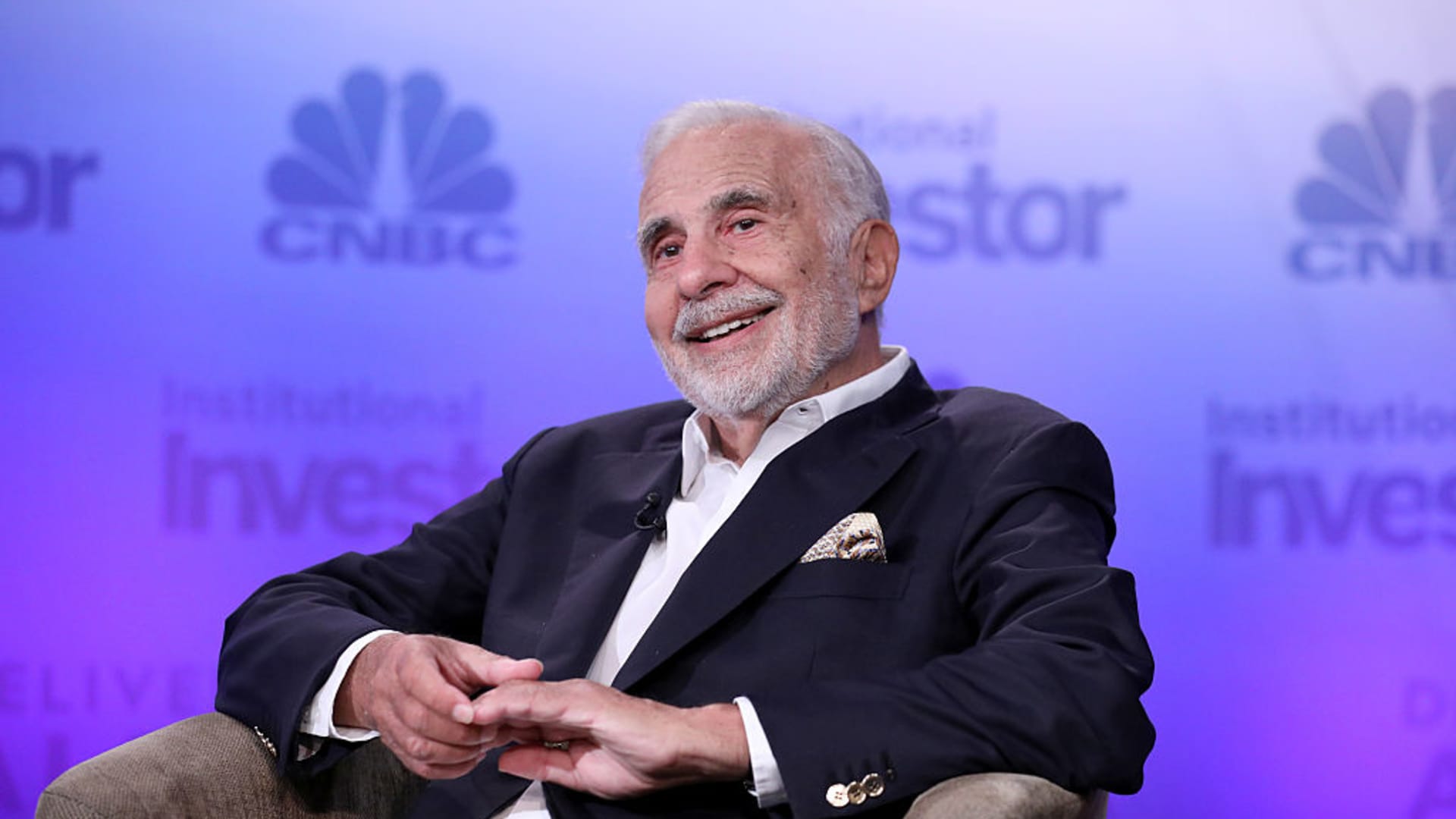

Shares of Carl Icahn’s conglomerate Icahn Enterprises professional a sharp market-off Friday immediately after the agency slashed quarterly dividend in 50 percent amid notable limited seller Hindenburg Research’s campaign.

IEP declared Friday it issued a $1 per depositary device distribution, which signifies a 12% annualized produce. That as opposed to a $2 dividend in the past quarter. The inventory tanked a whopping 30% following the information.

associated investing information

Icahn’s firm has been on a rollercoaster experience because the Nathan Anderson-led short seller took a community limited place in May possibly, alleging “inflated” asset valuations, amongst other good reasons. Shares of IEP, a keeping enterprise that is concerned in a myriad of corporations like power, automotive and real estate, tumbled nearly 44% in the next quarter. The stock is down 54% calendar year to day.

Loading chart…

Hindenburg took challenge with IEP’s large dividend yield, expressing it really is “unsupported” by the company’s dollars flow and expenditure overall performance.

“The payment of foreseeable future distributions will be identified by the board of directors quarterly, based on current economic disorders and enterprise performance and other things,” 87-calendar year-previous investor Icahn explained in a assertion Friday. “We do not intend to let a misleading Hindenburg report interfere with this apply.”

Icahn Enterprises reported a web decline of $269 million in the next quarter, a lot more than doubling the decline of $128 million from the very same quarter a yr back. Icahn attributed the disappointing quarter to the short-promoting action in his managing companies and investments.

“I think the 2nd quarter partly mirrored the impression of brief-providing on organizations we management or spend in, which I attribute to the misleading and self-serving Hindenburg report concerning our enterprise. It also mirrored the dimensions of the hedge reserve relative to our activist technique,” Icahn explained.

In the aftermath of Hindenburg’s responses, federal investigators sought information pertaining to IEP’s corporate governance, capitalization, securities offerings, dividends, valuation, advertising products, because of diligence and other components.

Icahn, the most well identified corporate raider in record, built his title immediately after pulling off a hostile takeover of Trans Planet Airways in the 1980s, stripping the enterprise of its belongings. Most not long ago, the billionaire trader has engaged in activist investing in McDonald’s and biotech firm Illumina.