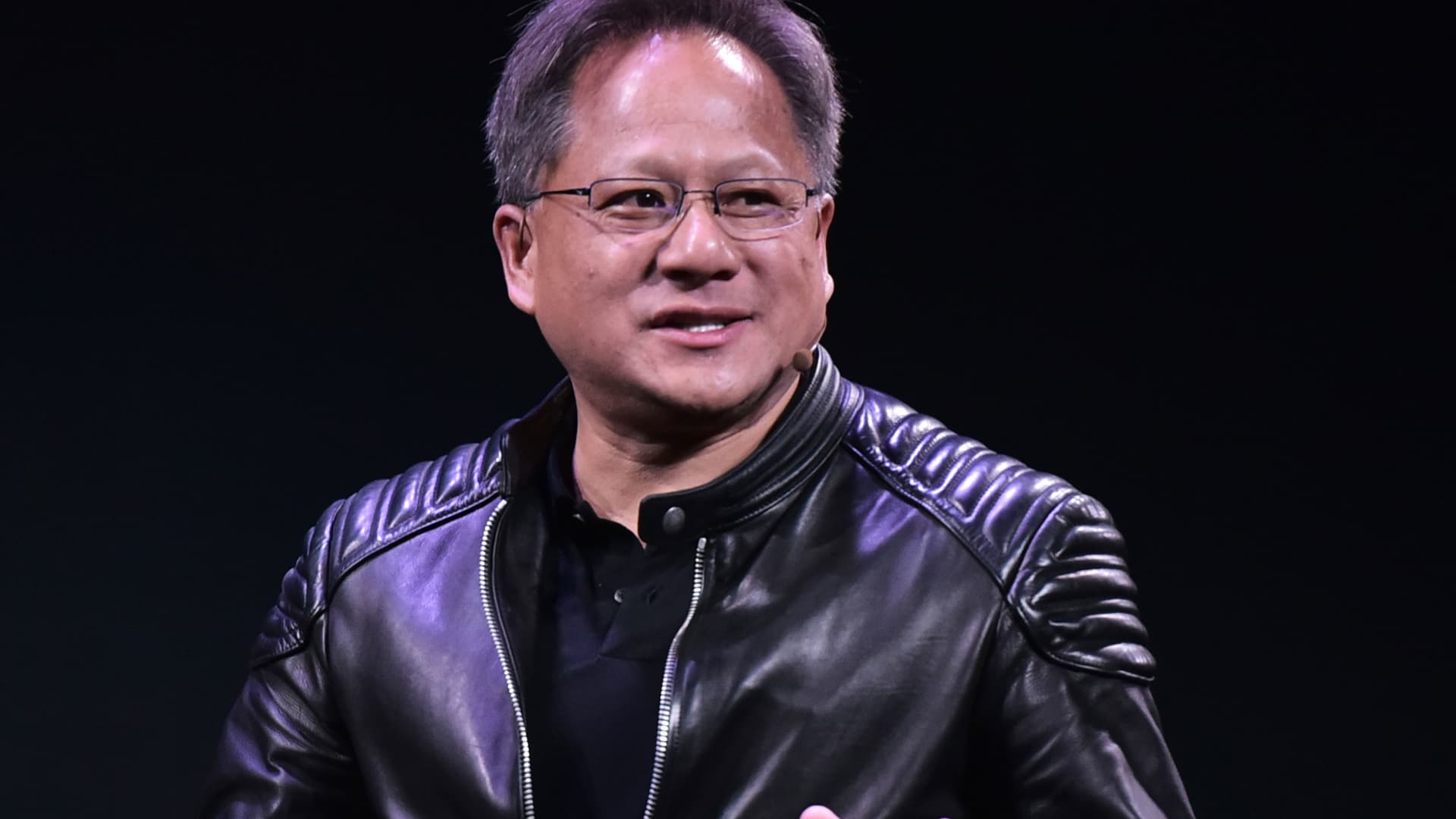

Nvidia CEO Jensen Huang speaks all through a push convention at CES 2018 in Las Vegas on Jan. 7, 2018.

Mandel Ngan | AFP | Getty Visuals

Shares of chipmaker Nvidia rose 5% in Thursday morning buying and selling, right after the business documented a conquer on the top rated and bottom traces and provided sturdy steerage for the approaching quarter.

Nvidia reported altered earnings for every share of $2.70 for the fiscal 2nd quarter, beating a Refinitiv consensus estimate of $2.09. The firm also reported quarterly profits of $13.51 billion, vs . a consensus estimate of $11.22 billion.

Analysts also honed in on sturdy assistance for the impending quarter. The corporation expects all over $16 billion of revenue for its fiscal third quarter, up 170% compared with the yr-back period.

JPMorgan’s Harlan Sur amplified his cost focus on from $500 to $600 and reiterated an chubby ranking on the stock.

“Anticipations were large coming into the print and the team managed to supply effects/outlook that ended up well-above purchase facet expectations driven by the huge demand pull for its datacenter items,” Sur wrote in a Thursday take note to customers.

Nvidia shares have savored a virtually uninterrupted run this yr.

Nvidia stock opened at a new 52-week significant, obtaining greater much more than 220% 12 months to date. The business has also been sitting comfortably in the $1 trillion market cap club for the very last couple weeks.

Heightened, AI-driven desire for Nvidia chips has been a boon for the chipmaker, which has traditionally concentrated on graphics processing models, or GPUs. As organizations throughout industries move to create out their AI chops, there has by no means been much more demand from customers for Nvidia chips.

The organization expects that heightened demand from customers will be sustained as a result of 2024.

— CNBC’s Kif Leswing contributed reporting.