuring filings.

That relationship may possibly facial area further pressures in the coming months. The Biden administration has proceed to implement stringent export controls on higher-driven semiconductors that can be made use of for artificial intelligence. The limitations have now strike Intel and Nvidia, and even though Arm won’t fabricate its individual chips, it does provide styles to many chip companies.

The Biden administration has also launched fresh outbound investment restrictions on key engineering sectors.

Son was focused on SoftBank’s stake in Alibaba, which SoftBank has been lowering steadily above the previous few yrs. “Most of the shares in Alibaba from SoftBank [are] currently offered,” Son instructed CNBC’s David Faber in an interview.

The minimized exposure might have less to do with challenges from China and extra with SoftBank’s have portfolios. SoftBank has taken large losses on its Eyesight Fund I and II, although Vision Fund I is now back in the black. And one of the most important prizes in its non-public portfolio, TikTok owner ByteDance, has been underneath stress from the U.S. authorities linked to info assortment techniques.