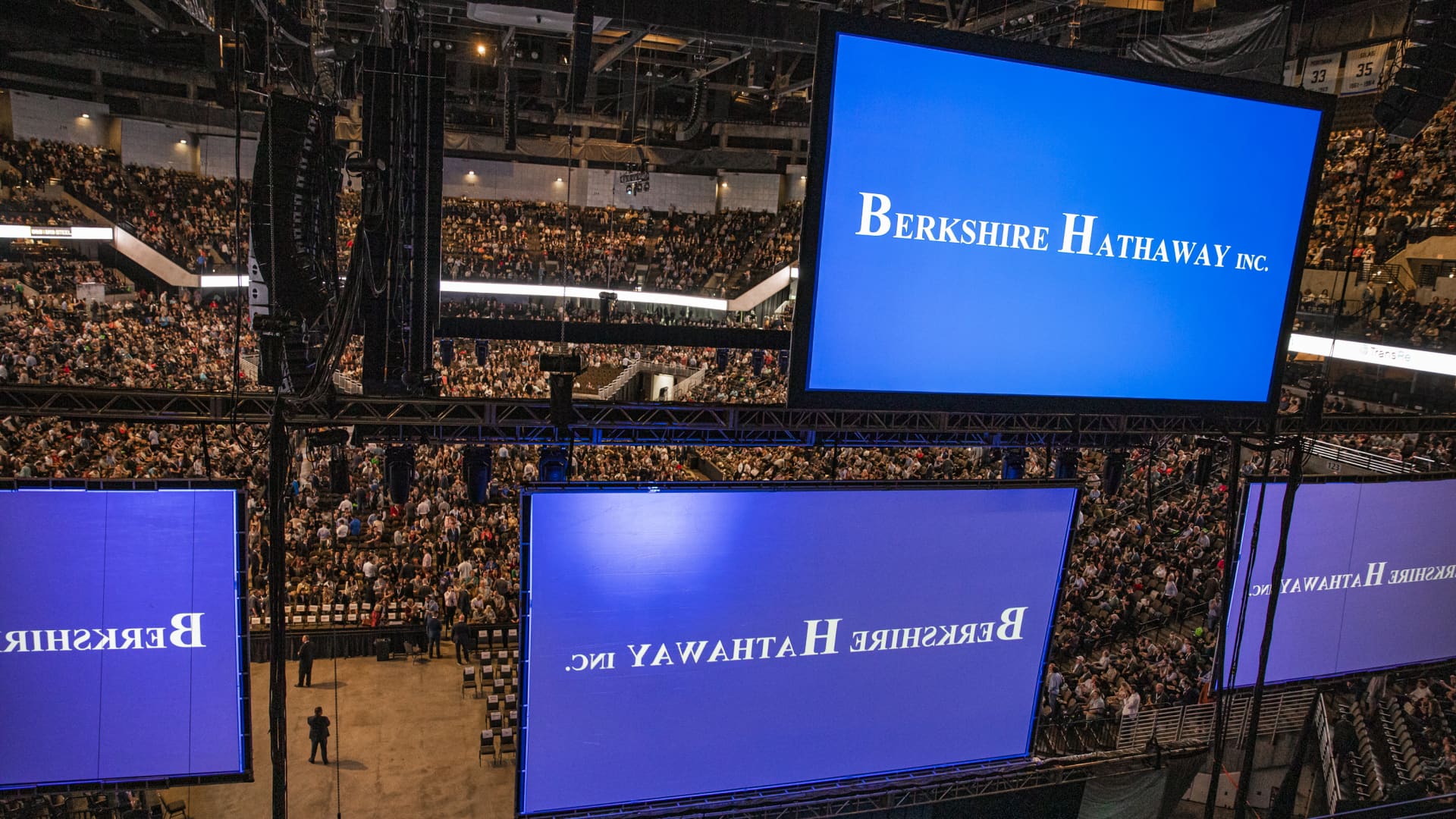

Buyers are nearly spoilt for option concerning the security of bonds and the potential upside of stocks. On the a single hand, the U.S. overall economy is exhibiting indicators of balanced progress, and some analysts hope shares to continue soaring. At the same time, U.S. authorities bonds offer you additional than 5% in hazard-totally free generate. Renowned worth trader Dude Spier weighed in on CNBC’s Professional Talks on regardless of whether it really is better to put your money in an S & P 500 index fund , in U.S. Treasurys , or in shares of Berkshire Hathaway for the extensive operate. Spier, who calls himself an “ardent disciple” of famous investor Warren Buffett and follows his concepts, manages the $350 million Aquamarine Fund — a portfolio inspired by the initial 1950s Buffett Partnership period . Asked whether he would spend in the S & P 500 or Buffett’s Berkshire Hathaway stock for the rest of his life, Spier mentioned the dilemma poses a untrue alternative that traders don’t will need to make. “It is completely acceptable to very own equally,” Spier mentioned. “I think that if I were in [the questioner’s] footwear, I could visualize myself actually undertaking this is: those are two really superior choices.” Instead than selecting 1 about the other, Spier implies dividing the investment decision 50-50 involving the S & P 500 and Berkshire, then rebalancing positions at the end of each individual calendar year. “Investing for the rest of one’s everyday living is the ideal problem. But then we shouldn’t tie our palms as well substantially. We do get the ability to make adjustments,” he discussed. When questioned by a 71-year-old investor if a 5% fastened return asset — this kind of as 2-12 months U.S. Treasurys — is more beautiful than risking a percentage in equities, Spier instructed that the respond to depends on how adaptable unique desires are. “If you want 100% of that [5% return] to stay on, and you will find no spot you could lower your expenses, then you likely should really stay in really harmless instruments,” Spier defined. He however believes most buyers will do better in equities above time, if they do not require all their cash flow straight away and are versatile in cutting expenses if the industry suffers an preliminary fall. Spier says context is useful in determining the correct investment tactic. A modest dangerous bet may perhaps be acceptable for an trader, if it signifies a small % of their general portfolio. But the very same wager could be disastrous, if it accounts for the the greater part of someone’s wealth. “There is a large difference in between somebody building a 1% or 2% wager in their portfolio, but they may well converse about it a large amount due to the fact it is really entertaining to communicate about, and it truly is fully valid as a 1 or 2% bet, but not as a 50 or a 60% guess,” Spier famous. He urges investors to take into consideration their comprehensive money image and essential money prior to choosing how significantly hazard to consider. Spier’s fund has posted an annualized return of 9% because he commenced it in 1997, according to Aquamarine. That compares to the S & P 500 ′s 8.2%, the MSCI Globe ‘s 6.9%, and the FTSE 100 ′s 3.6%.