Denmark’s Novo Nordisk on Friday briefly overtook French luxurious merchandise behemoth LVMH to turn into Europe’s most precious corporation as traders wager on the opportunity of its pounds decline drugs.

Novo Nordisk’s sector capitalization was $421 billion like unlisted stock at 9:43 a.m. London time, according to Refinitiv information cited by Reuters, vs . LVMH’s $420.97 billion.

LVMH regained the prime spot it beforehand held for two-and-a-half many years by 11 a.m. London time, Refinitiv facts showed, but the drugmaker continues to be on its heels.

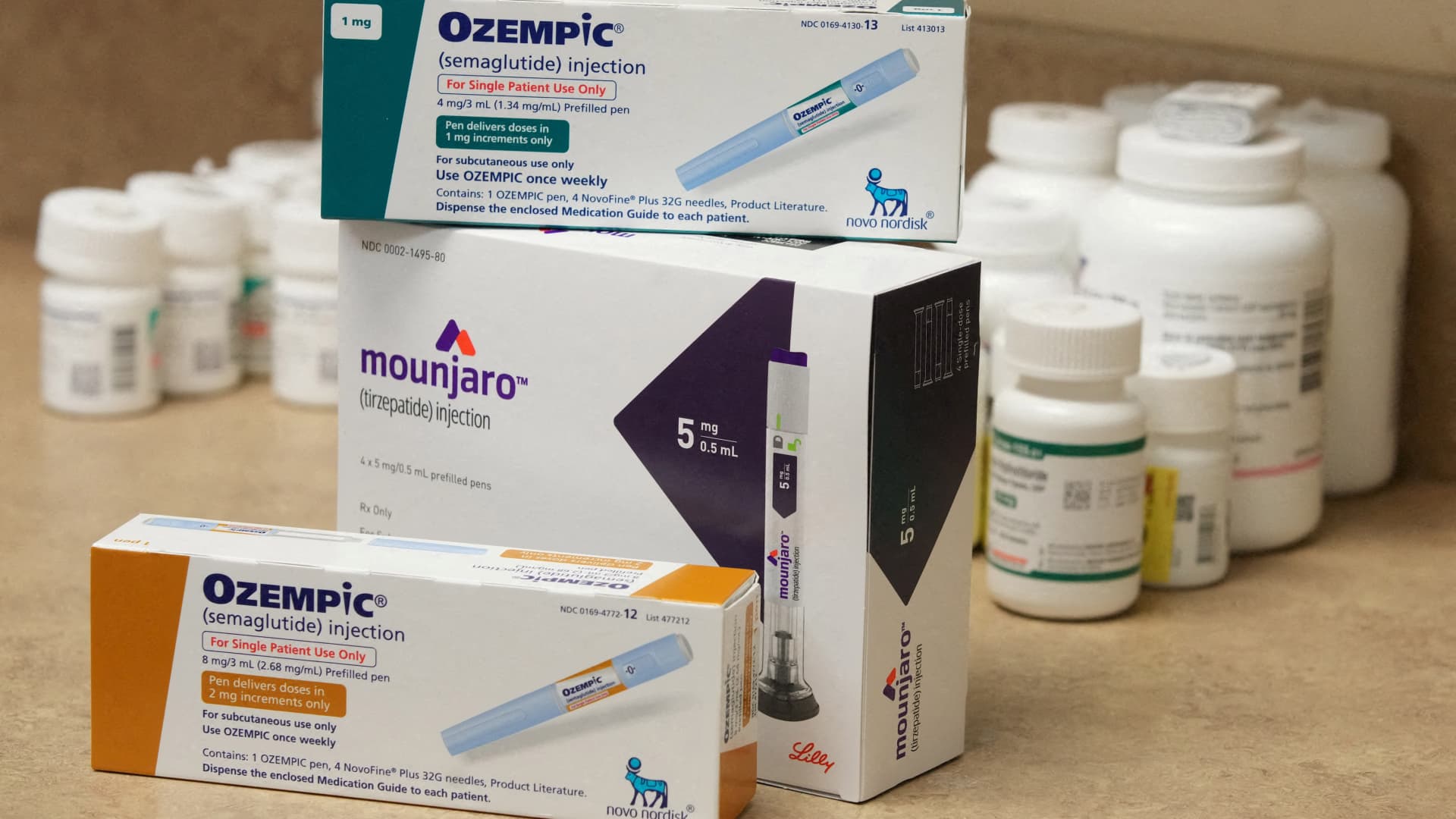

Novo Nordisk produces medication Ozempic and Wegovy, which have generated enormous hype in excess of the earlier yr above their opportunity bodyweight loss employs.

In August, the enterprise released scientific trial benefits indicating that Wegovy lessened the hazard of significant heart troubles and heart-connected dying by 20%. Its share price tag has far more than tripled above the past 3 years, and has attained 66% above the previous 12 months.

Denmark on Thursday revised up its GDP yearly progress forecast to 1.2% from .6%, citing a increase from the pharmaceutical market as a vital factor.

LVMH, the team guiding makes such as Louis Vuitton, Moët & Chandon and Tiffany, has found its shares soar to report highs over the very last 3 decades as luxurious expending has remained resilient. Its CEO, Bernard Arnault, is just one of the world’s richest individuals.

Nonetheless, its share price has declined in modern months as anticipations more than a rebound in Chinese journey and shelling out have cooled.