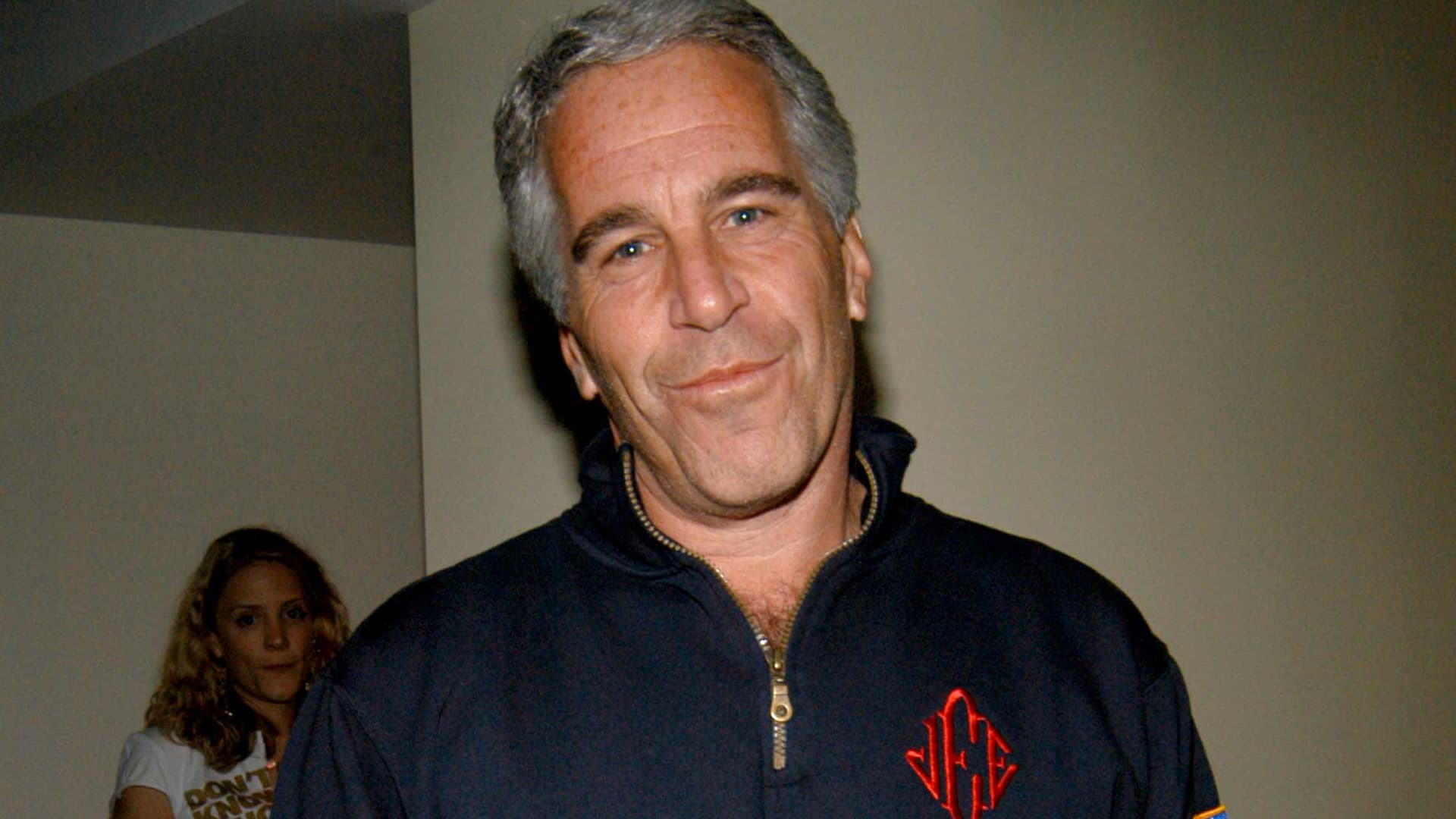

Jeffrey Epstein attends Launch of RADAR Journal at Lodge QT on May well 18, 2005.

Patrick McMullan | Getty Pictures

JPMorgan Chase taken care of far more than $1.1 million in payments from Jeffrey Epstein to “ladies or women of all ages” just after the large lender claims it fired the sex offender as a client, a lawyer for the U.S. Virgin Islands instructed a decide Monday.

A lot of of the girls or women experienced Japanese European surnames, the lawyer Linda Singer wrote to New York federal Decide Jed Rakoff.

And a lot more than $320,000 of the payments have been built to “many folks for whom JPMorgan experienced no formerly discovered payments,” Singer wrote in the letter.

The letter accuses JPMorgan of failing to disclose the payments till after the conclude of discovery, the time period through which the bank and the Virgin Islands exchanged proof as section of an ongoing lawsuit.

The Virgin Islands in that suit alleges that JPMorgan facilitated and economically benefited from sexual intercourse trafficking by Epstein of young ladies all through the a long time when he was a consumer. Epstein managed a residence on a personal island in the American territory in which he sexually abused scores of women.

JPMorgan states it reduce ties to Epstein in 2013. But Monday’s courtroom submitting problems the bank’s timeline.

The bank, which denies any wrongdoing relevant to Epstein, had no speedy remark on the letter.

Singer wrote that paperwork not too long ago turned about by JPMorgan contained information that had been formerly sought by the Virgin Islands in the course of the discovery time period.

That data was assembled internally by the lender in October 2019, much more than a few months right after Epstein was arrested on federal child intercourse trafficking prices. Epstein killed himself in jail in August 2019.

“There is no genuine purpose for JPMorgan failing to identify payments to women or ladies the bank by itself recognized as currently being relevant to Epstein — and possible proof of Epstein’s sex trafficking enterprise — years ahead of acquiring the USVI’s discovery requests,” the attorney wrote.

The letter states that a spreadsheet prepared by JPMorgan listing the dates and beneficiaries of much more than 9,000 transactions payable to Epstein-linked people among 2005 and 2019 “had a combined benefit of around $2.4 billion.”

“Quite a few of the entries reflected accounts and payments, numbering in the thousands and totaling in the hundreds of millions of dollars in worth, of which USVI experienced no prior knowledge or information from JPMorgan’s responses and productions throughout the reality discovery period,” Singer wrote.

The letter says that JPMorgan has argued the details was not disclosed earlier “for the reason that it was not in a custodial manufacturing and/or did not relate to people today precisely recognized by the USVI as similar to Epstein.”

But Singer mentioned, “The USVI has continuously built distinct that its discovery requests are not minimal to persons it specially identified as currently being related to Epstein.”

“The USVI particularly identified the people today it understood were connected to Epstein to make its discovery requests clearer — not alleviate JPMorgan of its duty to make acknowledged suitable paperwork,” the lawyer wrote.

This is breaking news. You should verify again for updates.