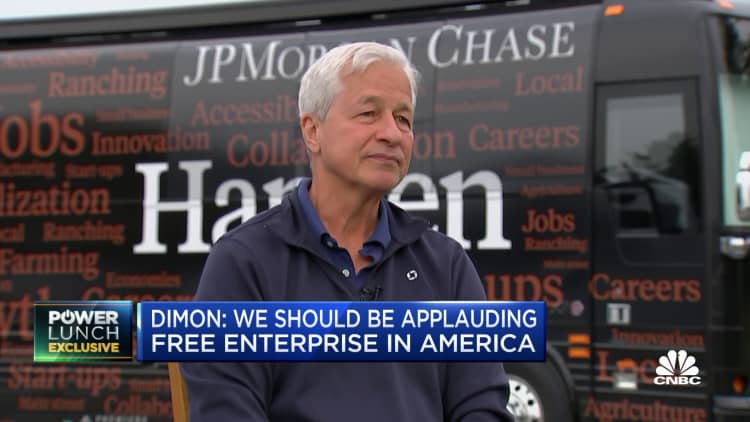

The Fitch Scores downgrade of the United States’ prolonged-term credit score score ultimately doesn’t issue, JPMorgan Chase CEO Jamie Dimon told CNBC on Wednesday.

“It will not really subject that much” simply because it is the sector, and not rating businesses, that establish borrowing expenses, Dimon instructed CNBC’s Leslie Picker.

However, it is “ridiculous” that nations around the world including Canada have higher credit scores than the U.S. when they rely on the steadiness developed by the U.S. and its military services, Dimon additional.

“To have them be triple-A and not The usa is variety of ridiculous,” Dimon claimed. “It’s still the most prosperous country on the planet, it really is the most protected nation in the planet.”

Fitch downgraded the country’s score to AA+ from AAA on Tuesday, pointing to “expected fiscal deterioration about the future a few many years,” an erosion of governance and a escalating standard financial debt burden.

The agency put the U.S. rating on look at in May perhaps just after members of Congress butted heads around boosting the financial debt ceiling and brought the nation to close to-default.

“We must get rid of the debt ceiling,” Dimon said. “It truly is used by the two events” in strategies that sow uncertainty for marketplaces, he explained.

In the huge-ranging interview, Dimon touched on topics such as geopolitics, bank regulation, artificial intelligence and the way of the economic climate.

The U.S. economy is staying supported by consumer and small business toughness, low unemployment and healthful stability sheets, he mentioned.

“It can be very fantastic, even if we go into economic downturn,” Dimon reported. “The storm cloud component is continue to there,” he additional, referring to a warning he gave past 12 months on the financial state.

What problems Dimon most are the geopolitical risks made by the Ukraine war and the Federal Reserve’s exertion to rein in its stability sheet recognized as quantitative tightening, he mentioned.

This is breaking information. Remember to examine back for updates.